Uncategorised

Client's Charter Achievement for 2025

| NO. | SELECTED ACTIVITY | STANDARD CHARTER | ACHIEVEMENT | |||

| JAN - MAR | APR - JUN | JUL - SEPT | OCT - DEC | |||

| 1. | To organize at least 30 trade promotion activities every 3 months: | At least 30 activities every 3 months | 383 | 410 | 0 | 0 |

| 2. | To entertain and answer information on trade opportunities within 2 working days | Within 2 working days | 1,175 | 2,275 | 0 | 0 |

| 3. | To inform the results to the applicants for participation in the trade fairs and trade missions within one (1) week after the Selection Committee Meeting. | Within 1 week | 51 | 66 | 0 | 0 |

| 4. | To ensure the release of publications as follows:- | |||||

| i) MATRADE Online News | Every 2 weeks | 6 | 6 | 0 | 0 | |

| ii) Up-coming Events | Every 3 months | 1 | 1 | 0 | 0 | |

| 5. | To update the website within 2 working days upon receiving the updated information | Within 2 working days | 50 | 39 | 0 | 0 |

| 6. | To approve completed Market Development Grant (MDG) applications within 7 working days | Within 7 working days | 771 | 581 | 0 | 0 |

| 7. | To process and approve applications and claims (upon completed documents) for Services Export Fund (SEF) :- | |||||

| Activity 1 / Activity 2 / Activity 3 / Activity 4 / Activity 7 / Activity 8 / Activity 9 / Activity 10 / Activity 11 / Activity 12 | Within 15 working days | 72 | 58 | 0 | 0 | |

| Activity 6 | Within 30 working days | 2 | 1 | 0 | 0 | |

| Activity 5 | Within 90 working days | 0 | 0 | 0 | 0 | |

Integrity Alert

2025

| Tarikh | Jenis | Program |

| JANUARI | ||

| 3 Januari | Integrity Alert | Integrity Alert 1/2025: Pantun Integriti (Infografik) |

| 9 Januari | Integrity Alert | Integrity Alert 2/2025: Ringkasan Kes Tatatertib MATRADE 2024 (Infografik) |

| 13 Januari | Integrity Alert | Integrity Alert 3/2025: Ketahuilah Bahawa Hadiah Itu Boleh Menjadi RASUAH (Infografik) |

| 15 Januari | Integrity Alert | Integrity Alert 4/2025: DISEGERAKAN (Infografik) |

| 31 Januari | Integrity Alert | Integrity Alert 5/2025: Ingin Melakukan Pekerjaan Luar? (Infografik) |

| FEBRUARI | ||

| 3 Februari | Integrity Alert | Integrity Alert 6/2025: Bicaralah Yang Baik Ataupun Baik Diam (Infografik) |

| 18 Februari | Integrity Alert | Integrity Alert 7/2025: Budayakan Rasa Syukur Dalam Diri (Infografik) |

| 24 Februari | Integrity Alert | Integrity Alert 8/2025: Pastikan Maklumat Aduan Anda Berkualiti (Infografik) |

| MAC | ||

| 11 Mac | Integrity Alert | Integrity Alert 9/2025: Buat Keputusan Dengan Bijak(Infografik) |

| 21 Mac | Integrity Alert | Integrity Alert 10/2025: Jauhi Konflik Kepentingan (Infografik) |

| 25 Mac | Integrity Alert | Integrity Alert 11/2025: Prosedur Penerimaan Hadiah (Infografik) |

| APRIL | ||

| 8 April | Integrity Alert | Integrity Alert 12/2025: Keberkatan Rezeki Di Tempat Kerja (Infografik) |

| 10 April | Integrity Alert | Integrity Alert 13/2025: Pegawai Anda Hilang Dari Radar? (Infografik) |

| 17 April | Integrity Alert | Integrity Alert 14/2025: Jangan Melepak Atau Buang Masa Di Pantry Pejabat (Infografik) |

| MEI | ||

| 2 Mei | Integrity Alert | Integrity Alert 15/2025: Bersikap Baik (Infografik) |

| 5 Mei | Integrity Alert | Integrity Alert 16/2025: Tanggungjawab Untuk Menjalankan Kawalan Dan Pengawasan Ke Atas Pegawai Seliaan (Infografik) |

| 7 Mei | Integrity Alert | Integrity Alert 17/2025: Ciri-Ciri Pekerja Bertanggungjawab Dan Tidak Bertanggungjawab (Infografik) |

| 9 Mei | Integrity Alert | Integrity Alert 18/2025: Menjadi Pekerja Dinamik Dalam Era IR 4.0 (Infografik) |

| 16 Mei | Integrity Alert | Integrity Alert 19/2025: How To Be More Creative (Infografik) |

| 19 Mei | Integrity Alert | Integrity Alert 20/2025: Larangan Membuat Pernyataan Awam (Infografik) |

| 21 Mei | Integrity Alert | Integrity Alert 21/2025: Nilai Dan Etika Dalam Perkhidmatan Awam (Infografik) |

| 22 Mei | Integrity Alert | Integrity Alert 22/2025: Ketidakhadiran Tanpa Cuti (Infografik) |

| 30 Mei | Integrity Alert | Integrity Alert 23/2025: AKTA 605 (Infografik) |

| JUN | ||

| 5 Jun | Integrity Alert | Integrity Alert 24/2025: Keterhutangan Kewangan Yang Serius (Infografik) |

| 13 Jun | Integrity Alert | