Services for Exporters

Services Export Fund (SEF)

Official Notice

Temporary Suspension of the Services Export Fund (SEF)

Dear Sir/Madam,

Please be informed that the Services Export Fund (SEF) is temporarily suspended with immediate effect until further notice. During this suspension period, no new applications will be accepted, while applications received prior to this notice will continue to be processed as usual.

We greatly appreciate your attention and cooperation during this period. Any latest updates regarding the reactivation of the fund will be communicated from time to time.

For further inquiries, please contact the SEF Secretariat at 03-6207 7077. Thank you.

For more information, please contact us at:

Market Development Unit2nd Floor, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur, MALAYSIA

Tel: +603-6207 7077

Fax: +603-6203 7252

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Market Development Grant (MDG)

Announcement

Market Development Grant (MDG) Application is Now Accessible via MADANI Digital Trade Platform

We are pleased to infom you that starting 13 March 2025, the Market Development Grant (MDG) application can be accessed through the MADANI Digital Trade Platform (MDT Platform) at madanitrade.com.

To begin your application, please visit madanitrade.com and click on the 'Explore Visual Showcase'. You will then see the Sign In/Sign Up option button located at the top right corner of the homepage.

- If your are already a registered user, simply log in using your email and password.

- If you are new to the platform, please complete the registration process to create an account.

Should you have any question or require further assistance, please do not hesitate to contact the MDG Secretariat at 03-6207 7066 or via e-mail at This email address is being protected from spambots. You need JavaScript enabled to view it..

What is MDG?

The Market Development Grant (MDG) is a support initiative in the form of a reimbursable grant. MDG was introduced in 2002 with the objective of assisting exporters in their efforts to promote Malaysian made products or services globally. The lifetime limit of MDG is RM300,000 and it is specifically formulated for Malaysian SME Companies, Professional Service Providers, Trade and Industry Associations, Chambers of Commerce, Professional Bodies and Co-operatives.

[Note: MDG reimbursements are subject to the availability of the government funds]

What activities are eligible for grant funding?

- Participation in International Trade Fairs or Exhibitions held in Malaysia/Overseas

- Participation in Trade & Investment Missions (TIM) or Export Acceleration Missions (EAM)

- Participation in International Conferences Held Overseas

- Listing Fees for Made in Malaysia Products in Supermarkets or Hypermarkets or Retail Centres or Boutique Outlets Located Overseas

- Participation in Virtual International Trade Fairs In Malaysia Or Overseas

- Participation In Business To Business (B2B) Meetings Related To Virtual Trade Investment Missions And Export Acceleration Missions

Who is eligible to claim for MDG? (please refer to MDG Guidelines)

- Small And Medium Enterprises (SMEs)

- Professional Service Providers (Sole Proprietor Or Partnership)

- Trade & Industry Associations, Chambers Of Commerce Or Professional Bodies

- Co-operatives

How do I submit my new application of claims or request for reimbursement of expenses?

All completed applications must be SUBMITTED ONLINE through MATRADE’s website:

Submissions for reimbursements must be:

|

No |

Promotion Activity |

Submission of Applications |

|

Physical Event |

||

|

i. |

Participation in International Trade Fairs or Exhibitions held in Malaysia/ Overseas |

Within 30 calendar days after the last date of event |

|

ii. |

Participation in Trade & Investment Missions (TIM) or Export Acceleration Missions (EAM) |

|

|

iii. |

Participation in International Conferences Held Overseas |

|

|

iv. |

Listing fees in Supermarkets or Hypermarkets or Retail Centres or Boutique Outlets Located Overseas |

Within 30 calendar days after the first day of listing |

|

v. |

International Certification for Exports |

Within 30 calendar days after certification approval date |

|

Virtual Event |

||

|

i. |

Participation in Virtual International Trade Fairs In Malaysia or Overseas |

Within 30 calendar days from the last date of the event |

|

ii. |

Participation In Business To Business (B2B) Meetings Related To Virtual Trade Investment Missions And Export Acceleration Missions |

Within 30 calendar days from the last date of the promotion activity |

For more information, please download information as per link below:

Apply MDG Check Disbursed Amount

All enquiries and submission of reports must be sent to:

Market Development Unit

2nd Floor, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur, MALAYSIA

Tel: +603-6207 7066

Email:This email address is being protected from spambots. You need JavaScript enabled to view it.

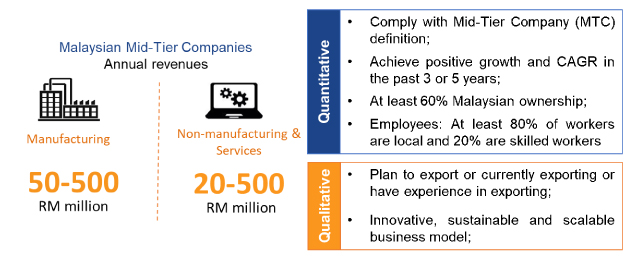

Mid-Tier Companies Development Programme (MTCDP)

The Mid-Tier Companies Development Programme (MTCDP) was developed and implemented in 2014. A 9-months, customised programme for export-oriented Mid-Tier Companies (MTCs) in Malaysia, either in manufacturing or services. The ultimate objective of MTCDP is to create a cluster of Malaysian Mid-Tier Companies that are globally competitive and successful as global & regional champions

Mid-Tier Companies (MTCs) and Their Contribution to Malaysia

Based on the study of Malaysia's key economic data in 2021/2022 by Deloitte Consulting, there are approximately 9,000 MTCs in Malaysia which is only 0.8% of all registered companies in Malaysia. However, MTCs employ 16% of the nation’s workforce while contributing 36% of the nation’s GDP.

It is undeniable that mid-tier companies are key drivers of economic growth and productivity. Their capabilities and capacities span various sectors, including manufacturing, services, and technology.

Therefore, supporting and promoting the interests of mid-tier companies is essential to further enhancing the competitiveness and resilience of Malaysia's economy on the global stage.This is a programme for MTCs and high-performing SMEs. As a result, MTCs must meet the following robust & stringent criteria to qualify for the programme:

Wish to apply for Mid-Tier Companies Development Programme?

Register NowThe Government of Malaysia and MATRADE recognise the importance of Malaysia’s MTCs and have established the MTCDP to help MTCs grow their business internationally. This programme will also strengthen the competitiveness of MTCs:

- Grow export market

- Global branding

- Internal growth

- Supply chain

- Productivity & efficiency

- Innovation & new product development

- Financing advisory services

- Industry 4.0

- Smart manufacturing

- Digitalisation

- Automation

- Compliance to sustainability

Major Components of the Programme

The Participants

Download list of MTCFor further information about the programme or if you are interested in applying, please contact us at:

