Services for Exporters

Dana Eksport Perkhidmatan (SEF)

Makluman Rasmi

Penggantungan Sementara Dana Eksport Perkhidmatan (SEF)

Tuan/Puan yang dihormati,

Dimaklumkan bahawa Dana Eksport Perkhidmatan (SEF) digantung buat sementara waktu berkuat kuasa serta-merta sehingga dimaklumkan kelak. Sepanjang tempoh penggantungan ini, tiada permohonan baharu akan diterima, manakala permohonan yang telah diterima sebelum tarikh makluman ini akan diproses seperti biasa.

Pihak kami amat menghargai perhatian dan kerjasama daripada tuan/puan sepanjang tempoh ini. Sebarang perkembangan terkini berhubung pengaktifan semula dana akan dimaklumkan dari semasa ke semasa.

Untuk sebarang pertanyaan lanjut, sila hubungi Sekretariat SEF di talian 03-6207 7077. Sekian, terima kasih.

SEF merupakan merupakan bantuan kewangan dalam bentuk geran pembayaran semula perbelanjaan kepada Syarikat Penyedia Perkhidmatan Malaysia (MSPs) bagi membantu dalam mengembangkan eksport dan menjalankan aktiviti-aktiviti penerokaan ke pasaran luar negara. Kelayakan siling bagi setiap syarikat yang memohon geran adalah bergantung kepada amaun maksimum bagi setiap aktiviti bagi tempoh 2021 - 2025.

- Untuk meningkatkan daya saing MSPs di luar negara;

- Untuk mengembangkan export MSPs di pasaran antarabangsa;

- Untuk meluaskan skop promosi eksport dalam mendapatkan akses pasaran dan peluang eksport bagi perkhidmatan; dan

- Untuk meningkatkan profil Malaysia di peringkat antarabangsa sebagai penyedia perkhidmatan yang cekap dan jenama Malaysia sebagai pembekal perkhidmatan.

Kelayakan aktiviti:

(Sila rujuk muka surat 14 Garis Panduan SEF untuk maklumat lanjut)

Aktiviti 1

Kos perjalanan dan penginapan sebagai peserta pertandingan antarabangsa untuk industri perkhidmatan yang diadakan di luar negara.

Aktiviti 2

Kos perjalanan dan penginapan ke destinasi antarabangsa untuk bidaan tender;

dan/atau

kos pembelian dokumen tender untuk projek di luar negara.

Aktiviti 3

Kos perjalanan dan penginapan untuk bertemu/ menjalin rangkaian/ menjalankan pembentangan kepada bakal pelanggan dan menerokai potensi perniagaan dan projek di luar negara.

Aktiviti 4

Kos perjalanan dan penginapan dalam memberikan perkhidmatan untuk projek yang dimeterai yang dijalankan di luar negara (perundingan, pembekalan, penghantaran, dan pelaksanaan projek)

Aktiviti 5

Kos menjalankan kajian kebolehlaksanaan untuk projek antarabangsa di luar negara

Aktiviti 6

Kos penubuhan pejabat komersial di luar negara.

Aktiviti 7

Kos mendapatkan laporan risikan/ pasaran komersial untuk menilai peluang perniagaan atau projek di pasaran antarabangsa.

Aktiviti 8

Kos membangunkan prototaip/ penyesuaian sistem/ lokalisasi untuk memenuhi keperluan projek di luar negara.

Aktiviti 9

Kos perjalanan, penginapan dan yuran penyertaan dalam program latihan antarabangsa yang diadakan di dalam/luar negara (fizikal/maya) berkaitan perkhidmatan syarikat.

Aktiviti 10

Kos untuk memperoleh pensijilan antarabangsa dalam perkhidmatan eksport (termasuk pematuhan kepada kelestarian).

Aktiviti 11

Kos penyewaan/langganan perisian;

dan/ atau

Kos penyewaan mesin/peralatan untuk perkhidmatan eksport ke luar negara.

Aktiviti 12

Kos logistik (pengangkutan laut/udara/darat) yang terlibat dalam penghantaran produk dan/atau peralatan Malaysia ke luar negara (pintu ke pintu), untuk projek luar negara yang dianugerahkan dan dilaksanakan oleh syarikat perkhidmatan Malaysia

Notis Penting

Selaras dengan pembangunan sistem SEF yang baru, pemohon dikehendaki untuk mengemaskini nombor pendaftaran syarikat (ROC) yang terkini dan menetapkannya sebagai "default" ID/ROC bagi akaun bank syarikat. Sila berhubung dengan pihak bank yang telah didaftarkan bagi membolehkan proses pembayaran tuntutan SEF dibuat.

Untuk maklumat lanjut sila hubungi:

Unit Pembangunan PasaranTingkat 2, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur, MALAYSIA

Tel: +603-6207 7077

Faks: +603-6203 7252

Emel: Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya.

Geran Pembangunan Pemasaran (MDG)

Announcement

Market Development Grant (MDG) Application is Now Accessible via MADANI Digital Trade Platform

We are pleased to infom you that starting 13 March 2025, the Market Development Grant (MDG) application can be accessed through the MADANI Digital Trade Platform (MDT Platform) at madanitrade.com.

To begin your application, please visit madanitrade.com and click on the 'Explore Visual Showcase'. You will then see the Sign In/Sign Up option button located at the top right corner of the homepage.

- If your are already a registered user, simply log in using your email and password.

- If you are new to the platform, please complete the registration process to create an account.

Should you have any question or require further assistance, please do not hesitate to contact the MDG Secretariat at 03-6207 7066 or via e-mail at Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya..

What is MDG?

The Market Development Grant (MDG) is a support initiative in the form of a reimbursable grant. MDG was introduced in 2002 with the objective of assisting exporters in their efforts to promote Malaysian made products or services globally. The lifetime limit of MDG is RM300,000 and it is specifically formulated for Malaysian SME Companies, Professional Service Providers, Trade and Industry Associations, Chambers of Commerce, Professional Bodies and Co-operatives.

[Note: MDG reimbursements are subject to the availability of the government funds]

What activities are eligible for grant funding?

- Participation in International Trade Fairs or Exhibitions held in Malaysia/Overseas

- Participation in Trade & Investment Missions (TIM) or Export Acceleration Missions (EAM)

- Participation in International Conferences Held Overseas

- Listing Fees for Made in Malaysia Products in Supermarkets or Hypermarkets or Retail Centres or Boutique Outlets Located Overseas

- Participation in Virtual International Trade Fairs In Malaysia Or Overseas

- Participation In Business To Business (B2B) Meetings Related To Virtual Trade Investment Missions And Export Acceleration Missions

Who is eligible to claim for MDG? (please refer to MDG Guidelines)

- Small And Medium Enterprises (SMEs)

- Professional Service Providers (Sole Proprietor Or Partnership)

- Trade & Industry Associations, Chambers Of Commerce Or Professional Bodies

- Co-operatives

How do I submit my new application of claims or request for reimbursement of expenses?

All completed applications must be SUBMITTED ONLINE through MATRADE’s website:

Submissions for reimbursements must be:

|

No |

Promotion Activity |

Submission of Applications |

|

Physical Event |

||

|

i. |

Participation in International Trade Fairs or Exhibitions held in Malaysia/ Overseas |

Within 30 calendar days after the last date of event |

|

ii. |

Participation in Trade & Investment Missions (TIM) or Export Acceleration Missions (EAM) |

|

|

iii. |

Participation in International Conferences Held Overseas |

|

|

iv. |

Listing fees in Supermarkets or Hypermarkets or Retail Centres or Boutique Outlets Located Overseas |

Within 30 calendar days after the first day of listing |

|

v. |

International Certification for Exports |

Within 30 calendar days after certification approval date |

|

Virtual Event |

||

|

i. |

Participation in Virtual International Trade Fairs In Malaysia or Overseas |

Within 30 calendar days from the last date of the event |

|

ii. |

Participation In Business To Business (B2B) Meetings Related To Virtual Trade Investment Missions And Export Acceleration Missions |

Within 30 calendar days from the last date of the promotion activity |

For more information, please download information as per link below:

Apply MDG Check Disbursed Amount

All enquiries and submission of reports must be sent to:

Market Development Unit

2nd Floor, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur, MALAYSIA

Tel: +603-6207 7066

Email:Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya.

Program Pembangunan Syarikat Peringkat Pertengahan (MTCDP)

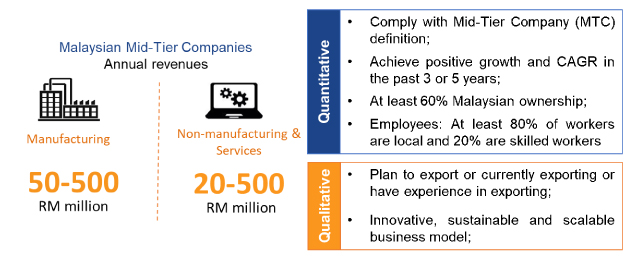

The Mid-Tier Companies Development Programme (MTCDP) was developed and implemented in 2014. A 9-months, customised programme for export-oriented Mid-Tier Companies (MTCs) in Malaysia, either in manufacturing or services. The ultimate objective of MTCDP is to create a cluster of Malaysian Mid-Tier Companies that are globally competitive and successful as global & regional champions

Mid-Tier Companies (MTCs) and Their Contribution to Malaysia

Based on the study of Malaysia's key economic data in 2021/2022 by Deloitte Consulting, there are approximately 9,000 MTCs in Malaysia which is only 0.8% of all registered companies in Malaysia. However, MTCs employ 16% of the nation’s workforce while contributing 36% of the nation’s GDP.

