Strong Double-Digit Growth for Trade, Exports and Imports in August 2024

Fastest Year-on-Year Trade Growth in 22 Months, Resilient Export Performance Contributed by E&E and Palm Oil-Based Products

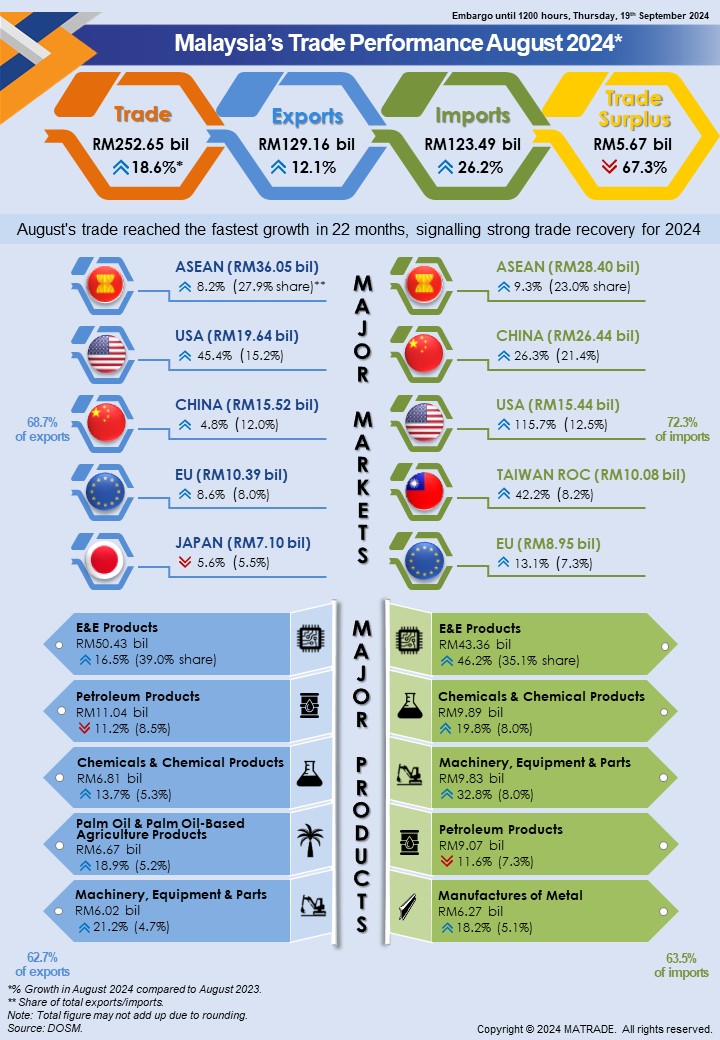

In August 2024, Malaysia’s trade maintained its stellar performance and continued an upward trajectory with trade, exports and imports registering strong double-digit expansion. Trade increased by 18.6% year-on-year (y-o-y), the fastest rate in 22 months to reach RM252.65 billion. Exports continued its growth momentum for the fifth consecutive month, rising 12.1% to RM129.16 billion and imports expanded by 26.2% to RM123.49 billion, marking the 52nd consecutive month of trade surplus since May 2020.

Export growth in August 2024 was primarily driven by increased demand for electrical and electronic (E&E) products, palm oil and palm oil-based agriculture products, machinery, equipment and parts as well as optical and scientific equipment. Additionally, exports of manufactured goods grew significantly with double-digit expansion.

In terms of markets, exports to all major trading partners namely ASEAN, China, the United States (US), the European Union (EU) and Taiwan recorded expansion. Exports to the US surged to a new record high mainly due to higher demand for E&E products primarily semiconductor devices and integrated circuits (ICs). The World Semiconductor Trade Statistics (WSTS) has forecasted global semiconductor sales to grow by 16% in 2024 led by stronger performance in computing end-markets.