MTCDP Secretariat

2nd Floor, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

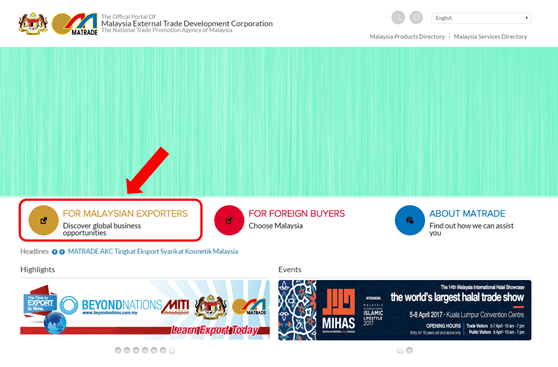

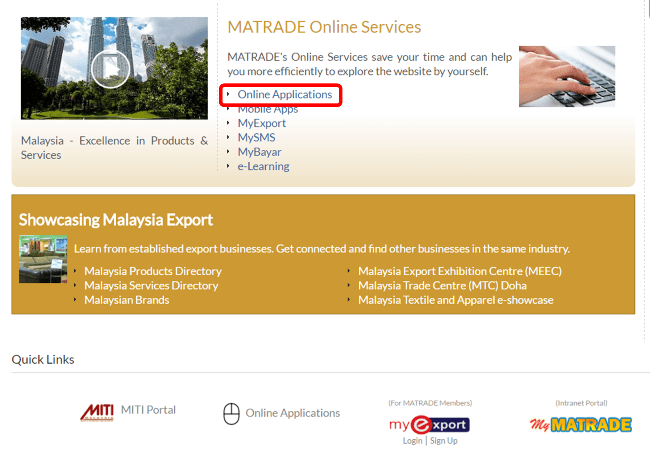

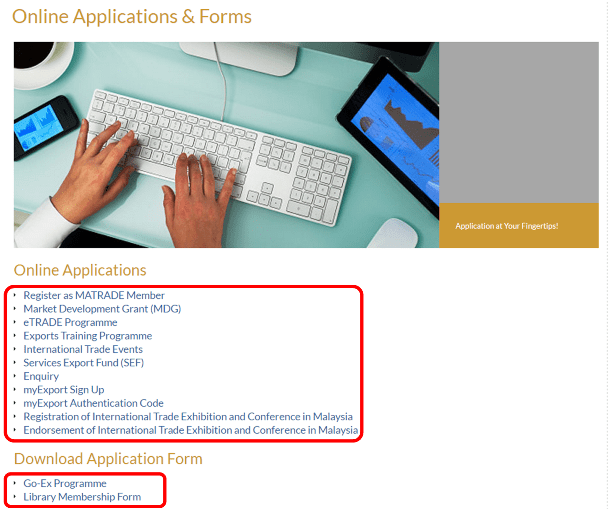

Online Application User Guide

This User Guide will help you get started and learn more about using our online application in this portal.

Step 1: To access the online application, go to "For Malaysian Exporters" section.

Step 2: At the "For Malaysian Exporters" section page, choose "Online Applications" in the MATRADE Online Services information.

Step 3: Choose the online applications or download the application forms.

Standards Map

Standards Map is an online tool developed by International Trade Centre for producers, exporters and buyers to increase opportunities for sustainable production and trade.

Standards Map is a comprehensive information that is searchable with more tha 40 private standards operating references information on over 40 private standards operating in more than 200 countries and certifying products and services in over 60 economic sectors. It contains quick fact sheet for each of the referenced standards and a link to more than 200 academic studies, thesis and research papers. User can review the standards across common theme and criteria and make comparison.

The Standards Map analysis tool can be accessed by all registered users. Registration is free of charge for all users from developing countries.

Trade Financing

Understanding how to manage trade risks is key to successful exporting.

The export market is an excellent opportunity for Malaysian exporters. Conducting business overseas has its many risks. As an exporter, it is important for you to understand these risks and find the right trade financing solution. MATRADE is sharing some basic information on trade financing.

The following trade financing/products/credit terms that are offered by local and international banks operating in Malaysia:

Open account

Exporter ships off goods to the importer before receiving payment. Payment terms vary from 30 to 90 days. The exporter is exposed to high risks on non-payment, protracted payment and insolvency of the importer.

Term collection

As an exporter, you have control of the goods until you receive a legally binding acceptance from the buyer regarding their debt to you.

Sight collection

As an exporter, you have control of the goods until you receive payment from the importer. A bill of lading is sent through the banking system to allow the buyer to take possession of the goods.

Unconfirmed Letter of Credit

As an exporter, you receive an undertaking from the importer’s bank to conditionally guarantee payment. Payment is based on the condition that your documentation complies with the condition stated in the letter of credit.

Confirmed Letter of Credit

Although similar to unconfirmed Letter of credit the difference is the LC is an irrevocable undertaking by issuing bank to honour the payment obligation in the LC. In other words if the foreign bank defaults payment, the domestic bank pays you.

Cash in Advance

The importer pays for the goods as agreed on a date before the exporter ships the goods. As an exporter, you will receive payment while still keeping control of the goods.

Please contact the banks directly to find out which financial product is most suitable for your business.

-

Trade products offered - Letter of Credit, Guarantees,

- Documentary Collections,

- Supplier Credit or Supplier Financing,

- Trust Receipts,

- Export Credit Refinancing,

- Vendor Financing

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade Documents required - Audited accounts (6 months/ 3 years)

- company registration,

- purchase or export order, invoice,

- transport documents or any other trade related documents

Interest/ profit rate (range) COF/ COF-i + spread % Fees and charges - Stamp duties,

- Legal fees,

- brokerage fee (Islamic only)

Process of approval 30 days from the application day (subject to complete information and documentation submitted) Remarks -

Trade products offered Jaguh Serantau

(Financing with profit rate subsidy)Business Exports Program (BEP)

(Developmental Program)Eligibility Requirements - SMEs including Large Enterprise with 51% or more of the equity held by Bumiputera.

- Shariah-compliant business.

- Product or services are having presence regionally or export-ready for regional market.

- Minimum of two (2) years in operations.

- Minimum 5% annual revenue growth and profitable for the last two (2) years of operation (except for the financial year ended 2020 and 2021, which are adversely affected by the COVID-19 pandemic period/ Movement Control Order).

- At least 60% Bumiputera owned Sdn Bhd company and management controlled company

- Minimum 3 years in business (evidenced by audited accounts)

- NOT a subsidiary of Public Listed Company (PLC), Multi-National Company (MNC), Government/ State Linked Company (G/SLC) or company under Menteri Kewangan DiPerbadankan (MKD)

- Good financial standing

- Open to all industries and sectors which applicable

Documents required - Copy of identity card for all directors/shareholders/partners/owners/ guarantors.

- Copy of valid business registration.

- Certified secretarial document.

- Audited accounts or recent management accounts.

- Bank account statement for the last 6 months.

- Business plan.

- Other relevant documents required by the Bank

- Company profile

- Audited Financial statement (last 3 years)

- Copy of Form 9 (certificate of Registration)/ Form 13 (Certificate of Incorporation on Change of Name of Company)

- Copy of latest Corporate Information obtained from Companies Commission Malaysia (CCM)

- Export Business Plan

- Export Revenue Statement (last 3 years)

Interest/ profit rate (range) As per SME Bank's Risk-based Pricing (BFR+0% p.a. to BFR+2.5% p.a.), with 1.5% p.a. profit rate subsidy by the Government Not applicable Fees and charges Existing fees and charges which have been approved earlier by Bank Negara Malaysia Not applicable Process of approval Financing application will be processed and the decision thereon shall be informed within 30 working days from the date of complete information having been received by the Bank - Evaluation by secretariat

- Export Readiness Assessment by SME Bank and/or, MATRADE and KUSKOP

- Presented for deliberation in BEP Project Working Committee (PWC) Meeting

- Presented for approval in BEP Project Steering Committee (PSC) Meeting

Remarks Not applicable -

Trade products offered - Bank Guarantee,

- Letter of Credit,

- Shipping Guarantee,

- Trade Working Capital Financing Purchase

- Trade Working Capital Financing Sales

Eligibility Requirements Companies (Sdn Bhd and Berhad status) that are incorporated in Malaysia in line with Bank's mandated role (i.e., any business activity related to food and agriculture and or any other business runs at gazetted land area) Documents required Application Documents: - Financial Statement,

- 3 years Audited Account, Company's profile and other documents required by the Bank

Disbursement documents

- TWCF: Invoice, transport documents, Bank's statement (reimbursement) and other supporting documents required by the Bank.

- LC : Proforma Invoice, Insurance (whenever applicable) and any supporting documents required by the Bank.

- BG: Sales contract or any other documents required by the Bank

Interest/ profit rate (range) COF, BFR and Concessionary Fund Fees and charges Disbursement charges:

- LC: 0.1% per month with minimum RM50.00

- BG: 1.25% per annum with minimum of RM 50.00

- Stamp Duty RM10.00

- Rentas: RM5.00 per transaction

Process of approval Subject to credit assessment process and approval level Remarks -

Trade products offered - Letter of Credit

- Trust Receipt

- Credit Bills Negotiation

- Outward Bills Purchased

- Letter of Credit Advising

- Inward/Outward Bills for Collection

- Invoice Financing

- Bankers’ Acceptance

- Foreign Currency Trade Loan

- Bank Guarantee

- Standby Letter of Credit

- Shipping Guarantee

- Supply Chain Finance

Eligibility Requirements - Incorporated under Business Act/Companies Act/Limited Liability Partnership Act/respective authorities for Sabah and Sarawak/respective statutory bodies for professional services providers

- More than 50% of turnover are export business

- Collateral: Guarantee by Credit Guarantee Corporation/Syarikat Jaminan Pembiayaan Perniagaan Berhad/fixed deposit/property

- Other criteria which AmBank (M) Berhad may impose from time to time

Documents required - Certified true copy of the company’s latest M&A, Annual return, Form 24 and Form 49 or the relevant constitution documents.