It is undeniable that mid-tier companies are key drivers of economic growth and productivity. Their capabilities and capacities span various sectors, including manufacturing, services, and technology.

Therefore, supporting and promoting the interests of mid-tier companies is essential to further enhancing the competitiveness and resilience of Malaysia's economy on the global stage.This is a programme for MTCs and high-performing SMEs. As a result, MTCs must meet the following robust & stringent criteria to qualify for the programme:

Wish to apply for Mid-Tier Companies Development Programme?

Register NowThe Government of Malaysia and MATRADE recognise the importance of Malaysia’s MTCs and have established the MTCDP to help MTCs grow their business internationally. This programme will also strengthen the competitiveness of MTCs:

- Grow export market

- Global branding

- Internal growth

- Supply chain

- Productivity & efficiency

- Innovation & new product development

- Financing advisory services

- Industry 4.0

- Smart manufacturing

- Digitalisation

- Automation

- Compliance to sustainability

Major Components of the Programme

The Participants

Download list of MTCFor further information about the programme or if you are interested in applying, please contact us at:

MTCDP Secretariat

2nd Floor, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Email: Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya.

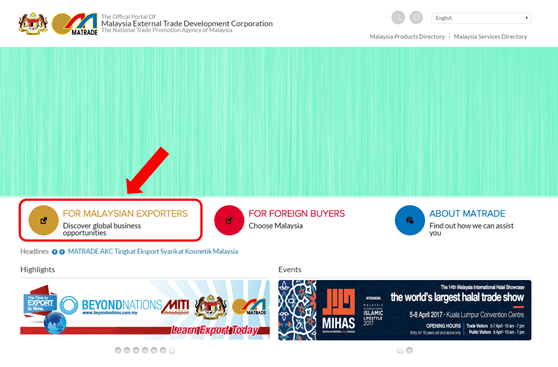

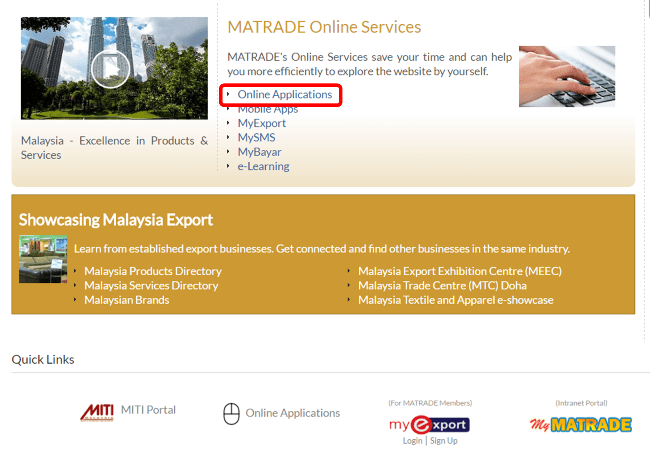

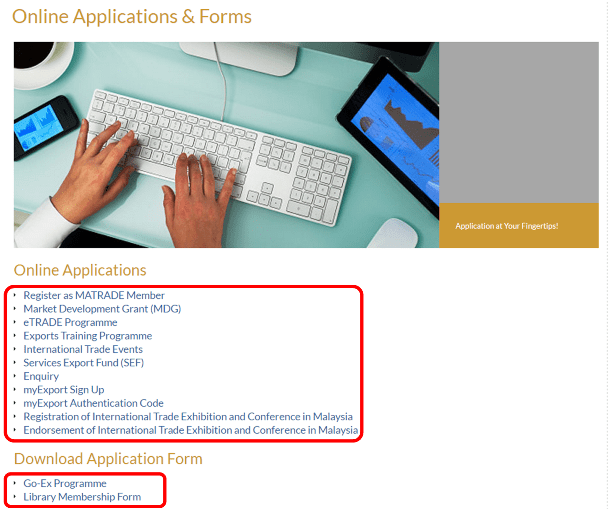

Online Application User Guide

This User Guide will help you get started and learn more about using our online application in this portal.

Step 1: To access the online application, go to "For Malaysian Exporters" section.

Step 2: At the "For Malaysian Exporters" section page, choose "Online Applications" in the MATRADE Online Services information.

Step 3: Choose the online applications or download the application forms.

Standards Map

Standards Map ialah alat dalam talian yang dibangunkan oleh Pusat Dagangan Antarabangsa untuk pengeluar, pengeksport dan pembeli bagi meningkatkan peluang bagi pengeluaran dan perdagangan yang mampan.

Standards Map ialah maklumat komprehensif yang boleh dicari dengan lebih daripada 40 maklumat rujukan pengendalian piawaian swasta mengenai lebih 40 piawaian swasta yang beroperasi di lebih 200 negara dan memperakui produk dan perkhidmatan di lebih 60 sektor ekonomi. Ia mengandungi lembaran fakta pantas untuk setiap piawaian yang dirujuk dan pautan kepada lebih daripada 200 kajian akademik, tesis dan kertas penyelidikan. Pengguna boleh menyemak piawaian merentas tema dan kriteria yang sama dan membuat perbandingan.

Alat analisis Standards Map boleh diakses oleh semua pengguna berdaftar. Pendaftaran adalah percuma untuk semua pengguna dari negara membangun.

Trade Financing

Understanding how to manage trade risks is key to successful exporting.

The export market is an excellent opportunity for Malaysian exporters. Conducting business overseas has its many risks. As an exporter, it is important for you to understand these risks and find the right trade financing solution. MATRADE is sharing some basic information on trade financing.

The following trade financing/products/credit terms that are offered by local and international banks operating in Malaysia:

Open account

Exporter ships off goods to the importer before receiving payment. Payment terms vary from 30 to 90 days. The exporter is exposed to high risks on non-payment, protracted payment and insolvency of the importer.

Term collection

As an exporter, you have control of the goods until you receive a legally binding acceptance from the buyer regarding their debt to you.

Sight collection

As an exporter, you have control of the goods until you receive payment from the importer. A bill of lading is sent through the banking system to allow the buyer to take possession of the goods.

Unconfirmed Letter of Credit

As an exporter, you receive an undertaking from the importer’s bank to conditionally guarantee payment. Payment is based on the condition that your documentation complies with the condition stated in the letter of credit.

Confirmed Letter of Credit

Although similar to unconfirmed Letter of credit the difference is the LC is an irrevocable undertaking by issuing bank to honour the payment obligation in the LC. In other words if the foreign bank defaults payment, the domestic bank pays you.

Cash in Advance

The importer pays for the goods as agreed on a date before the exporter ships the goods. As an exporter, you will receive payment while still keeping control of the goods.

Please contact the banks directly to find out which financial product is most suitable for your business.

-

Trade products offered - Letter of Credit, Guarantees,

- Documentary Collections,

- Supplier Credit or Supplier Financing,

- Trust Receipts,

- Export Credit Refinancing,

- Vendor Financing

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade Documents required - Audited accounts (6 months/ 3 years)

- company registration,

- purchase or export order, invoice,

- transport documents or any other trade related documents

Interest/ profit rate (range) COF/ COF-i + spread % Fees and charges - Stamp duties,

- Legal fees,

- brokerage fee (Islamic only)

Process of approval 30 days from the application day (subject to complete information and documentation submitted) Remarks -

Trade products offered Jaguh Serantau

(Financing with profit rate subsidy)Business Exports Program (BEP)

(Developmental Program)Eligibility Requirements - SMEs including Large Enterprise with 51% or more of the equity held by Bumiputera.

- Shariah-compliant business.

- Product or services are having presence regionally or export-ready for regional market.

- Minimum of two (2) years in operations.

- Minimum 5% annual revenue growth and profitable for the last two (2) years of operation (except for the financial year ended 2020 and 2021, which are adversely affected by the COVID-19 pandemic period/ Movement Control Order).

- At least 60% Bumiputera owned Sdn Bhd company and management controlled company

- Minimum 3 years in business (evidenced by audited accounts)

- NOT a subsidiary of Public Listed Company (PLC), Multi-National Company (MNC), Government/ State Linked Company (G/SLC) or company under Menteri Kewangan DiPerbadankan (MKD)

- Good financial standing

- Open to all industries and sectors which applicable

Documents required - Copy of identity card for all directors/shareholders/partners/owners/ guarantors.

- Copy of valid business registration.

- Certified secretarial document.

- Audited accounts or recent management accounts.

- Bank account statement for the last 6 months.

- Business plan.

- Other relevant documents required by the Bank

- Company profile

- Audited Financial statement (last 3 years)

- Copy of Form 9 (certificate of Registration)/ Form 13 (Certificate of Incorporation on Change of Name of Company)

- Copy of latest Corporate Information obtained from Companies Commission Malaysia (CCM)

- Export Business Plan

- Export Revenue Statement (last 3 years)

Interest/ profit rate (range) As per SME Bank's Risk-based Pricing (BFR+0% p.a. to BFR+2.5% p.a.), with 1.5% p.a. profit rate subsidy by the Government Not applicable Fees and charges Existing fees and charges which have been approved earlier by Bank Negara Malaysia Not applicable Process of approval Financing application will be processed and the decision thereon shall be informed within 30 working days from the date of complete information having been received by the Bank - Evaluation by secretariat

- Export Readiness Assessment by SME Bank and/or, MATRADE and KUSKOP

- Presented for deliberation in BEP Project Working Committee (PWC) Meeting

- Presented for approval in BEP Project Steering Committee (PSC) Meeting

Remarks Not applicable -

Trade products offered - Bank Guarantee,

- Letter of Credit,

- Shipping Guarantee,

- Trade Working Capital Financing Purchase

- Trade Working Capital Financing Sales

Eligibility Requirements Companies (Sdn Bhd and Berhad status) that are incorporated in Malaysia in line with Bank's mandated role (i.e., any business activity related to food and agriculture and or any other business runs at gazetted land area) Documents required Application Documents: - Financial Statement,

- 3 years Audited Account, Company's profile and other documents required by the Bank

Disbursement documents

- TWCF: Invoice, transport documents, Bank's statement (reimbursement) and other supporting documents required by the Bank.