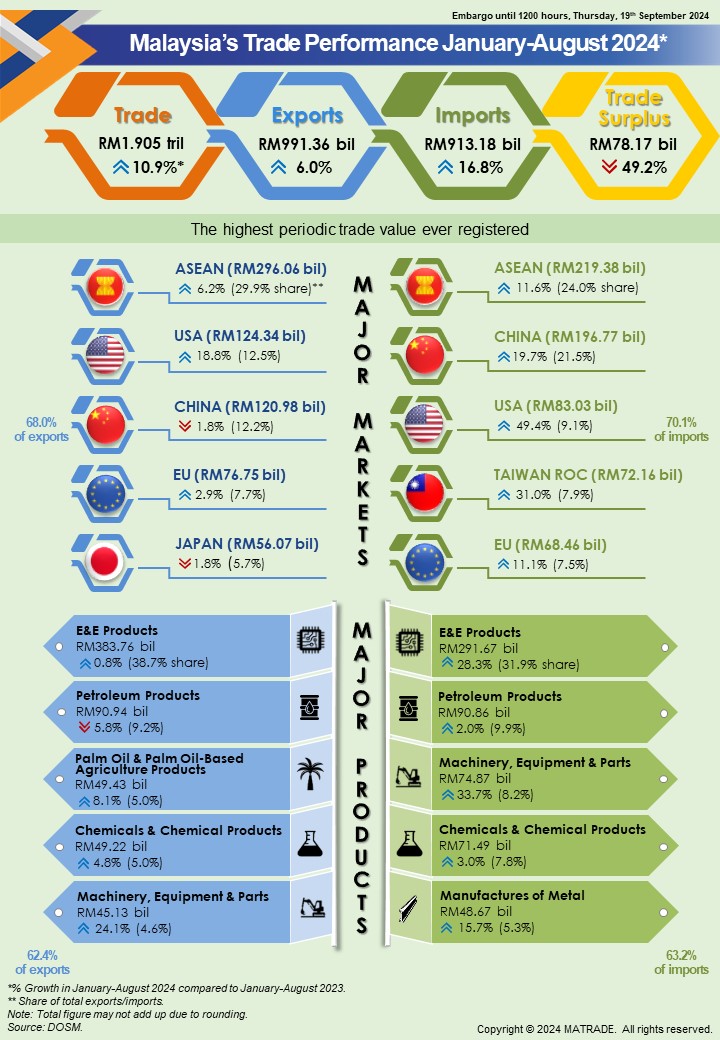

During the first eight months of 2024, trade posted the highest periodic value ever, expanding by 10.9% to RM1.905 trillion compared to the same period in 2023. Exports were up by 6% to RM991.36 billion and imports grew by 16.8% to RM913.18 billion, resulting in a trade surplus of RM78.17 billion.

The International Monetary Fund (IMF) maintained its global Gross Domestic Product (GDP) growth forecast at 3.2% for 2024, while highlighting concerns about potential inflation risks and ongoing trade tensions. For Malaysia, the IMF reaffirmed its GDP growth projection at 4.4% for 2024, indicating a stable economic outlook. The estimation is consistent with Malaysia’s 5.1% GDP growth in the first half (1H) of 2024 which exceeded the 4.1% growth recorded in 1H 2023. Despite these positive developments, MITI and its agencies will remain vigilant against any potential challenges or global disruptions to ensure that Malaysia could sustain its economic momentum.

Export Performance of Major Sectors

Manufactured and Agriculture Goods Recorded Robust Export Growth

In August 2024, exports of manufactured goods which accounted for 86.8% of total exports expanded by 14.1% to RM112.08 billion, the sixth consecutive month of y-o-y expansion. The increase was supported by higher exports of E&E products, machinery, equipment and parts as well as optical and scientific equipment.

Exports of agriculture goods (7.1% share) increased by 19.4% to RM9.14 billion, posting the fifth successive month of y-o-y expansion. This was contributed by increased exports of palm oil and palm oil-based agriculture products, driven by higher export volumes and prices.

Meanwhile, exports of mining goods (5.6% share) contracted by 16.1% y-o-y to RM7.21 billion on reduced exports of crude petroleum and liquefied natural gas (LNG) following lower export volumes and prices.

Major exports in August 2024:

• E&E products, valued at RM50.43 billion and accounted for 39% of total exports, increased by 16.5% compared to August 2023;

• Petroleum products, RM11.04 billion, 8.5% of total exports, ↓11.2%;

• Chemicals and chemical products, RM6.81 billion, 5.3% of total exports, ↑13.7%;

• Palm oil and palm oil-based agriculture products, RM6.67 billion, 5.2% of total exports, ↑18.9%; and

• Machinery, equipment and parts, RM6.02 billion, 4.7% of total exports, ↑21.2%.

On a month-on-month (m-o-m) basis, exports of manufactured, agriculture and mining goods declined by 0.002%, 9.1% and 10.3%, respectively.

During the first eight months of 2024, exports of manufactured goods grew by 6% to RM847.83 billion compared to the corresponding period in 2023, supported by robust exports of machinery, equipment and parts, manufactures of metal, optical and scientific equipment, processed food, iron and steel products as well as E&E products. Exports of mining goods edged up by 1.7% to RM70.06 billion due to higher shipments of crude petroleum. Meanwhile, exports of agriculture goods climbed 9.3% to RM66.87 billion on robust exports of palm oil and palm oil-based agriculture products as well as natural rubber.