- Certified true copy of the company’s latest 2 years audited financial statements and latest management account.

- Certified true copy of the directors/ guarantors’ NRIC and Borang BE for the past 2 years.

- Debtor and Creditor Aging, if any;

- List of on-going projects and tendered projects with details such as Project Description, Awarder, Amount, Project Duration and Commencement Date, if any;

- Projected Cash Flow;

- CCRIS Consent Letter

- Any other document which AmBank (M) Berhad may require on case to case basis

Interest/ profit rate (range) BLR/COF + (1.0% - 2.5%) p.a Fees and charges - Facility agreement as per Stamp Act 1949

- Other Fees and Charge as per AmBank (M) Berhad's Standard Trade Tariff at the link below

Process of approval Ranging from 30 - 45 days from the application day (subject to complete information and documentation submitted). Remarks -

Trade products offered - Letter of Credit-i

- Trust Receipt-i

- Credit Bills Negotiation-i

- Outward Bills Purchased-i

- Letter of Credit Advising-i

- Inward/Outward Bills for Collection-i

- Invoice Financing-i

- Accepted Bills-i

- Foreign Currency Trade Financing-i

- Bank Guarantee-i

- Standby Letter of Credit-i

- Shipping Guarantee-i

Eligibility Requirements - Incorporated under Business Act/Companies Act/Limited Liability Partnership Act/respective authorities for Sabah and Sarawak/respective statutory bodies for professional services providers

- More than 50% of turnover are export business

- Collateral: Guarantee by Credit Guarantee Corporation/Syarikat Jaminan Pembiayaan Perniagaan Berhad/fixed deposit/property

- Financing is of Shariah-compliant activities acceptable to AmBank Islamic Berhad

- Other criteria which AmBank Islamic Berhad may impose from time to time

Documents required - Certified true copy of the company’s latest M&A, Annual return, Form 24 and Form 49 or the relevant constitution documents.

- Certified true copy of the company’s latest 2 years audited financial statements and latest management account;

- Certified true copy of the directors/ guarantors’ NRIC and Borang BE for the past 2 years;

- Debtor and Creditor Aging, if any;

- List of on-going projects and tendered projects with details such as Project Description, Awarder, Amount, Project Duration and Commencement Date, if any;

- Projected Cash Flow; and

- CCRIS Consent Letter

- Any other document which AmBank Islamic Berhad may require on case to case basis

Interest/ profit rate (range) BFR/COF-i + (1.0% - 2.5%) p.a. Fees and charges - Facility agreement as per Stamp Act 1949

- Other Fees and Charge as per AmBank Islamic Berhad's Standard Trade Tariff at the link below:-

Process of approval Ranging from 30 - 45 days from the application day (subject to complete information and documentation submitted). Remarks -

Trade products offered - Letter of Credit-i,

- Trust Receipt-i,

- Accepted Bills-i,

- Bank Guarantee-i

Eligibility Requirements - Sole-Proprietor / Partnership / Private Limited Company

- Business in operation for at least 3 years

- Minimum 2 years relationship with Maybank or minimum 3 years with other Financial Institutions

Documents required - Certified photocopies of:

- Memorandum & Article of Association

- Business Registration

- Form D

- Form 9

- Form24 & 49

- Company and Holding Company profile, Particulars of Directors / Main Shareholders and a photocopy of each Director's NRIC

- Certified photocopies of the last 3 years of Audited Financial Accounts and latest Management Accounts, and the last 6 months of Bank Statements from other banks.

Interest/ profit rate (range) - Trust Receipt-i: BFR + 0% to 2.00% p.a.

- Accepted Bills-i (AB-i): ABi COF + 0.75% to 1.00% p.a.

Fees and charges - Stamp duties: as per Stamp Duty Act

- Trading Fees: RM15 per every RM1.0mil, in respect of Commodity Murabahah transaction

- Documentation fee: maximum of RM5,000 for in-house financing documentation

- Other actual cost & expenses e.g. legal fees etc.

Process of approval 20 days from the application day (subject to complete information and documentation submitted). Remarks -

Trade products offered - Letter of Credit

- Bankers Acceptance

- Invoice Financing,

- Import Loan

- Bank Guarantee,

- Shipping Guarantee

Eligibility Requirements - Locally incorporated

- Minimum 3 years of business operations (For partly secured facilities)

- At least 51% shareholding are Malaysian owned

Documents required - Audited Accounts

- Latest 6 months bank statements

- Company Constitution Documents

Interest/ profit rate (range) - COF + % (as low as 1.25%)

Fees and charges Stamp duties 5% of the facility granted Process of approval 20 days upon submission (subject to complete information and documentation submitted). Remarks -

Trade products offered - Outward Bills for Collection

- Inward Documentary Credit

- Without Recourse Export Financing

- Foreign Bills Purchased/ Discounted

- Multi-Currency Trade Loan

- Domestic Bills Purchased/ Discounted

- Bankers Acceptance

- Export Credit Refinancing Pre & Post Shipment

- Accounts Receivable Purchase

- Bank Guarantee

- Standby Letter of Credit

- Quick Guarantee

Remarks -

Trade products offered - Outward Bills for Collection-i

- Inward Documentary Credit-i

- Without Recourse Export Financing-i

- Foreign Bills of Exchange Purchased-i

- Multi-Currency Trade Financing-i

- Domestic Bills of Exchange Purchased-i

- Accepted Bills-i

- Accounts Receivable Transfer

- Bank Guarantee-i

- Standby Letter of Credit-i Quick Guarantee-i

Remarks -

Trade products offered - Bill of Exchange Purchase-Authority to Purchase (BEP/AP)

Financing against the exporter or domestic seller (borrower)'s bills of exchange and/or document drawn under sight/usance Letter of Credit that acceptable by BOCM. - Bill of Exchange Purchase (BEP)

Financing against the exporter or domestic seller (borrower)'s sight/usance export and/or domestic sales documents under collection that acceptable by BOCM. - Export Invoice Financing (EIF)

MYR/FCY Financing against export and/or domestic sales of goods/services in relation to the exporter or domestic seller (borrower)'s nature of business on open account basis. - Bankers Acceptance(BA) - Export/Domestic Sales

MYR Financing against export and/or domestic sales of goods in relation to the exporter or domestic seller (borrower)'s nature of business on open account basis

Eligibility Requirements Exporter or domestic seller who granted BEP/AP, BEP, EIF or BA(S) facility from BOCM. Documents required Statutory Document, Latest 3 years' Financial Statement and any other document that prescribed by BOCM Fees and charges Standard charges on international trade services operations shall refer to www.bankofchina.com.my Process of approval Subject to the completion of the required credit assessment with statisfactory outcome. Remarks www.bankofchina.com.my - Bill of Exchange Purchase-Authority to Purchase (BEP/AP)

-

Trade products offered - Bank Guarantees,

- Supplier Financing,

- Vendor Financing,

- Invoice & Export Financing,

- SBLC Issuance

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade and Non-Resident Companies with Trade facilities requirements onshore. Documents required Typically Financial Statement for 3 years and Management Account every 6 months. Summary of invoices and actual invoices depending on facilities required. Fees and charges Stamp duties as per LHDN charges, Arrangement Fee for selected facilities. Process of approval Average of 60 days from the application day (subject to complete information and documentation submitted). Remarks Not Available -

Trade products offered - Trade Time Loan (TTL)

- Onshore Foreign Currency Loan (OSFCL)