- LC : Proforma Invoice, Insurance (whenever applicable) and any supporting documents required by the Bank.

- BG: Sales contract or any other documents required by the Bank

Interest/ profit rate (range) COF, BFR and Concessionary Fund Fees and charges Disbursement charges:

- LC: 0.1% per month with minimum RM50.00

- BG: 1.25% per annum with minimum of RM 50.00

- Stamp Duty RM10.00

- Rentas: RM5.00 per transaction

Process of approval Subject to credit assessment process and approval level Remarks -

Trade products offered - Letter of Credit

- Trust Receipt

- Credit Bills Negotiation

- Outward Bills Purchased

- Letter of Credit Advising

- Inward/Outward Bills for Collection

- Invoice Financing

- Bankers’ Acceptance

- Foreign Currency Trade Loan

- Bank Guarantee

- Standby Letter of Credit

- Shipping Guarantee

- Supply Chain Finance

Eligibility Requirements - Incorporated under Business Act/Companies Act/Limited Liability Partnership Act/respective authorities for Sabah and Sarawak/respective statutory bodies for professional services providers

- More than 50% of turnover are export business

- Collateral: Guarantee by Credit Guarantee Corporation/Syarikat Jaminan Pembiayaan Perniagaan Berhad/fixed deposit/property

- Other criteria which AmBank (M) Berhad may impose from time to time

Documents required - Certified true copy of the company’s latest M&A, Annual return, Form 24 and Form 49 or the relevant constitution documents.

- Certified true copy of the company’s latest 2 years audited financial statements and latest management account.

- Certified true copy of the directors/ guarantors’ NRIC and Borang BE for the past 2 years.

- Debtor and Creditor Aging, if any;

- List of on-going projects and tendered projects with details such as Project Description, Awarder, Amount, Project Duration and Commencement Date, if any;

- Projected Cash Flow;

- CCRIS Consent Letter

- Any other document which AmBank (M) Berhad may require on case to case basis

Interest/ profit rate (range) BLR/COF + (1.0% - 2.5%) p.a Fees and charges - Facility agreement as per Stamp Act 1949

- Other Fees and Charge as per AmBank (M) Berhad's Standard Trade Tariff at the link below

Process of approval Ranging from 30 - 45 days from the application day (subject to complete information and documentation submitted). Remarks -

Trade products offered - Letter of Credit-i

- Trust Receipt-i

- Credit Bills Negotiation-i

- Outward Bills Purchased-i

- Letter of Credit Advising-i

- Inward/Outward Bills for Collection-i

- Invoice Financing-i

- Accepted Bills-i

- Foreign Currency Trade Financing-i

- Bank Guarantee-i

- Standby Letter of Credit-i

- Shipping Guarantee-i

Eligibility Requirements - Incorporated under Business Act/Companies Act/Limited Liability Partnership Act/respective authorities for Sabah and Sarawak/respective statutory bodies for professional services providers

- More than 50% of turnover are export business

- Collateral: Guarantee by Credit Guarantee Corporation/Syarikat Jaminan Pembiayaan Perniagaan Berhad/fixed deposit/property

- Financing is of Shariah-compliant activities acceptable to AmBank Islamic Berhad

- Other criteria which AmBank Islamic Berhad may impose from time to time

Documents required - Certified true copy of the company’s latest M&A, Annual return, Form 24 and Form 49 or the relevant constitution documents.

- Certified true copy of the company’s latest 2 years audited financial statements and latest management account;

- Certified true copy of the directors/ guarantors’ NRIC and Borang BE for the past 2 years;

- Debtor and Creditor Aging, if any;

- List of on-going projects and tendered projects with details such as Project Description, Awarder, Amount, Project Duration and Commencement Date, if any;

- Projected Cash Flow; and

- CCRIS Consent Letter

- Any other document which AmBank Islamic Berhad may require on case to case basis

Interest/ profit rate (range) BFR/COF-i + (1.0% - 2.5%) p.a. Fees and charges - Facility agreement as per Stamp Act 1949

- Other Fees and Charge as per AmBank Islamic Berhad's Standard Trade Tariff at the link below:-

Process of approval Ranging from 30 - 45 days from the application day (subject to complete information and documentation submitted). Remarks -

Trade products offered - Letter of Credit-i,

- Trust Receipt-i,

- Accepted Bills-i,

- Bank Guarantee-i

Eligibility Requirements - Sole-Proprietor / Partnership / Private Limited Company

- Business in operation for at least 3 years

- Minimum 2 years relationship with Maybank or minimum 3 years with other Financial Institutions

Documents required - Certified photocopies of:

- Memorandum & Article of Association

- Business Registration

- Form D

- Form 9

- Form24 & 49

- Company and Holding Company profile, Particulars of Directors / Main Shareholders and a photocopy of each Director's NRIC

- Certified photocopies of the last 3 years of Audited Financial Accounts and latest Management Accounts, and the last 6 months of Bank Statements from other banks.

Interest/ profit rate (range) - Trust Receipt-i: BFR + 0% to 2.00% p.a.

- Accepted Bills-i (AB-i): ABi COF + 0.75% to 1.00% p.a.

Fees and charges - Stamp duties: as per Stamp Duty Act

- Trading Fees: RM15 per every RM1.0mil, in respect of Commodity Murabahah transaction

- Documentation fee: maximum of RM5,000 for in-house financing documentation

- Other actual cost & expenses e.g. legal fees etc.

Process of approval 20 days from the application day (subject to complete information and documentation submitted). Remarks -

Trade products offered - Letter of Credit

- Bankers Acceptance

- Invoice Financing,

- Import Loan

- Bank Guarantee,

- Shipping Guarantee

Eligibility Requirements - Locally incorporated

- Minimum 3 years of business operations (For partly secured facilities)

- At least 51% shareholding are Malaysian owned

Documents required - Audited Accounts

- Latest 6 months bank statements

- Company Constitution Documents

Interest/ profit rate (range) - COF + % (as low as 1.25%)

Fees and charges Stamp duties 5% of the facility granted Process of approval 20 days upon submission (subject to complete information and documentation submitted). Remarks -

Trade products offered - Outward Bills for Collection

- Inward Documentary Credit

- Without Recourse Export Financing

- Foreign Bills Purchased/ Discounted

- Multi-Currency Trade Loan

- Domestic Bills Purchased/ Discounted

- Bankers Acceptance

- Export Credit Refinancing Pre & Post Shipment

- Accounts Receivable Purchase

- Bank Guarantee

- Standby Letter of Credit

- Quick Guarantee

Remarks -

Trade products offered - Outward Bills for Collection-i

- Inward Documentary Credit-i

- Without Recourse Export Financing-i

- Foreign Bills of Exchange Purchased-i

- Multi-Currency Trade Financing-i

- Domestic Bills of Exchange Purchased-i

- Accepted Bills-i

- Accounts Receivable Transfer

- Bank Guarantee-i

- Standby Letter of Credit-i Quick Guarantee-i

Remarks -

Trade products offered - Bill of Exchange Purchase-Authority to Purchase (BEP/AP)

Financing against the exporter or domestic seller (borrower)'s bills of exchange and/or document drawn under sight/usance Letter of Credit that acceptable by BOCM. - Bill of Exchange Purchase (BEP)

Financing against the exporter or domestic seller (borrower)'s sight/usance export and/or domestic sales documents under collection that acceptable by BOCM. - Export Invoice Financing (EIF)

MYR/FCY Financing against export and/or domestic sales of goods/services in relation to the exporter or domestic seller (borrower)'s nature of business on open account basis. - Bankers Acceptance(BA) - Export/Domestic Sales

MYR Financing against export and/or domestic sales of goods in relation to the exporter or domestic seller (borrower)'s nature of business on open account basis

Eligibility Requirements Exporter or domestic seller who granted BEP/AP, BEP, EIF or BA(S) facility from BOCM. Documents required Statutory Document, Latest 3 years' Financial Statement and any other document that prescribed by BOCM Fees and charges Standard charges on international trade services operations shall refer to www.bankofchina.com.my Process of approval Subject to the completion of the required credit assessment with statisfactory outcome. Remarks www.bankofchina.com.my - Bill of Exchange Purchase-Authority to Purchase (BEP/AP)

-

Trade products offered - Bank Guarantees,

- Supplier Financing,

- Vendor Financing,

- Invoice & Export Financing,

- SBLC Issuance

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade and Non-Resident Companies with Trade facilities requirements onshore. Documents required Typically Financial Statement for 3 years and Management Account every 6 months. Summary of invoices and actual invoices depending on facilities required. Fees and charges Stamp duties as per LHDN charges, Arrangement Fee for selected facilities. Process of approval Average of 60 days from the application day (subject to complete information and documentation submitted). Remarks Not Available -

Trade products offered - Trade Time Loan (TTL)

- Onshore Foreign Currency Loan (OSFCL)

- Bankers Acceptances

- Trust Receipt (TR) Loan

- Bank Guarantees

- Shipping Guarantees

- Export Letters of Credit

- Export Collections

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. May require additional KYC requirements as provisioned from time to time. Documents required Please refer to the respective product disclosure sheets for documentation requirements. Fees and charges Please refer to the respective product disclosure sheets for pricing information. Process of approval Process of approval varies depending on exporter. KYC needs to be in place. Pls contact Relationship Manager for further guidance or refer to products disclosure sheets. Remarks https://www.citigroup.com/citi/about/countries-and-jurisdictions/malaysia.html#Trade-Finance-and-Services -

Trade products offered - Letter of Credit

- Import Collection

- Export Letter of Credit

- Export Collection

- Bank Guarantee

- Supplier Financing

- Accounts Receivables Purchase / Promissory Notes Financing

Eligibility Requirements Local and Multinational Corporate Companies in Malaysia. Documents required - Audited Financial Statement

- Company Constitution Documents

*Additional documents may be required subject to the Bank's credit assessment

Fees and charges Stamp duties as per Stamp Duty Act Process of approval 30 days from the application day (subject to complete information and documentation submitted). Remarks https://country.db.com/malaysia/documents/other-information/Deutsche-Bank-Malaysia-Schedule-of-Charges.pdf -

Trade products offered Bankers Acceptances (BA) / Foreign Currency Trade Financing (FCTF) Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. Documents required Audited Financial Statements for the last 3 years / Corporate Profile (M&A, Forms 24, 44 and 49 / Details of existing borrowing / Listings of suppliers and etc Fees and charges - Stamp Duties : As per Stamp Duty Act 1949 (Revised 1989)

- Disbursement Fee : Include fees for registration of charge and Power of Attorney (for property with individual or strata title and for property under master title respectively), land search, bankruptcy search and other related charges.