Trade Performance with Major Markets

In August 2024, Malaysia’s major trading partners were ASEAN, China, the US, the EU and Taiwan, making up 69.8% share of Malaysia’s total trade.

ASEAN – Exports Increased Consistently since April 2024

In August 2024, trade with ASEAN which contributed 25.5% to Malaysia’s total trade increased by 8.7% y-o-y to RM64.45 billion, the sixth successive month of expansion. Exports increased since April 2024, expanded by 8.2% to RM36.05 billion underpinned by robust exports of E&E products, chemicals and chemical products as well as machinery, equipment and parts. Imports from ASEAN were up by 9.3% to RM28.4 billion.

Breakdown of exports to ASEAN countries:

• Singapore RM18.88 billion, increased by 12.4%, y-o-y;

• Indonesia RM5.52 billion, ↑38.2%;

• Thailand RM4.58 billion, ↑2.1%;

• Viet Nam RM3.84 billion, ↓11.7%;

• Philippines RM2.46 billion, ↓14.7%;

• Brunei RM445.3 million, ↑4.5%;

• Cambodia RM182.5 million, ↑8.7%;

• Myanmar RM147.9 million, ↓27.8%; and

• Lao PDR RM4.2 million, ↓75.4%.

Exports to major markets in ASEAN that recorded growth were Singapore which increased by RM2.08 billion y-o-y backed by expansion in exports of E&E products, Indonesia (↑RM1.53 billion, petroleum products) and Thailand, (↑RM93 million, iron and steel products).

On a m-o-m basis, trade, exports and imports slipped by 9.3%, 10.1% and 8.2%, respectively.

During the first eight months of 2024, trade with ASEAN increased by 8.4% to RM515.44 billion compared to the corresponding period in 2023. Exports to this region rose 6.2% to RM296.06 billion boosted by higher exports of petroleum products, machinery, equipment and parts as well as manufactures of metal. Imports from ASEAN expanded by 11.6% to RM219.38 billion.

China – Exports Rebounded in August

In August 2024, trade with China which represented 16.6% of Malaysia’s total trade grew by 17.4% y-o-y to RM41.95 billion. This was the fifth consecutive month of double-digit expansion and the fastest growth recorded since September 2022. Exports picked up by 4.8% to RM15.52 billion, after registering two consecutive months of y-o-ycontraction on account of robust exports of E&E products and rubber products. Importsfrom China rose 26.3% to RM26.44 billion.

Compared to July 2024, trade and exports were up by 0.6% and 5.1%, respectively while imports shrank 1.9%.

During the first eight months of 2024, trade with China expanded by 10.5% to RM317.74 billion compared to the same period in 2023. Exports fell 1.8% to RM120.98 billion owing to reduced shipments of E&E products and metalliferous ores and metal scrap. Amid the contraction, export expansion was recorded for paper and pulp products, manufactures of metal and LNG. Imports from China increased by 19.7% to RM196.77 billion.

The US – Highest Trade and Export Value Thus Far

Trade with the US in August 2024 which took up 13.9% of Malaysia’s total trade recorded the highest value thus far, leaped by 69.7% y-o-y to RM35.09 billion. Exports continued to register double-digit y-o-y growth of 45.4% to RM19.64 billion, the highest value ever registered and was the eighth consecutive month of export growth. The expansion was supported by higher exports of E&E products, machinery, equipment and parts as well as palm oil and palm oil-based agriculture products. Imports from the US surged by 115.7% to RM15.44 billion.

Compared to July 2024, trade, exports and imports posted double-digit increase of 10.5%, 10.4% and 10.5%, respectively.

During the first eight months of 2024, trade with the US climbed 29.4% to RM207.38 billion compared to the corresponding period in 2023. Exports continued to expand with double-digit growth of 18.8% to RM124.34 billion backed by solid demand for E&E products, machinery, equipment and parts as well as optical and scientific equipment. Imports from the US increased by 49.4% to RM83.03 billion.

The EU – Robust Growth for Trade, Exports and Imports

In August 2024, trade with the EU which comprised 7.7% of Malaysia’s total trade climbed 10.6% y-o-y to RM19.35 billion. Exports rose 8.6% to RM10.39 billion, aided by higher exports of palm oil-based manufactured products, rubber products as well as petroleum products. Imports from the EU increased by 13.1% to RM8.95 billion.