- Bankers Acceptances

- Trust Receipt (TR) Loan

- Bank Guarantees

- Shipping Guarantees

- Export Letters of Credit

- Export Collections

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. May require additional KYC requirements as provisioned from time to time. Documents required Please refer to the respective product disclosure sheets for documentation requirements. Fees and charges Please refer to the respective product disclosure sheets for pricing information. Process of approval Process of approval varies depending on exporter. KYC needs to be in place. Pls contact Relationship Manager for further guidance or refer to products disclosure sheets. Remarks https://www.citigroup.com/citi/about/countries-and-jurisdictions/malaysia.html#Trade-Finance-and-Services -

Trade products offered - Letter of Credit

- Import Collection

- Export Letter of Credit

- Export Collection

- Bank Guarantee

- Supplier Financing

- Accounts Receivables Purchase / Promissory Notes Financing

Eligibility Requirements Local and Multinational Corporate Companies in Malaysia. Documents required - Audited Financial Statement

- Company Constitution Documents

*Additional documents may be required subject to the Bank's credit assessment

Fees and charges Stamp duties as per Stamp Duty Act Process of approval 30 days from the application day (subject to complete information and documentation submitted). Remarks https://country.db.com/malaysia/documents/other-information/Deutsche-Bank-Malaysia-Schedule-of-Charges.pdf -

Trade products offered Bankers Acceptances (BA) / Foreign Currency Trade Financing (FCTF) Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. Documents required Audited Financial Statements for the last 3 years / Corporate Profile (M&A, Forms 24, 44 and 49 / Details of existing borrowing / Listings of suppliers and etc Fees and charges - Stamp Duties : As per Stamp Duty Act 1949 (Revised 1989)

- Disbursement Fee : Include fees for registration of charge and Power of Attorney (for property with individual or strata title and for property under master title respectively), land search, bankruptcy search and other related charges.

- Valuation Fee : Payable on professional valuation done on properties charged to the bank

Process of approval 2 to 3 months Remarks https://malaysia.icbc.com.cn/en/column/1438058492123824181.html -

Trade products offered - Advising of Export L/C

Facilitating the advising of a Letter of Credit issued in your favour by its correspondent banks (Letter of Credit Issuing Bank), located locally or abroad. The Bank acts as an intermediary i.e. Advising Bank, whose primary role is to authenticate the said Letter of Credit upon receipt from their correspondent bank prior to advising the instrument to you, without any further engagement on its part. - Export LC Discounting

Supplier gets paid early based on L/C and acceptance from Issuing Bank - Outward Export Documentary Collections (DA/DP)

- A transaction whereby the exporter entrusts the collection of payment to the exporter's bank (remitting bank), which sends documents to the importer's bank (collecting bank), along with instructions for payment. - Negotiation of Export Bills without LC

Prefinance of financial documents (for example an invoice) under usual reserve which are due in the future. Discounting is with recourse: if the bank is not able to recover the funds at maturity, banks client (beneficiary) will be debited again. - Bank Guarantee (BG)

A definite undertaking by the bank (guarantor) to pay the beneficiary a certain sum of money within a specified period if the applicant (principal) fails to fulfill his contractual or other obligations of an underlying transaction. - Account Receivable Purchase Scheme (APRS)

whereby MUFG Bank purchase trade receivables at a discount from our customer (the "Seller"), on a non recourse basis in a manner of legal true-sale. The receivables are owed by pre-agreed obligors which are customers of MUFG. - Onshore Foreign Currency Loan (OFCL) - Trade

A trade financing facility for financing of exports and domestic sales under Open account terms. - Bankers Acceptance (BA) - Sales

A short term working capital facility extended by MUFG Bank (Malaysia) Berhad to a Customer (Seller) facilitating the financing of their sale/ export of goods. BA is a usance

Bills of Exchange (BA Draft) drawn by the Customer on and accepted by the Bank to finance sale to resident, or export to non-resident supported by documentation evidencing the movement of goods between the two parties

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. Documents required (1) Export LC to be advised to MUFG Bank (M) Bhd through swift add. BOTKMYKX.

(2) and (3) Companies must be a client of MUFG Bank (M) Bhd

(4), (5), (6), (7) and (8) Companies must be a client of MUFG Bank (M) Bhd and Credit facility need to be set up for this.Fees and charges (1) Customer: MYR50.00 + courier charges, Non-customer: MYR100.00 + courier charges

(2), (3) and (4) Handling commission for Foreign Currency: 0.1% (min MYR100.00, max MYR200.00) + courier charges + cable charge (MYR30.00 per cable),

Handling Commission for Ringgit: Commission In-Lieu of Exchange - 0.1% (min MYR100.00, max MYR500.00) + courier charges + cable charge (MYR30.00 per cable). Please refer to our Tariff and Charges as at June 2022 at www.bk.mufg.jp/malaysia/productsandservices/productsservices_commercial/index.html

(5) BG commission at 1.2% per annum (min MYR100.00 per BG) + courier charges (if required)

(6), (7) and (8) Please refer to our Tariff and Charges as at June 2022 at https://www.bk.mufg.jp/malaysia/productsandservices/productsservices_commercial/index.htmlProcess of approval (1) and (3) N/A

(2) T + 1 basis subject to available limits for issuing bank.

(4) Upon setting up of credit facility, bills can be discounted on T + 1 basis.

(5) Upon setting up of credit facility, BG can issued on T + 1 basis subject to acceptable BG wording.

(6) Upon setting up of credit facility, ARPS can be drawdown on T + 2 basis.

(7) Upon setting up of credit facility, OFCL Trade can be drawdown on T + 2 basis.

(8) Upon setting up of credit facility, BA sales can be drawdown on T + 2 basis.Remarks (1) and (5) https://www.bk.mufg.jp/malaysia/productsandservices/others/index.html

(2), (3), (4), (6), (7) and (8) Nil - Advising of Export L/C

-

Trade products offered - Letter of Credit

- Inward Bills for Collection

- Outward Bills for Collection

- Shipping Guarantee, Endorsement of Airway Bill/Parcel Post Receipt/Bill of Lading

- Bank Guarantee/Standby Letter of Credit

- Bankers’ Acceptance

- Onshore Foreign Currency Loan

- Invoice Financing, Trust Receipt

- Foreign / Domestic Bill of Exchange Purchased

- Foreign / Domestic Bill of Exchange Purchased- Authority to Purchase

- Advance Against Trade

- Export Credit Refinancing

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade. The companies must satisfy the bank's credit underwriting policies and complies with the bank's compliance / due diligence procedures Documents required As per PDS, for drawdown on the transaction basis, application forms, invoice, transport documents and other satisfactory documentary evidence of the trade transaction Fees and charges Stamp Duties : As per Stamp Duty Act 1949 (Revised 1989)

Disbursement Fee : Include fees for registration of charge and Power of Attorney (for property with individual or strata title and for property under master title respectively), land search, bankruptcy search and other related charges.

Valuation Fee : Payable on professional valuation done on properties charged to the bankProcess of approval 2 to 3 months Remarks https://malaysia.icbc.com.cn/en/column/1438058492123824181.html -

Trade products offered - Letter of Credit (LC)

- Inward Bills Collection (IBC)

- Shipping Guarantee (SG) / Advance Endorsement (AE)

- Letter of Credit Advising (LA)

- Letter of Credit Transfer (LT)

- Letter of Credit Confirmation

- Outward Bills Collection (OBC)

- Bank Guarantee (BG)

- Standby LC (SBLC

- Banker's Acceptance (BA)

- Trust Receipt (TR) / Foreign Currency Trust Receipt (FCTR)

- Invoice Financing (IF) / Foreign Currency Invoice Financing (FCIF)

- Packing Credit (PC)

- Bills of Exchange Purchase (BEP)

- Credit Bills Purchased (CBP)

- Export Credit Refinancing (ECR)

- Factoring

- Supplier Finance (SF)

- Account Receivables Purchase (ARP)

- Dealer/Distributor Finance (DF)

Eligibility Requirements Companies that are incorporated in Malaysia who are directly or indirectly involved in export activity and international trade Documents required - Company’s profile

- Registration documents example: SSM; approval from any local authorities such as MITI; MIDA.