- Valuation Fee : Payable on professional valuation done on properties charged to the bank

Process of approval 2 to 3 months Remarks https://malaysia.icbc.com.cn/en/column/1438058492123824181.html -

Trade products offered - Advising of Export L/C

Facilitating the advising of a Letter of Credit issued in your favour by its correspondent banks (Letter of Credit Issuing Bank), located locally or abroad. The Bank acts as an intermediary i.e. Advising Bank, whose primary role is to authenticate the said Letter of Credit upon receipt from their correspondent bank prior to advising the instrument to you, without any further engagement on its part. - Export LC Discounting

Supplier gets paid early based on L/C and acceptance from Issuing Bank - Outward Export Documentary Collections (DA/DP)

- A transaction whereby the exporter entrusts the collection of payment to the exporter's bank (remitting bank), which sends documents to the importer's bank (collecting bank), along with instructions for payment. - Negotiation of Export Bills without LC

Prefinance of financial documents (for example an invoice) under usual reserve which are due in the future. Discounting is with recourse: if the bank is not able to recover the funds at maturity, banks client (beneficiary) will be debited again. - Bank Guarantee (BG)

A definite undertaking by the bank (guarantor) to pay the beneficiary a certain sum of money within a specified period if the applicant (principal) fails to fulfill his contractual or other obligations of an underlying transaction. - Account Receivable Purchase Scheme (APRS)

whereby MUFG Bank purchase trade receivables at a discount from our customer (the "Seller"), on a non recourse basis in a manner of legal true-sale. The receivables are owed by pre-agreed obligors which are customers of MUFG. - Onshore Foreign Currency Loan (OFCL) - Trade

A trade financing facility for financing of exports and domestic sales under Open account terms. - Bankers Acceptance (BA) - Sales

A short term working capital facility extended by MUFG Bank (Malaysia) Berhad to a Customer (Seller) facilitating the financing of their sale/ export of goods. BA is a usance

Bills of Exchange (BA Draft) drawn by the Customer on and accepted by the Bank to finance sale to resident, or export to non-resident supported by documentation evidencing the movement of goods between the two parties

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. Documents required (1) Export LC to be advised to MUFG Bank (M) Bhd through swift add. BOTKMYKX.

(2) and (3) Companies must be a client of MUFG Bank (M) Bhd

(4), (5), (6), (7) and (8) Companies must be a client of MUFG Bank (M) Bhd and Credit facility need to be set up for this.Fees and charges (1) Customer: MYR50.00 + courier charges, Non-customer: MYR100.00 + courier charges

(2), (3) and (4) Handling commission for Foreign Currency: 0.1% (min MYR100.00, max MYR200.00) + courier charges + cable charge (MYR30.00 per cable),

Handling Commission for Ringgit: Commission In-Lieu of Exchange - 0.1% (min MYR100.00, max MYR500.00) + courier charges + cable charge (MYR30.00 per cable). Please refer to our Tariff and Charges as at June 2022 at www.bk.mufg.jp/malaysia/productsandservices/productsservices_commercial/index.html

(5) BG commission at 1.2% per annum (min MYR100.00 per BG) + courier charges (if required)

(6), (7) and (8) Please refer to our Tariff and Charges as at June 2022 at https://www.bk.mufg.jp/malaysia/productsandservices/productsservices_commercial/index.htmlProcess of approval (1) and (3) N/A

(2) T + 1 basis subject to available limits for issuing bank.

(4) Upon setting up of credit facility, bills can be discounted on T + 1 basis.

(5) Upon setting up of credit facility, BG can issued on T + 1 basis subject to acceptable BG wording.

(6) Upon setting up of credit facility, ARPS can be drawdown on T + 2 basis.

(7) Upon setting up of credit facility, OFCL Trade can be drawdown on T + 2 basis.

(8) Upon setting up of credit facility, BA sales can be drawdown on T + 2 basis.Remarks (1) and (5) https://www.bk.mufg.jp/malaysia/productsandservices/others/index.html

(2), (3), (4), (6), (7) and (8) Nil - Advising of Export L/C

-

Trade products offered - Letter of Credit

- Inward Bills for Collection

- Outward Bills for Collection

- Shipping Guarantee, Endorsement of Airway Bill/Parcel Post Receipt/Bill of Lading

- Bank Guarantee/Standby Letter of Credit

- Bankers’ Acceptance

- Onshore Foreign Currency Loan

- Invoice Financing, Trust Receipt

- Foreign / Domestic Bill of Exchange Purchased

- Foreign / Domestic Bill of Exchange Purchased- Authority to Purchase

- Advance Against Trade

- Export Credit Refinancing

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. The companies must satisfy the bank's credit underwriting policies and complies with the bank's compliance / due diligence procedures Documents required As per PDS, for drawdown on the transaction basis, application forms, invoice, transport documents and other satisfactory documentary evidence of the trade transaction Fees and charges Stamp Duties : As per Stamp Duty Act 1949 (Revised 1989)

Disbursement Fee : Include fees for registration of charge and Power of Attorney (for property with individual or strata title and for property under master title respectively), land search, bankruptcy search and other related charges.

Valuation Fee : Payable on professional valuation done on properties charged to the bankProcess of approval 2 to 3 months Remarks https://malaysia.icbc.com.cn/en/column/1438058492123824181.html -

Trade products offered - Letter of Credit (LC)

- Inward Bills Collection (IBC)

- Shipping Guarantee (SG) / Advance Endorsement (AE)

- Letter of Credit Advising (LA)

- Letter of Credit Transfer (LT)

- Letter of Credit Confirmation

- Outward Bills Collection (OBC)

- Bank Guarantee (BG)

- Standby LC (SBLC

- Banker's Acceptance (BA)

- Trust Receipt (TR) / Foreign Currency Trust Receipt (FCTR)

- Invoice Financing (IF) / Foreign Currency Invoice Financing (FCIF)

- Packing Credit (PC)

- Bills of Exchange Purchase (BEP)

- Credit Bills Purchased (CBP)

- Export Credit Refinancing (ECR)

- Factoring

- Supplier Finance (SF)

- Account Receivables Purchase (ARP)

- Dealer/Distributor Finance (DF)

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade Documents required - Company’s profile

- Registration documents example: SSM; approval from any local authorities such as MITI; MIDA.

- Bank statement for the past 6 months

- Annual Report

- Key suppliers and buyers

Fees and charges Fees and charges are according to the product features. https://www.uob.com.my/corporate/fees-and-rates/trade-services.page

Process of approval The process of approving the credit facility is subject to the amount requested and complexity of the case. Generally, the turnaround for approval about a month.Credit cases are process by independent credit approver team Remarks https://www.uob.com.my/corporate/transaction/trade-services/export-services.page -

Trade products offered - Advising of Export L/C

With a wide network of correspondent banks globally, the Bank can promptly authenticate the inward Letter of Credit received in your favour and advise you in the most expeditious manner - Bills Negotiation

Immediate advance to exporters or sellers against presentation of compliant documents against Letter of Credit, without the need of pre-approved trade facilities - Bills of Exchange Purchased/Discounted (BEP/D)

Facility whereby the bank purchases your outward bills for collection and credits your account immediately - Outward Export Documentary Collections (DA/DP)

Handling of foreign or domestic outward collection documents based on customer’s instructions to obtain payment or acceptance - Bank Guarantee (BG)

An undertaking by the Bank to pay an agreed sum to the beneficiary in the event that the Guarantee's applicant fails to perform its obligations - Bankers Acceptance (BA) - Sales

A short-term financing for your export or sales of goods to local or international buyer - Flexi Trade Loan (FTL) - Sales

A flexible solution which allows you to cover financing for both tangible goods and services under your exports or local sales transactions

Eligibility Requirements - Malaysian controlled or owned businesses

- Business must be minimum 3 years in operations

- Viable business with proven track record and ability to meet financing obligations

- Key director(s)/management must have minimum 3 years’ experience in the similar line of business

- Confined to the Shariah Compliant business/requirement (For Islamic Facilities)

- Company that is involved directly or indirectly in export activity and international trade

Documents required - 3 years financial Statutory documents of business

- 6 months bank statements

- Any other document which the Bank may require on case-to-case basis

Interest/ Profit Rate (range) Up to BLR/ BFR + 1.35% p.a.