Within the EU, the top 10 markets which accounted for 91.8% of Malaysia’s total exports to the region were:

• Germany RM2.95 billion, increased by 19%, y-o-y;

• Netherlands RM2.87 billion, ↓10.8%;

• Spain RM807.8 million, ↑52.6%;

• Belgium RM759.7 million, ↓5.9%;

• France RM604.0 million, ↑16.1%;

• Italy RM471.0 million, ↓21.1%;

• Hungary RM359.1 million, ↑175.0%;

• Poland RM300.7 million, ↑34.7%;

• Czech Republic RM255.4 million, ↑32.4%; and

• Sweden RM168.9 million, ↑45.6%.

Among major export markets in the EU that recorded double-digit growth were Germany which grew by RM470.3 million and France, increased by RM83.7 million each buoyed by higher exports of E&E products while exports to Spain grew by RM278.4 million on higher exports of palm oil-based manufactured products.

On a m-o-m basis, exports expanded by 1.1% while trade and imports dropped by 2.3% and 6%, respectively.

During the first eight months of 2024, trade with the EU was higher by 6.6% to RM145.21 billion compared to the same period in 2023. Exports edged up by 2.9% to RM76.75 billion led by higher demand for palm oil and palm oil-based products, rubber products, processed food as well as E&E products. Imports from the EU expanded by 11.1% to RM68.46 billion.

Taiwan – Exports Grew Significantly since January 2024

In August 2024, trade with Taiwan which absorbed 6.2% of Malaysia’s total trade jumped by 52.3% to RM15.54 billion compared to August 2023. Exports leaped by 75.1% to RM5.46 billion, the eighth double-digit expansion since January 2024 attributed to strong exports of E&E products, optical and scientific equipment as well as chemicals and chemical products. Imports from Taiwan grew by 42.2% to RM10.08 billion.

Compared to July 2024, trade, exports and imports climbed 1.1%, 2.6% and 0.3%, respectively.

During the first eight months of 2024, trade with Taiwan increased by 37.1% to RM113.8 billion compared to the same period in 2023. Exports soared by 49.1% to RM41.63 billion fuelled by higher exports of E&E products, optical and scientific equipment as well as LNG. Imports from Taiwan expanded by 31% to RM72.16 billion.

Trade with FTA Partners

In August 2024, trade with FTA partners which constituted 62.4% of Malaysia’s total trade edged up by 9.7% y-o-y to RM157.73 billion. Exports to FTA partners increased by 5.1% to RM83.57 billion while imports increased by 15.4% to RM74.16 billion.

Markets that recorded export growth were Hong Kong SAR which expanded by 11.7% y-o-y to RM7.03 billion and Canada, rose 119.5% to RM782.7 million following strong exports of E&E products. Exports to India increased by 3.1% to RM4.01 billion, Australia (↑10.1% to RM4.73 billion) and Chile (↑39.5% to RM81.1 million) buoyed by robust shipments of petroleum products.

Meanwhile, exports to Mexico rose 19.2% to RM1.46 billion contributed by increased demand for iron and steel products, Pakistan (↑5.6% to RM434.2 million, chemicals and chemical products) and Peru (↑61.3% to RM68.2 million, processed food).

On a m-o-m basis, trade, exports and imports were down by 4.2%, 4.9% and 3.4%, respectively.

During the first eight months of 2024, trade with FTA partners grew by 7.1% to RM1.244 trillion, exports edged up by 2.6% to RM672.18 billion and imports climbed 12.9% to RM572.31 billion compared to the same period in 2023.

Import Performance

Total imports in August 2024 grew by 26.2% y-o-y to RM123.49 billion. The three main categories of imports by end use, which accounted for 79% of total imports were:

• Intermediate goods, valued at RM72.29 billion or 58.5% of total imports, surged by 40.4% y-o-y, due to higher imports of parts and accessories of non-transport capital goods;

• Capital goods, valued at RM14.95 billion or 12.1% of total imports, grew by 39.6%, following higher imports of non-transport capital goods; and

• Consumption goods, valued at RM10.34 billion or 8.4% of total imports, expanded by 21.2%, as a result of higher imports of durables.

Compared to July 2024, imports in August 2024 declined by 1%. Imports of intermediate goods were higher by 4.5% while imports of capital and consumption goods declined by 1% and 5.8%, respectively.

During the first eight months of 2024, imports climbed by 16.8% to RM913.18 billion compared to the corresponding period last year. Imports of intermediate goods rose 26.1% to RM503.15 billion, capital goods (↑36.9% to RM107 billion) and consumption goods (↑17.3% to RM78.64 billion).