- Bank statement for the past 6 months

- Annual Report

- Key suppliers and buyers

Fees and charges Fees and charges are according to the product features. https://www.uob.com.my/corporate/fees-and-rates/trade-services.page

Process of approval The process of approving the credit facility is subject to the amount requested and complexity of the case. Generally, the turnaround for approval about a month.Credit cases are process by independent credit approver team Remarks https://www.uob.com.my/corporate/transaction/trade-services/export-services.page -

Trade products offered - Advising of Export L/C

With a wide network of correspondent banks globally, the Bank can promptly authenticate the inward Letter of Credit received in your favour and advise you in the most expeditious manner - Bills Negotiation

Immediate advance to exporters or sellers against presentation of compliant documents against Letter of Credit, without the need of pre-approved trade facilities - Bills of Exchange Purchased/Discounted (BEP/D)

Facility whereby the bank purchases your outward bills for collection and credits your account immediately - Outward Export Documentary Collections (DA/DP)

Handling of foreign or domestic outward collection documents based on customer’s instructions to obtain payment or acceptance - Bank Guarantee (BG)

An undertaking by the Bank to pay an agreed sum to the beneficiary in the event that the Guarantee's applicant fails to perform its obligations - Bankers Acceptance (BA) - Sales

A short-term financing for your export or sales of goods to local or international buyer - Flexi Trade Loan (FTL) - Sales

A flexible solution which allows you to cover financing for both tangible goods and services under your exports or local sales transactions

Eligibility Requirements - Malaysian controlled or owned businesses

- Business must be minimum 3 years in operations

- Viable business with proven track record and ability to meet financing obligations

- Key director(s)/management must have minimum 3 years’ experience in the similar line of business

- Confined to the Shariah Compliant business/requirement (For Islamic Facilities)

- Company that is involved directly or indirectly in export activity and international trade

Documents required - 3 years financial Statutory documents of business

- 6 months bank statements

- Any other document which the Bank may require on case-to-case basis

Interest/ Profit Rate (range) Up to BLR/ BFR + 1.35% p.a.

Up to COF/ iCOF + 2.75% p.a.Fees and charges Please refer to the respective Trade product for fees and charges information at https://www.affinalways.com/en/fees-and-charges

Process of approval 30 to 45 days upon submission of Application date (subject to complete information and documentation submitted) Remarks Please refer to https://www.affinalways.com/en/corporate-trade-finance for detail of Trade products and services - Advising of Export L/C

-

Trade products offered - Outward Bills for Collection-i

- Inward Bills for Collection-i

- Wakalah Bank Guarantee-i

- Over-the-counter Wakalah Bank Guarantee-i

- Documentary Credit-I

- Over-the-counter Documentary Credit-i

- Standby LC- i

- Accepted Bills-i

- Trust Receipt-i

- Promissiory Notes - i

- Export Negotiation-i

- Shipping Guarantee-i

- Invoice Financing-i

Eligibility Requirements - In operation for 3 years and above

- Profitable business

Documents required - For pre-screening, we just need the below documents

- Audited account for 3 years

- Latest management account

Interest/ Profit Rate (range) BFR / COF + (1.25% - 2.50%) p.a

Fees and charges - Stamp Duty as per Stamp Duty Act 1949

- Legal fees

- Other actual cost and charges as per Alliance Bank (M) Berhad standard tariff

Process of approval Within 30 days from application day (subject to complete information and documents submitted) Remarks General Trade Financing information: https://www.alliancebank.com.my/business/trade-finance/trade-finance

New Exporters Development Programme

Announcement

We would like to inform all Malaysian exporters that, the Bumiputera, Women and Youth Exporters Development Programme has been suspended until further notice. MATRADE understands the importance of this programme and apologises for any inconvenience caused by this suspension.

For companies new to exporting, MATRADE has three intensive programmes to hasten export readiness of SMEs. The Women Exporters Development Programme (WEDP), Youth Exporters Development Programme (YEDP) and Bumiputera Exporter's Development Programme (BEDP), are all targeted export support facilities, each specifically tailored to boost export learning and performance of three specialised population groups, consisting of women, youths and Bumiputera. Statistics have shown that these groups have historically exhibited low levels of export participation in Malaysia.

Companies interested in the WEDP, YEDP and BEDP specialised programmes can apply directly to the Women, Youth and Bumiputera Exporters Development Unit at the contact listed below. Applications must be substantiated with verified documents and all applicants must meet a standard participation criterion. Shortlisted companies will be subjected to factory audits, interviews and assessment by MATRADE prior to the final selection.

MATRADE uses the Exporters' Readiness and Capability Assessment (ERCA) model to assess the companies for selection into the programme. Selected companies will undergo the programmes for three years.

Standard Criteria:

| Programme | Women Exporters Development Programme (WEDP) | Youth Exporters Development Programme (YEDP) | Bumiputera Exporters Development Programme (BEDP) |

|---|---|---|---|

| CEO/Managing Director(s) | Must be women | Must be youths | Must be Bumiputera |

| Equity | Majority or at least 51% owned by women |

Majority or at least 51% owned by youth(s) |

Majority or at least 51% owned by Bumiputera |

| Company Status |

|

||

| Local Business Presence |

|

||

| Industry Sector | Open. Either merchandise or services trade | ||

WEDP is a gender specific, three-year export support program, targeted for women exporters. WEDP began in 2005 with the aim of encouraging competitive and sustainable women-owned companies to expand their product and services exports.

Who can apply?

Briefly, the eligibility criteria include women-owned companies where the majority or at least 51 percent of the equity is held by women. The CEO and/or Managing Director should be women. Other requirements include, being classified as a Small and Medium Enterprise (SME), has been in operation for a minimum of three years, has attained some level of market visibility domestically, and has a designated business premise or manufacturing locale.

Shortlisted companies will be audited and assessed by a committee consisting of TERAJU, PUNB, MARA, MITI and MATRADE. Assessments will be based on site audits, interviews and scores on the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

WEDP is an intensive hand-holding program involving customised business coaching, skills enhancement training, international business exposure and market immersions, networking and mentoring sessions, and leadership and entrepreneurial development.

Companies in the programme receive some financial support in the form of assisted visits to international trade fairs or other international trade promotion events and selective free participation in seminars and workshops organised by MATRADE.

Eligibility and Selection Criteria

- The company must be owned by women with a majority, or at least 51% of equity held by women. The majority shareholding can be through a single female individual or a group of women shareholders.

- The Chief Executive Officer and/or Managing Director must be women. This set requirement for the leadership position to be held by a woman is considered important, as the programme emphasises on the leadership development of the individual placed in a position of power.

- Companies for WEDP must fit the national definition of a Small and Medium Enterprise (SME).

- The company must be in operation for a minimum of three years and attained an acceptable level of market footprint/presence/share/dominance locally

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Women-owned companies based in Sabah and Sarawak can be given priority for WEDP, on the basis of diversifying the spread of regional socio-economic growth.

- Special preference will be accorded to companies that are involved in technology-driven, high value-added and knowledge-based industries. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc., and are generally non-traditional to women entrepreneurs.

What is it?

BEDP is another specialised export support program targeted specifically for Bumiputera companies. Started in 2004, it is almost identical and is managed along the same lines as the WEDP and YEDP. It is also a three-year program with the objective of growing competitive and sustainable Bumiputera exporters.

Who can apply?

Eligible applicants are Bumiputera-owned companies with a majority or at least 51% equity owned by Bumiputera. The CEO and/or Managing Director should be a Bumiputera. Applicants must be classified as a Small and Medium Enterprise (SME), in operation for at least three years, attained an acceptable level of market recognition/prominence in the Malaysian domestic market, and have a designated business premises or manufacturing facility.

Shortlisted applicants will be audited and assessed by a committee of entities, including PUNB, MARA, TERAJU, MITI and MATRADE. Assessments will be made after a site visit, interviews with management, as well as a tally of the scores attained on the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

Exactly like WEDP, the Bumiputera Exporters Development Programme (BEDP) comprise of several support initiatives including skills enhancement training, leadership and entrepreneurial development, network and mentoring sessions, customised business coaching and international business exposure and market immersions.