Up to COF/ iCOF + 2.75% p.a.Fees and charges Please refer to the respective Trade product for fees and charges information at https://www.affinalways.com/en/fees-and-charges

Process of approval 30 to 45 days upon submission of Application date (subject to complete information and documentation submitted) Remarks Please refer to https://www.affinalways.com/en/corporate-trade-finance for detail of Trade products and services - Advising of Export L/C

-

Trade products offered - Outward Bills for Collection-i

- Inward Bills for Collection-i

- Wakalah Bank Guarantee-i

- Over-the-counter Wakalah Bank Guarantee-i

- Documentary Credit-I

- Over-the-counter Documentary Credit-i

- Standby LC- i

- Accepted Bills-i

- Trust Receipt-i

- Promissiory Notes - i

- Export Negotiation-i

- Shipping Guarantee-i

- Invoice Financing-i

Eligibility Requirements - In operation for 3 years and above

- Profitable business

Documents required - For pre-screening, we just need the below documents

- Audited account for 3 years

- Latest management account

Interest/ Profit Rate (range) BFR / COF + (1.25% - 2.50%) p.a

Fees and charges - Stamp Duty as per Stamp Duty Act 1949

- Legal fees

- Other actual cost and charges as per Alliance Bank (M) Berhad standard tariff

Process of approval Within 30 days from application day (subject to complete information and documents submitted) Remarks General Trade Financing information: https://www.alliancebank.com.my/business/trade-finance/trade-finance

Program Pembangunan Pengeksport Baru

Pengumuman

Dengan hormatnya MATRADE ingin memaklumkan kepada semua pengeksport Malaysia bahawa Program Pembangunan Eksport Bumiputera, Wanita dan Belia telah ditangguhkan sehingga pemberitahuan selanjutnya. Segala kesulitan yang timbul amat dikesali.

Bagi syarikat yang baru mengeksport, MATRADE mempunyai tiga program intensif untuk mempercepatkan tahap kesediaan eksport untuk Perusahan Kecil dan Sederhana (PKS). Program Pembangunan Pengeksport Wanita (WEDP), Program Pembangunan Pengeksport Belia (YEDP) and Program Pembangunan Pengeksport Bumiputera (BEDP) merupakan kemudahan sokongan eksport untuk kumpulan sasaran dimana setiap satu disesuaikan khusus untuk meningkatkan pembangunan eksport dan prestasi melibatkan tiga kumpulan utama yang terdiri daripada Wanita, Belia dan Bumiputera. Statistik telah menunjukkan bahawa ketiga - tiga kumpulan ini dari segi sejarah menunjukkan tahap penyertaan eksport yang rendah di Malaysia.

Syarikat yang berminat dengan program khusus WEDP, YEDP dan BEDP boleh memohon terus dengan menghubungi unit berkenaan di talian yang tertera di bawah. Permohonan mesti dibuktikan dengan dokumen yang disahkan dan semua pemohon mesti memenuhi standard kriteria penyertaan. Syarikat yang telah berjaya disenarai pendek akan tertakluk kepada audit, temu duga dan penilaian oleh MATRADE sebelum pemilihan akhir.

MATRADE menggunakan model Exporters' Readiness and Capability Assessment (ERCA) untuk menilai syarikat untuk dipilih ke dalam program tersebut. Syarikat terpilih akan menjalani program tersebut selama tiga tahun.

Kriteria:

| Program | Program Pembangunan Pengeksport Wanita (WEDP) | Program Pembangunan Pengeksport Belia (YEDP) | Program Pembangunan Pengeksport Bumiputera (BEDP) |

|---|---|---|---|

| Ketua Pegawai Eksekutif/Pengarah Urusan | Wanita | Belia | Bumiputera |

| Ekuiti | Majoriti atau sekurang-kurangnya 51% dimiliki oleh wanita |

Majoriti atau sekurang-kurangnya 51% dimiliki oleh belia |

Majoriti atau sekurang-kurangnya 51% dimiliki oleh Bumiputera |

| Status Syarikat |

|

||

| Local Business Presence |

|

||

| Sektor Industri | Terbuka. Sama ada barangan atau perkhidmatan | ||

WEDP ialah program sokongan eksport tiga tahun disasarkan untuk pengeksport wanita. WEDP bermula pada tahun 2005 dengan matlamat untuk menggalakkan syarikat milik wanita yang berdaya saing dan mampan untuk mengembangkan eksport produk dan perkhidmatan mereka.

Siapa yang boleh memohon?

Secara ringkas, kriteria kelayakan termasuk syarikat milik wanita di mana majoriti atau sekurang-kurangnya 51 peratus ekuiti dipegang oleh wanita. Ketua Pegawai Eksekutif dan/atau Pengarah Urusan mestilah wanita. Keperluan lain termasuklah diklasifikasikan sebagai Perusahaan Kecil dan Sederhana (PKS), telah beroperasi selama sekurang-kurangnya tiga tahun, telah mencapai level of market visibility di dalam negara, dan mempunyai premis perniagaan tetap atau tempat pembuatan.

Syarikat yang disenarai pendek akan diaudit dan dinilai oleh jawatankuasa yang terdiri daripada TERAJU, PUNB, MARA, MITI dan MATRADE. Penilaian adalah berdasarkan audit, temuramah dan markah berdasarkan model Exporter's Readiness and Capability Assessment (ERCA).

Perbelanjaan yang disokong dan faedah menyertai program:

WEDP ialah program hand-holding intensif yang melibatkan bimbingan perniagaan khusus, latihan peningkatan kemahiran, pendedahan perniagaan antarabangsa dan market immersions, rangkaian dan sesi bimbingan, serta pembangunan kepimpinan dan keusahawanan.

Syarikat dalam program ini menerima sedikit sokongan kewangan dalam bentuk lawatan bantuan ke pameran perdagangan antarabangsa atau acara promosi perdagangan antarabangsa yang lain dan penyertaan bebas terpilih dalam seminar dan bengkel anjuran MATRADE.

Kriteria Kelayakan dan Pemilihan

- Syarikat itu mesti dimiliki oleh wanita dengan majoriti, atau sekurang-kurangnya 51% daripada ekuiti yang dipegang oleh wanita. Pegangan saham majoriti boleh melalui individu wanita tunggal atau sekumpulan pemegang saham wanita.

- Ketua Pegawai Eksekutif dan/atau Pengarah Urusan mestilah wanita. Keperluan yang ditetapkan untuk jawatan kepimpinan disandang oleh seorang wanita ini dianggap penting, kerana program ini menekankan pembangunan kepimpinan individu di dalam position of power.

- Syarikat untuk WEDP mesti menepati definisi nasional Perusahaan Kecil dan Sederhana (PKS).

- Syarikat mesti beroperasi selama sekurang-kurangnya tiga tahun dan mempunyai level of market footprint/presence/saham dalam pasaran tempatan.

- Syarikat yang berurusan dengan barangan atau perkhidmatan mesti mempunyai premis perniagaan atau fasiliti pembuatan yang tetap dengan alamat khusus dan bukan Peti Surat sahaja. Syarikat milik wanita yang berpangkalan di Sabah dan Sarawak boleh diberi keutamaan untuk WEDP, atas dasar mempelbagaikan pertumbuhan sosio-ekonomi serantau.

- Keutamaan istimewa akan diberikan kepada syarikat yang terlibat dalam industri berasaskan teknologi, mempunyai nilai tambah tinggi dan berasaskan pengetahuan. Jenis industri ini termasuk pembuatan alat ganti berketepatan tinggi, bioteknologi, kejuruteraan bioperubatan, animasi dan sistem pengawasan lanjutan dan sebagainya dan secara amnya bukan tradisional kepada usahawan wanita.

BEDP ialah satu lagi program sokongan eksport khusus yang disasarkan untuk syarikat Bumiputera. Dimulakan pada tahun 2004, ia hampir sama dan diuruskan mengikut barisan yang sama seperti WEDP dan YEDP. Ia juga merupakan program tiga tahun dengan objektif untuk mengembangkan pengeksport Bumiputera yang berdaya saing dan mampan.

Siapa yang boleh memohon?

Pemohon yang layak adalah syarikat milik Bumiputera dengan majoriti atau sekurang-kurangnya 51% ekuiti dimiliki oleh Bumiputera. Ketua Pegawai Eksekutif dan/atau Pengarah Urusan hendaklah seorang Bumiputera. Pemohon mesti diklasifikasikan sebagai Perusahaan Kecil dan Sederhana (PKS), beroperasi sekurang-kurangnya tiga tahun, mencapai tahap pengiktirafan/penonjolan pasaran yang boleh diterima dalam pasaran domestik Malaysia, dan mempunyai premis perniagaan atau fasiliti pembuatan tetap.

Syarikat yang disenarai pendek akan diaudit dan dinilai oleh jawatankuasa yang terdiri daripada TERAJU, PUNB, MARA, MITI dan MATRADE. Penilaian adalah berdasarkan audit, temuramah dan markah berdasarkan model Exporter's Readiness and Capability Assessment (ERCA).

Perbelanjaan yang disokong dan faedah menyertai program:

Sama seperti WEDP, BEDP terdiri daripada beberapa inisiatif sokongan termasuk latihan peningkatan kemahiran, kepimpinan dan pembangunan keusahawanan, rangkaian dan sesi mentor, bimbingan perniagaan khusus dan pendedahan perniagaan antarabangsa serta penerokaan pasaran.

Syarikat-syarikat dalam BEDP juga diperkenalkan kepada peluang dan persaingan dalam pasaran antarabangsa dan diberi sokongan kewangan dalam bentuk lawatan bantuan ke pameran perdagangan antarabangsa atau mana-mana acara promosi perdagangan antarabangsa lain yang sesuai dengan keperluan mereka. Syarikat BEDP juga diberikan tahap penyertaan percuma dalam seminar dan bengkel anjuran MATRADE sepanjang program tiga tahun itu.

Kriteria Kelayakan dan Pemilihan

- Mestilah syarikat milik Bumiputera dengan majoriti atau sekurang-kurangnya 51% daripada ekuiti syarikat milik Bumiputera. Pegangan saham Bumiputera dalam syarikat boleh dipegang oleh sama ada individu atau sekumpulan pemegang saham Bumiputera.

- Ketua Pegawai Eksekutif dan/atau Pengarah Urusan mestilah seorang Bumiputera. Oleh kerana BEDP memfokuskan dalam membangunkan traits di dalam seseorang yang penting, penetapan untuk jawatan kepimpinan tertinggi (CEO/MD/atau COO) untuk menjadi Bumiputera sebenarnya agak penting. Ini kerana individu teratas akan menjadi orang yang membuat keputusan kritikal dan memutuskan hala tuju syarikat.

- Syarikat itu mesti berada di bawah takrifan baharu Perusahaan Kecil dan Sederhana (PKS).

- Syarikat mesti beroperasi selama sekurang-kurangnya tiga tahun dan mempunyai level of market footprint/presence/saham dalam pasaran tempatan.

- Syarikat yang berurusan dengan barangan atau perkhidmatan mesti mempunyai premis perniagaan atau fasiliti pembuatan yang tetap dengan alamat khusus dan bukan Peti Surat sahaja. Syarikat milik bumiputera yang berpangkalan di Sabah dan Sarawak boleh diberi pertimbangan khusus untuk BEDP, atas dasar mempelbagaikan pertumbuhan sosio-ekonomi serantau.

- Syarikat bumiputera yang terlibat dalam industri yang dipacu teknologi, mempunyai nilai tambah tinggi dan industri berasaskan pengetahuan boleh diberi keutamaan. Jenis industri ini termasuk pembuatan alat ganti berketepatan tinggi, bioteknologi, kejuruteraan bioperubatan, animasi dan sistem pengawasan lanjutan dan lain - lain.

Program tiga tahun khusus dan disasarkan untuk belia, antara umur 20 hingga 40 tahun, yang berminat atau sudah terlibat dalam eksport. YEDP merangkumi pelbagai sektor tetapi memberi pertimbangan khusus kepada 'soft export' daripada industri kreatif seperti seni, muzik, fesyen, gaya hidup, kraf, reka bentuk dan lain-lain. Program ini merupakan program baru dan telah dimulakan pada 2014.

Siapa yang boleh memohon?

Ketua Pegawai Eksekutif dan/atau Pengarah Urusan mestilah berumur antara 20 hingga 40 tahun. Sekurang-kurangnya 51 peratus daripada ekuiti firma itu mesti dipegang oleh belia yang berumur antara 20 hingga 40 tahun. Syarikat itu juga mesti beroperasi sekurang-kurangnya 3 tahun dan mempunyai footprint dalam pasaran domestik Malaysia.

Syarikat yang disenarai pendek akan diaudit dan dinilai oleh jawatankuasa yang terdiri daripada TERAJU, PUNB, MARA, MITI dan MATRADE. Penilaian adalah berdasarkan audit, temuramah dan markah berdasarkan model Exporter's Readiness and Capability Assessment (ERCA).

Perbelanjaan yang disokong dan faedah menyertai program:

YEDP dijalankan sama seperti WEDP dan BEDP merupakan program hand-holding intensif yang melibatkan bimbingan perniagaan khusus. Program ini melibatkan bimbingan perniagaan khusus dan khidmat nasihat eksport, latihan peningkatan kemahiran, kepimpinan dan pembangunan keusahawanan, sesi rangkaian dan bimbingan serta pendedahan perniagaan antarabangsa dan penerokaan pasaran.

Syarikat YEDP diberi tahap sokongan kewangan dalam bentuk lawatan bersubsidi ke pameran perdagangan antarabangsa atau sebarang acara promosi perdagangan antarabangsa lain yang akan membolehkan pendedahan maksimum, pengalaman pembelajaran dan peningkatan syarikat di arena antarabangsa. Syarikat dalam program YEDP juga diberi akses kepada penyertaan percuma dalam seminar dan bengkel anjuran MATRADE.

Kriteria Kelayakan dan Pemilihan

- Majoriti ekuiti atau sekurang-kurangnya 51% daripada ekuiti syarikat mestilah berada di tangan belia yang berumur antara 20-40 tahun. Pegangan saham majoriti boleh dipegang oleh seorang individu belia tunggal atau sekumpulan belia sebagai pemegang saham majoriti.

- Ketua Pegawai Eksekutif dan/atau Pengarah Urusan mestilah seorang belia. Keperluan yang ditetapkan untuk jawatan kepimpinan disandang oleh belia ini dianggap penting, kerana program ini menekankan pembangunan kepimpinan individu sebagai jawatan yang paling berkuasa.

- Syarikat untuk YEDP mesti menepati definisi nasional Perusahaan Kecil dan Sederhana (PKS).

- Syarikat mesti beroperasi selama sekurang-kurangnya tiga tahun dan mempunyai level of market footprint/presence/saham dalam pasaran tempatan.

- Syarikat yang berurusan dengan barangan atau perkhidmatan mesti mempunyai premis perniagaan atau fasiliti pembuatan yang tetap dengan alamat khusus dan bukan Peti Surat sahaja. Syarikat milik belia yang berpangkalan di Sabah dan Sarawak boleh diberi pertimbangan khusus dalam pemilihan YEDP, atas dasar mempelbagaikan pertumbuhan sosio-ekonomi serantau.

- PKS yang terlibat dalam industri berasaskan teknologi, mempunyai nilai tambah tinggi dan berasaskan pengetahuan akan diberi tumpuan khusus. Jenis industri ini termasuk pembuatan alat ganti berketepatan tinggi, bioteknologi, kejuruteraan bioperubatan, animasi dan sistem pengawasan lanjutan dan lain-lain.

Faedah:

PKS yang dipilih untuk sama ada program WEDP, YEDP atau BEDP boleh memperoleh faedah berikut daripada program tiga tahun:

- Bimbingan perniagaan dan intensive hand-holding support. okongan eksport akan disediakan oleh pegawai berpengalaman dan terlatih yang mempunyai pengetahuan luas dalam promosi eksport melalui pendedahan selama bertahun-tahun dalam perdagangan eksport. Jurulatih disokong oleh pegawai dari Unit Pembangunan Pengeksport Wanita, Belia dan Bumiputera yang akan berkhidmat sebagai pegawai projek perhubungan yang bertanggungjawab ke atas prestasi dan rekod syarikat.

- Latihan peningkatan kemahiran akan dijalankan pada setiap suku tahun dalam bentuk seminar, bengkel dan simposium. Kehadiran dan penyertaan dalam acara yang dianjurkan oleh MATRADE ini adalah percuma. Latihan peningkatan kemahiran ini meliputi topik kritikal seperti:

- Cross Cultural Understanding In International Business

- Langkah-langkah untuk Berjaya Mengeksport

- Komunikasi Perniagaan Antarabangsa

- Kemahiran Perundingan Berkesan

- Merangka Pelan Eksport & Strategi Kemasukan Pasaran

- Effective Bookkeeping for Exporters

- Penjenamaan untuk Pasaran Global

- Pendedahan kepada pasaran global melalui penyertaan aktif dalam aktiviti promosi perdagangan antarabangsa yang diadakan di luar negara. PKS terpilih akan diberi peluang untuk mempromosikan produk dan perkhidmatan mereka di pameran perdagangan antarabangsa, misi jualan yang disesuaikan dan misi pemasaran khusus.

- Ruang pameran percuma untuk pendedahan pasaran, publisiti dan peluang mempamerkan produk atau perkhidmatan untuk tempoh 12 bulan di Pusat Pameran Eksport Malaysia (MEEC). MEEC ialah pusat pameran tetap bagi barangan dan perkhidmatan buatan Malaysia berorientasikan eksport yang terletak di Menara MATRADE, Kuala Lumpur.

- Sesi rangkaian dan bimbingan di kalangan PKS dan syarikat yang lebih besar membantu meluaskan jangkauan perniagaan melalui perkongsian pengetahuan. Syarikat mempelajari melalui sesi perkongsian dan pencapaian syarikat lain.

- Pembangunan kualiti kepimpinan dan keusahawanan. Sesi ini memupuk dan membangunkan ciri-ciri yang membantu dalam membina hubungan interpersonal yang seterusnya penting untuk kerjasama perniagaan

Permohonan & Borang Dalam Talian

Permohonan Dalam Talian

- Daftar sebagai Ahli MATRADE | Manual Pengguna

- Geran Pembangunan Pasaran (MDG)

- Acara Perdagangan Antarabangsa

- Program Latihan Pengeksport

- Pembelajaran Digital MATRADE

- Pertanyaan

- Pendaftaran Pameran dan Persidangan Perdagangan Antarabangsa di Malaysia

- Pengesahan Pameran dan Persidangan Perdagangan Antarabangsa di Malaysia

Development Programme for New Exporters

MATRADE’s Bumiputera Exporters Development Programme (BEDP) and Women Exporters Development Programme (WEDP) are export assistance programmes designed for small and medium-sized Bumiputera and women-owned businesses that are new to, or have limited experience in exporting. These programmes help SMEs develop the necessary skills and knowledge to penetrate and further expand their export markets.

Designed and managed by MATRADE, these programmes give participants the best possible start to exporting by providing valuable advice, information and assistance in selected overseas markets. Under these programmes participants are expected to complete a 3-year programme that will expose them in export promotional activities, trainings, seminars and visitation programmes in enhancing their capability and knowledge to become sustainable exporters.