Companies in BEDP are also introduced to opportunities and competition in the international market and are given some financial support in the form of assisted visits to international trade fairs or any other international trade promotion event that fits their needs. BEDP companies are also granted a level of free participation in MATRADE-organised seminars and workshops throughout the three-year programme.

Eligibility and Selection Criteria

- Must be Bumiputera-owned companies with majority or at least 51% of equity of the company owned by Bumiputera. The Bumiputera shareholding in the company can be held by either an individual or a group of Bumiputera shareholders.

- The Chief Executive Officer and/or Managing Director must be a Bumiputera . As the BEDP focuses on nurturing and developing favourable traits in the main person or the entrepreneur, the stipulation for the top leadership position (CEO/MD/or COO) to be a Bumiputera is actually rather crucial. This is because the top individual will be the one making the critical decisions and deciding on the direction of the company.

- The company must fall under the new definition of a small and medium enterprise (SME).

- The company must be in operation for a minimum of three years and has a certain level of market footprint/presence/share/dominance locally.

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Bumiputera-owned companies based in Sabah and Sarawak can be given special consideration for the BEDP, on the basis of diversifying regional socio-economic growth.

- Bumiputera companies which are involved in technology-driven, high value-added and knowledge-based industries can be given preference. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc.

What is it?

A specific and targeted three-year programme formulated for youths, between the ages of 20 to 40 years, who are interested or already involved in exporting. YEDP covers a broad range of sectors but gives special consideration to 'soft exports' from the creative industry such as the arts, music, fashion, lifestyle, crafts, design etc. The programme is relatively new and was started in 2014.

Who can apply?

The CEO and/or Managing Director must be between the ages 20 to 40 years. At least 51 percent of the firm's equity must be held by youths between the ages of 20 to 40 years. The company must also be in operation for at least 3 years and have some footprint in the Malaysian domestic market.

Shortlisted candidates will undergo a screening process. Prior to selection by a panel committee consisting of MARA, MITI, TERAJU, PUNB and MATRADE, a site visit will be conducted, together with interviews with management and the rating of the company done through the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

YEDP is run and managed along the same lines as WEDP and BEDP, and like its sister programmes, it is an intensive hand-holding support facility.

The support framework, much like WEDP and BEDP, involves customised business coaching and export advisory services, skills enhancement training, leadership and entrepreneurial development, networking and mentoring sessions and international business exposure and market immersions.

YEDP companies are given a level of financial support in the form of subsidised visits to international trade fairs or any other international trade promotional event that would allow for the maximum exposure, learning experience and scaling-up of the company in the international arena. Companies in the YEDP programme are also given access to free participation in seminars and workshops organised by MATRADE.

Eligibility and Selection Criteria

- The majority of the equity or at least 51% of equity of the company must be in the hands of youth(s) between the ages of 20-40 years. The majority shareholding can be held by a single youth individual or a group of youths as majority shareholders.

- The Chief Executive Officer and/or Managing Director must be a youth. This set requirement for the leadership position to be held by youths is considered pertinent, as the programme emphasises on the leadership development of the individual placed in a position of power.

- Companies for YEDP must fit the national definition of a Small and Medium Enterprise (SME).

- The company must be in operation for a minimum of three years and attained an acceptable level of market footprint/presence/share/dominance locally.

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Youth-owned companies based in Sabah and Sarawak can be given special consideration in the selection for YEDP, on the basis of diversifying the dispersion of regional socio-economic growth.

- SMEs which are involved in technology-driven, high value-added and knowledge-based industries will be given special focus. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc.

Benefits:

SMEs selected for either the WEDP, YEDP or BEDP programmes can derive the following benefits from the three year programme:

- Customised business coaching and intensive hand-holding support. Export support will be provided by experienced and trained officers who have extensive knowledge in export promotion through years of exposure in export trade. Coaches are supported by officers from the Women, Youth and Bumiputera Exporters Development Unit who will serve as liaison project officers responsible for the companies' performance and records.

- Skills enhancement training will be conducted on a quarterly basis in the form of seminars, workshops and symposiums. Attendance and participation in these events organised by MATRADE are free. These skills enhancement training address critical topics such as:

- Cross Cultural Understanding In International Business

- Steps to Successful Exporting

- International Business Communications

- Effective Negotiation Skills

- Formulating Export Plan & Market Entry Strategies

- Effective Bookkeeping for Exporters

- Branding for Global Market

- Exposure to global markets through active participation in international trade promotion activities held abroad. Selected SMEs will be given opportunities to promote their products and services at international trade fairs, customised selling missions and specialised marketing missions.

- Free exhibition space allocation for market exposure, publicity and opportunity to showcase their product or service offering for a period of 12 months at Malaysia Export Exhibition Centre (MEEC). MEEC is a permanent display centre for export-oriented Malaysian-made goods and services located at Menara MATRADE, Kuala Lumpur.

- Networking and mentoring sessions amongst SMEs and larger companies help broaden business outreach through the sharing of knowledge. Companies learn through sharing and are inspired by role-models and the achievements of others.

- Development of leadership and entrepreneurial qualities. These sessions nurture and develop behavioural traits that help build binding interpersonal relationships which in turn are vital for business cooperation

FAQ:

Online Applications & Forms

Online Applications

- Register as MATRADE Member | User Guide

- Market Development Grant (MDG)

- International Trade Events

- Exporters Training Programme

- MATRADE Digital Learning

- Enquiry

- Registration of International Trade Exhibition and Conference in Malaysia

- Endorsement of International Trade Exhibition and Conference in Malaysia

Development Programme for New Exporters

MATRADE’s Bumiputera Exporters Development Programme (BEDP) and Women Exporters Development Programme (WEDP) are export assistance programmes designed for small and medium-sized Bumiputera and women-owned businesses that are new to, or have limited experience in exporting. These programmes help SMEs develop the necessary skills and knowledge to penetrate and further expand their export markets.

Designed and managed by MATRADE, these programmes give participants the best possible start to exporting by providing valuable advice, information and assistance in selected overseas markets. Under these programmes participants are expected to complete a 3-year programme that will expose them in export promotional activities, trainings, seminars and visitation programmes in enhancing their capability and knowledge to become sustainable exporters.

Eligibility Criteria

BEDP and WEDP were designed specifically for new and irregular exporters with limited experience who are capable and willing to develop the skills needed to become a sustainable exporter. Due to overwhelming responses from Bumiputera and women owned businesses in joining these programmes, participations are based on invitation basis and limited to 12 businesses per intake per year for each programme. Selection into the programme is based on merit and consensus by the New Exporters Development Unit Committee members.

To be eligible for these programmes your business should be:

- A Sendirian Berhad (SDN BHD) company with at least 51% equities of the company owned by Bumiputera entity and has a valid Malaysian Company Registration Number with Suruhanjaya Syarikat Malaysia (SSM). Preference will be given to 100% owned Bumiputera Company. (For Bumiputera Exporter Development Programme).

- A Sendirian Berhad (SDN BHD) company with at least 51% equities of the company owned by Malaysian women entity and has a valid Malaysian Company Registration Number with Suruhanjaya Syarikat Malaysia (SSM). Preference will be given to 100% Malaysian owned company. (For Women Exporter Development Programme).

- Able to provide Ministry of Finance Bumiputera registration forms (For Bumiputera Exporter Programme).

- Able to provide EPF statement, form 24 and 49.

- In business for at least 4 years and have some experience in both domestic and export markets.

- Malaysia as its main place of business and not as their marketing office or representative office.

- Never previously been signed on to MATRADE Trade Outreach Programme (MTOP) or Women Trade Outreach Programme (WTOP) either directly or indirectly through their stake holders.

- In total control of production, operation and marketing of products or services offered. Export agents / brokers, traders or OBM and OEM suppliers will not be considered.

- In sound financial status with healthy cash flow and able to provide audited financial account for the last 3 financial years.

In addition, your business must be export-ready and have:

- A product or service with clear export potential.

- Management commitment to becoming an exporter and developing the export side of the business, including a willingness to visit the market if appropriate.

- A team of at least 2 personnel from company whom will dedicate their time and resources in ensuring the success of this programme.

- An understanding that the company will need to participate in compulsory training courses before participating in any export promotional activities.