Eligibility Criteria

BEDP and WEDP were designed specifically for new and irregular exporters with limited experience who are capable and willing to develop the skills needed to become a sustainable exporter. Due to overwhelming responses from Bumiputera and women owned businesses in joining these programmes, participations are based on invitation basis and limited to 12 businesses per intake per year for each programme. Selection into the programme is based on merit and consensus by the New Exporters Development Unit Committee members.

To be eligible for these programmes your business should be:

- A Sendirian Berhad (SDN BHD) company with at least 51% equities of the company owned by Bumiputera entity and has a valid Malaysian Company Registration Number with Suruhanjaya Syarikat Malaysia (SSM). Preference will be given to 100% owned Bumiputera Company. (For Bumiputera Exporter Development Programme).

- A Sendirian Berhad (SDN BHD) company with at least 51% equities of the company owned by Malaysian women entity and has a valid Malaysian Company Registration Number with Suruhanjaya Syarikat Malaysia (SSM). Preference will be given to 100% Malaysian owned company. (For Women Exporter Development Programme).

- Able to provide Ministry of Finance Bumiputera registration forms (For Bumiputera Exporter Programme).

- Able to provide EPF statement, form 24 and 49.

- In business for at least 4 years and have some experience in both domestic and export markets.

- Malaysia as its main place of business and not as their marketing office or representative office.

- Never previously been signed on to MATRADE Trade Outreach Programme (MTOP) or Women Trade Outreach Programme (WTOP) either directly or indirectly through their stake holders.

- In total control of production, operation and marketing of products or services offered. Export agents / brokers, traders or OBM and OEM suppliers will not be considered.

- In sound financial status with healthy cash flow and able to provide audited financial account for the last 3 financial years.

In addition, your business must be export-ready and have:

- A product or service with clear export potential.

- Management commitment to becoming an exporter and developing the export side of the business, including a willingness to visit the market if appropriate.

- A team of at least 2 personnel from company whom will dedicate their time and resources in ensuring the success of this programme.

- An understanding that the company will need to participate in compulsory training courses before participating in any export promotional activities.

- Marketing materials, such as a packaging, website or brochure, with an understanding that materials specific to the international market may need to be developed.

- The capacity to build supply capability and able to cater for export demand.

- An export market plan strategy with three (3) years forward planning for MATRADE assessment.

Benefits Under These Programmes

Participants under these programmes will be supervised by one of the officers of the New Exporters Development Unit and are entitled to receive the following services:

- Assistance in the form of selecting an export market/s.

- Entitlement to participate up to three (3) Export Promotional Activities per year for 3-year programme period. Export Promotional activities comprise participation in International Trade Exhibition, Specialised Selling Mission, Trade and Investment Mission and Individual Business Mission.

- Free participation in any MATRADE’s organised seminars at MATRADE headquarters.

- Free participation in field trips and visitation programmes to selected private and government sectors related to companies business.

- 12 months fees waiver for exhibiting products at MATRADE’s MEEC

Responsibilities Of Participants

Participants are required to:

- Commit resources and reasonable management time to the programme.

- Participate and provide full co-operation in any market research organised by MATRADE.

- Accountable to action directly or indirectly taken by company personnel that affect the programme.

- Abide to regulation and rules as stipulated in terms and condition of the programme.

- Be aware that the entitlements to participate in Export Promotional Activities are subjected to MATRADE approval and their entitlement is up to 3 events per year (non-exclusive basis) for 3-year programme. If company fails to utilise their entitlement for the year then it will be forfeited.

- Be aware that MATRADE have the rights to terminate or suspend any participants which fail to perform or co-operate during the duration of the programme without explanation.

-

Enquiries

For further enquiries, please contact:

Address :

New Exporters Development Unit

Level 9, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Tel : 03-6207 7077

Fax : 03-6203 7251

Pendaftaran dan Pengesahan Acara Perdagangan di Malaysia

Pameran dan Persidangan Perdagangan Antarabangsa adalah salah satu cara promosi perdagangan yang paling berkesan dan terkini di Malaysia. Negara ini mempunyai kemudahan yang mencukupi serta bertaraf antarabangsa untuk menganjurkan pameran dan persidangan antarabangsa dalam negara. Pameran dan persidangan semakin besar dan lebih terperinci. Ke arah mempromosi industri pameran dan persidangan di negara ini, Kerajaan memutuskan bahawa semua acara perdagangan, baik berstatus tempatan dan antarabangsa, berdaftar dengan MATRADE.

PENGUMUMAN

Notis pelaksanaan yuran pemprosesan untuk Pendaftaran dan Pengiktirafan Pameran dan Persidangan Perdagangan yang diadakan di Malaysia berkuat kuasa 1 Mac 2024 (permohonan sekurang-kurangnya 6 bulan sebelum acara).

PENDAFTARAN

Acara-acara yang layak untuk pendaftaran ialah Pameran Perdagangan, Persidangan atau kedua-duanya, yang diadakan di Malaysia. Faedah yang bakal diperoleh dari pendaftaran acara-acara ini dengan MATRADE adalah:

- Penyenaraian acara dalam portal MATRADE;

- Penyenaraian acara dalam direktori MATRADE dan brosiur pameran perdagangan dan industri di Malaysia;

- Promosi acara melalui pejabat wilayah dan pejabat Perdagangan MATRADE di luar negara; dan

- Promosi acara semasa aktiviti promosi MATRADE.

KRITERIA UNTUK PENDAFTARAN

- Penganjur mestilah merupakan syarikat tempatan atau asing yang berdaftar;

- Tempat pameran hendaklah dilengkapi dengan peralatan dan kemudahan yang sesuai;

- Penganjuran acara mesti memenuhi ruang kasar minimum seluas 1,000 meter persegi; dan

- Penganjuran acara ini menampilkan produk, teknologi atau perkhidmatan yang selaras dengan keperluan industri.

PERMOHONAN

Permohonan untuk pendaftaran acara boleh dibuat secara dalam talian melalui Borang Pendaftaran MATRADE (Borang R1). Sila serahkan salinan cetak Borang R1 yang telah lengkap diisi bersama-sama dengan:

- Memorandum Persatuan (untuk Syarikat) / Sijil Pendaftaran daripada Pendaftar Pertubuhan (untuk Persatuan), jika anda adalah pemohon kali pertama;

- Bukti tempahan tempat daripada pengendali tempat; dan

- Satu set bahan promosi acara contoh: risalah atau risalah

YURAN PEMPROSESAN PENDAFTARAN

- Pendaftaran bagi Acara Perdagangan Antarabangsa yang diadakan di Malaysia adalah WAJIB; dan

- Yuran pendaftaran adalah RM100.00 bagi setiap permohonan untuk sesuatu acara (Yuran tidak boleh dikembalikan).

Nota: Pendaftaran tidak melayakkan penganjur menggunakan logo MATRADE pada mana-mana bahan atau media promosi.

PENGIKTIRAFAN

Pengesahan Pameran dan Persidangan Perdagangan Antarabangsa menambah kredibiliti kepada sesuatu acara dan membantu penganjur mempromosikan acara tersebut dengan lebih berkesan. Acara yang layak untuk pengesahan ialah Pameran Perdagangan atau Persidangan dengan Pameran Perdagangan. Manfaat menyokong acara dengan MATRADE adalah seperti berikut:

- Penyenaraian acara dalam Portal MATRADE;

- Penyenaraian acara dalam direktori MATRADE dan brosiur pameran perdagangan dan industri di Malaysia;

- Promosi acara melalui pejabat wilayah dan luar negara MATRADE;

- Promosi acara semasa aktiviti promosi MATRADE;

- Penggunaan logo MATRADE dengan kapsyen "DIIKTIRAF OLEH" pada semua bahan bercetak; dan

- Syarikat adalah layak untuk pembayaran balik perbelanjaan untuk menyertai pameran atau pameran perdagangan antarabangsa yang diadakan di Malaysia, dengan pengesahan oleh MATRADE jika pameran perdagangan itu tidak dianjurkan oleh MATRADE

KRITERIA UNTUK PENDAFTARAN

- Penganjur mestilah syarikat tempatan atau asing yang berdaftar;

- Tempat pameran hendaklah dilengkapi dengan peralatan dan kemudahan yang sesuai;

- Penganjuran acara mesti memenuhi ruang kasar minimum seluas 1,000 meter persegi;

- Penganjuran acara perlu menampilkan produk, teknologi atau perkhidmatan yang selaras dengan keperluan industri; dan

- Penganjur dikehendaki mengemukakan Laporan Beraudit (Baru) bagi Pameran Terdahulu yang telah diadakan di Malaysia dan mematuhi sekurang-kurangnya satu daripada kriteria berikut:

- sekurang-kurangnya 20% peserta pameran adalah peserta dari luar negara, atau

- sekurang-kurangnya 20% ruang pameran telah disewakan kepada pempamer asing, atau; dan

- sekurang-kurangnya 10% daripada pelawat adalah terdiri dari pelawat perdagangan asing.

Nota: Dalam mana-mana kes, sekiranya penganjur tidak dapat menyediakan laporan yang telah diaudit untuk menunjukkan pematuhan dengan kriteria di atas, atau jika acara itu semata-mata merupakan acara Persidangan sahaja, MATRADE hanya akan mendaftarkan acara tanpa pengiktirafan.

PERMOHONAN

Permohonan untuk pengesahan acara boleh dibuat secara atas talian melalui Borang Pengiktirafan MATRADE (Borang E1). Sila serahkan salinan cetak Borang E1 yang telah lengkap diisi bersama-sama dengan:

- Memorandum Persatuan (untuk Syarikat) / Sijil Pendaftaran daripada Pendaftar Pertubuhan (untuk Persatuan), sekiranya anda adalah pemohon kali pertama;

- Laporan Audit penganjuran acara sebelumnya daripada juruaudit bertauliah atau syarikat pengurusan pangkalan data;

- Bukti tempahan tempat daripada pengendali tempat; dan

- Satu set bahan promosi acara, contoh: risalah atau risalah.

YURAN PEMPROSESAN UNTUK PENGIKTIRAFAN

- Yuran pemprosesan untuk Pengiktirafan Acara Perdagangan Antarabangsa yang diadakan di Malaysia ialah RM5,000.00 bagi setiap permohonan untuk sesuatu acara. (Tidak akan dikembalikan).

PENAFIAN UNDANG-UNDANG / SYARAT PENGGUNAAN

MATRADE tidak akan bertanggungjawab terhadap sebarang keputusan yang terhasil untuk permohonan yang ditolak.

Yuran pemprosesan untuk permohonan tidak akan dikembalikan.

Permohonan yang diterima tidak menjamin acara tersebut akan DIIKTIRAFKAN / DIDAFTARKAN oleh MATRADE. Kelulusan akan diberikan secara bertulis; dan

Dengan menggunakan logo MATRADE, pengguna bersetuju untuk mematuhi sepenuhnya dan terikat dengan terma undang-undang kami seperti berikut:

- Pematuhan Undang-undang: Pengguna bersetuju untuk mematuhi semua undang-undang yang terpakai dan dengan semua arahan, perintah, keperluan dan arahan yang diberikan kepada pengguna oleh mana-mana pihak berkuasa yang kompeten untuk berbuat demikian di bawah mana-mana undang-undang yang berkenaan. MATRADE berhak untuk menyiasat aduan atau melaporkan pelanggaran Terma Undang-undang kami dan untuk mengambil sebarang tindakan yang kami anggap sesuai, termasuk tetapi tidak terhad kepada melaporkan sebarang penyalahgunaan atau aktiviti yang disyaki menyalahi undang-undang kepada pihak berkuasa penguatkuasaan undang-undang atau mengambil sebarang tindakan undang-undang terhadap pengguna.

- Penggunaan: Logo MATRADE hendaklah digunakan untuk tujuan program yang disebutkan di atas sahaja. Penggunaan logo MATRADE untuk sebarang tujuan lain tanpa kelulusan bertulis MATRADE adalah dilarang sama sekali. MATRADE berhak untuk membuat tuntutan terhadap pengguna bagi sebarang kerugian atau kerosakan yang dialami akibat penggunaan logo MATRADE secara cuai oleh pengguna.

- Harta Intelek: Logo MATRADE adalah Harta Intelek dan tanda dagangannya dilindungi oleh undang-undang hak cipta dan undang-undang lain yang berkenaan. Logo MATRADE tidak boleh disalin, diterbitkan semula atau ditiru sama ada secara keseluruhan atau sebahagian, melainkan dibenarkan secara bertulis oleh MATRADE. Pengguna hendaklah bertanggungjawab untuk sebarang tuntutan sekiranya penggunaan logo MATRADE melanggar paten, hak cipta atau reka bentuk berdaftar; dan

- Indemniti: Pengguna perlu melepaskan MATRADE daripada sebarang tuntutan undang-undang yang berkaitan ke atas penggunaan logo MATRADE. Dalam apa jua keadaan, MATRADE tidak akan bertanggungjawab untuk sebarang kerosakan sampingan, berbangkit atau apa-apa jua yang timbul daripada penggunaan logo MATRADE oleh pengguna.

Maklumat lanjut dan penyerahan permohonan:

PUSAT PAMERAN EKSPORT MALAYSIA

Menara MATRADE,

Tingkat 5 Sayap Barat,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Tel: +603-6207 7453 / 7452

Emel: Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya.

Program MATRADE bersama Usahawan & Pengeksport

Program MATRADE bersama Usahawan dan Pengeksport merupakan inisiatif berterusan MATRADE untuk menambah baik sistem penyampaian serta mendekati syarikat - syarikat di luar Lembah Klang.

Sesi - sesi ini berfungsi sebagai platform untuk komuniti pengeksport memberikan maklum balas berkaitan isu, program dan aktiviti melibatkan eksport.

|

MATRADE’s EXPORTERS OUTREACH PROGRAMMES 2025 Nota: Jadual program adalah berdasarkan maklumat terkini sehingga 14 Oktober 2025 |

||

| Tarikh | Acara | Lokasi |

| 14-15 Nov 2025 | MITI ASEAN Day 2025 | Menara MITI, Kuala Lumpur |

| 20 Nov 2025 | Dialog Usahawan Madani | Bangunan TD1303, Jalan Sultan Zainal Abidin, Kuala Terengganu |

| 23-25 Nov 2025 | Info Booth @ WE 2025: Future in Motion - Women in Trade, Investment, Leadership | MITEC, Kuala Lumpur |

| 28-30 Nov 2025 | Info Booth @ Ekspo Usahawan Selangor (SELBIZ) 2025 | SACC, Shah Alam |

Untuk makluman lanjut, silat hubungi :

Unit Khidmat Nasihat dan Latihan Pengeksport (EATU)

Tingkat 2, Sayap Barat, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur.

Tel : 603-6207 7077

Email : Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya.

Meja Bantuan MATRADE

Meja Bantuan MATRADE berfungsi sebagai perkhidmatan pelanggan barisan hadapan kepada pelawat perniagaan ke MATRADE. Bertujuan untuk menjawab pertanyaan umum mengenai rangkaian penuh perkhidmatan dan program kami, Meja Bantuan MATRADE juga menangani pertanyaan telefon daripada kedua-dua perniagaan tempatan dan antarabangsa.

Jika anda mempunyai sebarang komen, cadangan atau pertanyaan tentang perkhidmatan kami, sila hubungi kami melalui telefon, e-mel atau faks di bawah:

Perbadanan Pembangunan Perdagangan Luar Malaysia (MATRADE)

Tingkat 2, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur.

Tel: 603-6207 7077 ext 7633

Fax: 603-6203 7253

Email: Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya.

Women Exporters Development Programme (WEDP)

WEDP is a gender specific, three-year export support program, targeted for women exporters. WEDP began in 2005 with the aim of encouraging competitive and sustainable women-owned companies to expand their product and services exports.

Who can apply?

Briefly, the eligibility criteria include women-owned companies where the majority or at least 51 percent of the equity is held by women. The CEO and/or Managing Director should be women. Other requirements include, being classified as a Small and Medium Enterprise (SME), has been in operation for a minimum of three years, has attained some level of market visibility domestically, and has a designated business premise or manufacturing locale.

Shortlisted companies will be audited and assessed by a committee consisting of TERAJU, PUNB, MARA, MITI and MATRADE. Assessments will be based on site audits, interviews and scores on the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

WEDP is an intensive hand-holding program involving customised business coaching, skills enhancement training, international business exposure and market immersions, networking and mentoring sessions, and leadership and entrepreneurial development.

Companies in the programme receive some financial support in the form of assisted visits to international trade fairs or other international trade promotion events and selective free participation in seminars and workshops organised by MATRADE.

Eligibility and Selection Criteria

- The company must be owned by women with a majority, or at least 51% of equity held by women. The majority shareholding can be through a single female individual or a group of women shareholders.

- The Chief Executive Officer and/or Managing Director must be women. This set requirement for the leadership position to be held by a woman is considered important, as the programme emphasises on the leadership development of the individual placed in a position of power.

- Companies for WEDP must fit the national definition of a Small and Medium Enterprise (SME).

- The company must be in operation for a minimum of three years and attained an acceptable level of market footprint/presence/share/dominance locally

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Women-owned companies based in Sabah and Sarawak can be given priority for WEDP, on the basis of diversifying the spread of regional socio-economic growth.

- Special preference will be accorded to companies that are involved in technology-driven, high value-added and knowledge-based industries. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc., and are generally non-traditional to women entrepreneurs.

Program Pembangunan Pengeksport Belia (YEDP)

What is it?

A specific and targeted three-year programme formulated for youths, between the ages of 20 to 40 years, who are interested or already involved in exporting. YEDP covers a broad range of sectors but gives special consideration to 'soft exports' from the creative industry such as the arts, music, fashion, lifestyle, crafts, design etc. The programme is relatively new and was started in 2014.

Who can apply?

The CEO and/or Managing Director must be between the ages 20 to 40 years. At least 51 percent of the firm's equity must be held by youths between the ages of 20 to 40 years. The company must also be in operation for at least 3 years and have some footprint in the Malaysian domestic market.

Shortlisted candidates will undergo a screening process. Prior to selection by a panel committee consisting of MARA, MITI, TERAJU, PUNB and MATRADE, a site visit will be conducted, together with interviews with management and the rating of the company done through the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

YEDP is run and managed along the same lines as WEDP and BEDP, and like its sister programmes, it is an intensive hand-holding support facility.

The support framework, much like WEDP and BEDP, involves customised business coaching and export advisory services, skills enhancement training, leadership and entrepreneurial development, networking and mentoring sessions and international business exposure and market immersions.

YEDP companies are given a level of financial support in the form of subsidised visits to international trade fairs or any other international trade promotional event that would allow for the maximum exposure, learning experience and scaling-up of the company in the international arena. Companies in the YEDP programme are also given access to free participation in seminars and workshops organised by MATRADE.

Eligibility and Selection Criteria

- The majority of the equity or at least 51% of equity of the company must be in the hands of youth(s) between the ages of 20-40 years. The majority shareholding can be held by a single youth individual or a group of youths as majority shareholders.