- Marketing materials, such as a packaging, website or brochure, with an understanding that materials specific to the international market may need to be developed.

- The capacity to build supply capability and able to cater for export demand.

- An export market plan strategy with three (3) years forward planning for MATRADE assessment.

Benefits Under These Programmes

Participants under these programmes will be supervised by one of the officers of the New Exporters Development Unit and are entitled to receive the following services:

- Assistance in the form of selecting an export market/s.

- Entitlement to participate up to three (3) Export Promotional Activities per year for 3-year programme period. Export Promotional activities comprise participation in International Trade Exhibition, Specialised Selling Mission, Trade and Investment Mission and Individual Business Mission.

- Free participation in any MATRADE’s organised seminars at MATRADE headquarters.

- Free participation in field trips and visitation programmes to selected private and government sectors related to companies business.

- 12 months fees waiver for exhibiting products at MATRADE’s MEEC

Responsibilities Of Participants

Participants are required to:

- Commit resources and reasonable management time to the programme.

- Participate and provide full co-operation in any market research organised by MATRADE.

- Accountable to action directly or indirectly taken by company personnel that affect the programme.

- Abide to regulation and rules as stipulated in terms and condition of the programme.

- Be aware that the entitlements to participate in Export Promotional Activities are subjected to MATRADE approval and their entitlement is up to 3 events per year (non-exclusive basis) for 3-year programme. If company fails to utilise their entitlement for the year then it will be forfeited.

- Be aware that MATRADE have the rights to terminate or suspend any participants which fail to perform or co-operate during the duration of the programme without explanation.

-

Enquiries

For further enquiries, please contact:

Address :

New Exporters Development Unit

Level 9, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Tel : 03-6207 7077

Fax : 03-6203 7251

Registration and Endorsement of Trade Events in Malaysia

International Trade Exhibition and Conference, one of the most effective trade promotional tools is now becoming a major business in Malaysia. The country has sufficient facilities of international standard to hold international exhibitions and conferences locally. Exhibitions and conferences are getting bigger and more elaborate. Towards promoting the exhibitions and conferences industry in the country, the Government decided that all such trade events, both of local and international status, be registered with MATRADE.

ANNOUNCEMENT

Notice of implementation of processing fees for Registration and Endorsement of Trade Exhibition and Conference held locally effective 1 March 2024 (submission at least 6 months before the event).

REGISTRATION

Events eligible for registration are Trade Exhibitions, Conferences or both combined, held in Malaysia. The benefits of event registration with MATRADE are:

- Listing of the event in MATRADE’s portal;

- Listing of the event in MATRADE’s directories and brochures of trade and industry exhibitions in Malaysia;

- Promotion of event through MATRADE’s regional and overseas offices; and

- Promotion of event during MATRADE’s promotional activities.

CRITERIA FOR REGISTRATION

- The organiser must be a registered local or foreign company;

- The venue of the exhibition must be equipped with suitable equipment and facilities;

- The event must occupy a minimum gross space of 1,000 square metres; and

- The event features products, technologies or services that are consistent with industry requirements.

APPLICATION

Application for event registration can be made via online through MATRADE's Registration (Form R1). Please submit a hardcopy of completed Form R1 together with:

- Memorandum of Association (for Company) / Registration Certificate from Registrar of Society (for Association), if you are a first-time applicant;

- Proof of venue booking from venue operator; and

- A set of event promotional materials e.g. brochures or flyers.

PROCESSING FEE FOR REGISTRATION

- The Registration of International Trade Event held in Malaysia is compulsory; and

- The fee is RM100.00 per application for an event. (Non-refundable)

Note: Registration does not entitle the organiser the usage of MATRADE logo on any promotional materials or media.

ENDORSEMENT

Endorsement of International Trade Exhibition and Conference adds credibility to the event and helps the organiser to promote the event more effectively. Events eligible for endorsement are Trade Exhibitions or Conferences with Trade Exhibitions. The benefits of endorsing an event with MATRADE are as follows.

- Listing of the event in MATRADE’s portal;

- Listing of the event in MATRADE’s directories and brochures of trade and industry exhibitions in Malaysia;

- Promotion of event through MATRADE’s regional and overseas offices;

- Promotion of event during MATRADE’s promotional activities;

- Use of MATRADE logo with caption “ENDORSED BY” on all printed materials; and

- Companies would be eligible for reimbursement of expenses for participating in an international trade fair or exhibition held in Malaysia, with the endorsement by MATRADE if the trade exhibition is not organised by MATRADE.

CRITERIA FOR REGISTRATION

- The organiser must be a registered local or foreign company.

- The venue of the exhibition must be equipped with suitable equipment and facilities.

- The event must occupy a minimum gross space of 1,000 square metres.

- The event features products, technologies or services that are consistent with industry requirements.

- Organiser is required to submit an (NEW) Audited Report of Previous Exhibition which was held in Malaysia and to comply with at least one of the following criteria:

- at least 20% of participants were foreign exhibitors; or

- at least 20% nett space was rented to foreign exhibitors; or, and

- at least 10% of visitors were foreign trade visitors.

Note: In cases where the organiser is not able to provide the audited report to indicate compliance with the above criteria, or if the event is solely a Conference only, MATRADE will only register the event without the endorsement.

APPLICATION

Application for event endorsement can be made online through MATRADE's Endorsement (Form E1). Please submit a hardcopy of completed Form E1 together with:

- Memorandum of Association (for Company)/Registration Certificate from Registrar of Society (for Association), if you are a first-time applicant;

- Audited Report of previous event from a certified auditor or database management company;

- Proof of venue booking from venue operator;

- A set of event promotional materials e.g. brochures or flyers

PROCESSING FEE FOR ENDORSEMENT

- The processing fee for Endorsement of International Trade Event held in Malaysia is RM5,000.00 per application for an event. (Non-refundable)

LEGAL DISCLAIMER / TERMS OF USE

MATRADE will not be liable to any outcome resulted for the rejected application.

Processing fees for applications are not refundable.

The application received does not guarantee that the event will be ENDORSED / REGISTERED by MATRADE. Approval will be given in writing.

By using MATRADE’s logo, the user agrees to fully comply with and be bound by our legal Terms as follows:

- Legal Compliance: The user agrees to comply with all applicable laws and with all directions, orders, requirements and instructions given to the user by any authority competent to do so under any applicable law. MATRADE reserves the right to investigate complaints or reported violations of our Legal Terms and to take any action we deem appropriate, including but not limited to reporting any misuse or suspected unlawful activity to law enforcement authority or taking any legal action against the user.

- Usage: MATRADE’S logo shall be used for the aforesaid programme purposes only. The use of MATRADE’s logo for any other purposes without a written approval of MATRADE is strictly prohibited. MATRADE shall be entitled to claim against the user for any losses or damages suffered arising from the negligent use of MATRADE’s logo by the user.

- Intellectual Property: MATRADE’s logo and its trademark are protected by copy right law and other law applicable. MATRADE’s logo may not be copied, reproduced or imitated whether in whole or in part, unless expressly permitted by MATRADE. The user shall be responsible for any claim in the event that the use of MATRADE’s logo infringes a patent, copyright or registered designs.

- Indemnity: The user releases MATRADE to the fullest extent permitted by law from any claims relating to the usage of MATRADE’s logo. In no event will MATRADE be liable for any incidental, consequential or any damages whatsoever arising from the use of MATRADE’s logo by the user.

Further information and submission the application:

MALAYSIA EXPORT EXHIBITION CENTRE (MEEC)

Menara MATRADE,

Level 5 West Wing,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Tel: +603-6207 7453 / 7452

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

MATRADE's Outreach Programme with Entrepreneurs and Exporters

MATRADE's Outreach Programme with Entrepreneurs and Exporters is part of MATRADE's ongoing efforts to improve its delivery system and to reach out to companies outside the Klang Valley.

These sessions serves as a platform for the export community to provide feedback on exports related issues, programmes and activities.

|

MATRADE’s EXPORTERS OUTREACH PROGRAMMES 2025 Note: Programme schedule is based on information as at 14 October 2025. |

||

| Date | Event | Location |

| 14-15 Nov 2025 | MITI ASEAN Day 2025 | Menara MITI, Kuala Lumpur |

| 20 Nov 2025 | Dialog Usahawan Madani | Bangunan TD1303, Jalan Sultan Zainal Abidin, Kuala Terengganu |

| 23-25 Nov 2025 | Info Booth @ WE 2025: Future in Motion - Women in Trade, Investment, Leadership | MITEC, Kuala Lumpur |

| 28-30 Nov 2025 | Info Booth @ Ekspo Usahawan Selangor (SELBIZ) 2025 | SACC, Shah Alam |

For further information, kindly contact :

Exporters Advisory & Training Unit

2nd Floor, West Wing, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur.

Tel : 603-6207 7077

Email : This email address is being protected from spambots. You need JavaScript enabled to view it.

MATRADE Help Desk

The MATRADE Help Desk serves as the front line customer service to business visitors to MATRADE. Aiming to answer general enquiries on our full range of services and programmes, the MATRADE Help Desk also attends to phone enquiries from both local and international businesses.

If you have any comments, suggestions or questions about our services, please contact us via phone, email or fax below:

Malaysia External Trade Development Corporation (MATRADE)

Tingkat 2, Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur.

Tel: 603-6207 7077 ext 7633

Fax: 603-6203 7253

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Women Exporters Development Programme (WEDP)

WEDP is a gender specific, three-year export support program, targeted for women exporters. WEDP began in 2005 with the aim of encouraging competitive and sustainable women-owned companies to expand their product and services exports.

Who can apply?

Briefly, the eligibility criteria include women-owned companies where the majority or at least 51 percent of the equity is held by women. The CEO and/or Managing Director should be women. Other requirements include, being classified as a Small and Medium Enterprise (SME), has been in operation for a minimum of three years, has attained some level of market visibility domestically, and has a designated business premise or manufacturing locale.

Shortlisted companies will be audited and assessed by a committee consisting of TERAJU, PUNB, MARA, MITI and MATRADE. Assessments will be based on site audits, interviews and scores on the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

WEDP is an intensive hand-holding program involving customised business coaching, skills enhancement training, international business exposure and market immersions, networking and mentoring sessions, and leadership and entrepreneurial development.

Companies in the programme receive some financial support in the form of assisted visits to international trade fairs or other international trade promotion events and selective free participation in seminars and workshops organised by MATRADE.

Eligibility and Selection Criteria

- The company must be owned by women with a majority, or at least 51% of equity held by women. The majority shareholding can be through a single female individual or a group of women shareholders.

- The Chief Executive Officer and/or Managing Director must be women. This set requirement for the leadership position to be held by a woman is considered important, as the programme emphasises on the leadership development of the individual placed in a position of power.

- Companies for WEDP must fit the national definition of a Small and Medium Enterprise (SME).

- The company must be in operation for a minimum of three years and attained an acceptable level of market footprint/presence/share/dominance locally

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Women-owned companies based in Sabah and Sarawak can be given priority for WEDP, on the basis of diversifying the spread of regional socio-economic growth.

- Special preference will be accorded to companies that are involved in technology-driven, high value-added and knowledge-based industries. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc., and are generally non-traditional to women entrepreneurs.

Youth Exporters Development Programme (YEDP)

What is it?

A specific and targeted three-year programme formulated for youths, between the ages of 20 to 40 years, who are interested or already involved in exporting. YEDP covers a broad range of sectors but gives special consideration to 'soft exports' from the creative industry such as the arts, music, fashion, lifestyle, crafts, design etc. The programme is relatively new and was started in 2014.

Who can apply?

The CEO and/or Managing Director must be between the ages 20 to 40 years. At least 51 percent of the firm's equity must be held by youths between the ages of 20 to 40 years. The company must also be in operation for at least 3 years and have some footprint in the Malaysian domestic market.

Shortlisted candidates will undergo a screening process. Prior to selection by a panel committee consisting of MARA, MITI, TERAJU, PUNB and MATRADE, a site visit will be conducted, together with interviews with management and the rating of the company done through the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

YEDP is run and managed along the same lines as WEDP and BEDP, and like its sister programmes, it is an intensive hand-holding support facility.

The support framework, much like WEDP and BEDP, involves customised business coaching and export advisory services, skills enhancement training, leadership and entrepreneurial development, networking and mentoring sessions and international business exposure and market immersions.

YEDP companies are given a level of financial support in the form of subsidised visits to international trade fairs or any other international trade promotional event that would allow for the maximum exposure, learning experience and scaling-up of the company in the international arena. Companies in the YEDP programme are also given access to free participation in seminars and workshops organised by MATRADE.

Eligibility and Selection Criteria

- The majority of the equity or at least 51% of equity of the company must be in the hands of youth(s) between the ages of 20-40 years. The majority shareholding can be held by a single youth individual or a group of youths as majority shareholders.

- The Chief Executive Officer and/or Managing Director must be a youth. This set requirement for the leadership position to be held by youths is considered pertinent, as the programme emphasises on the leadership development of the individual placed in a position of power.

- Companies for YEDP must fit the national definition of a Small and Medium Enterprise (SME).

- The company must be in operation for a minimum of three years and attained an acceptable level of market footprint/presence/share/dominance locally.

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Youth-owned companies based in Sabah and Sarawak can be given special consideration in the selection for YEDP, on the basis of diversifying the dispersion of regional socio-economic growth.

- SMEs which are involved in technology-driven, high value-added and knowledge-based industries will be given special focus. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc.

Bumiputera Exporters Development Programme (BEDP)

What is it?

BEDP is another specialised export support program targeted specifically for Bumiputera companies. Started in 2004, it is almost identical and is managed along the same lines as the WEDPand YEDP. It is also a three-year program with the objective of growing competitive and sustainable Bumiputera exporters.

Who can apply?

Eligible applicants are Bumiputera-owned companies with a majority or at least 51% equity owned by Bumiputera. The CEO and/or Managing Director should be a Bumiputera. Applicants must be classified as a Small and Medium Enterprise (SME), in operation for at least three years, attained an acceptable level of market recognition/prominence in the Malaysian domestic market, and have a designated business premises or manufacturing facility.

Shortlisted applicants will be audited and assessed by a committee of entities, including PUNB, MARA, TERAJU, MITI and MATRADE. Assessments will be made after a site visit, interviews with management, as well as a tally of the scores attained on the Exporter's Readiness and Capability Assessment (ERCA) Model.

Expenses it supports and benefits of being in the programme:

Exactly like WEDP, the Bumiputera Exporters Development Programme (BEDP) comprise of several support initiatives including skills enhancement training, leadership and entrepreneurial development, network and mentoring sessions, customised business coaching and international business exposure and market immersions.

Companies in BEDP are also introduced to opportunities and competition in the international market and are given some financial support in the form of assisted visits to international trade fairs or any other international trade promotion event that fits their needs. BEDP companies are also granted a level of free participation in MATRADE-organised seminars and workshops throughout the three-year programme.

Eligibility and Selection Criteria

- Must be Bumiputera-owned companies with majority or at least 51% of equity of the company owned by Bumiputera. The Bumiputera shareholding in the company can be held by either an individual or a group of Bumiputera shareholders.

- The Chief Executive Officer and/or Managing Director must be a Bumiputera . As the BEDP focuses on nurturing and developing favourable traits in the main person or the entrepreneur, the stipulation for the top leadership position (CEO/MD/or COO) to be a Bumiputera is actually rather crucial. This is because the top individual will be the one making the critical decisions and deciding on the direction of the company.

- The company must fall under the new definition of a small and medium enterprise (SME).

- The company must be in operation for a minimum of three years and has a certain level of market footprint/presence/share/dominance locally.

- Companies dealing with merchandise goods or services must have a designated business premise or manufacturing facility with a dedicated address and not a PO Box. Bumiputera-owned companies based in Sabah and Sarawak can be given special consideration for the BEDP, on the basis of diversifying regional socio-economic growth.

- Bumiputera companies which are involved in technology-driven, high value-added and knowledge-based industries can be given preference. These types of industries include high-precision parts manufacturing, biotechnology, biomedical engineering, animation and advance surveillance systems etc.

Trade Facilitation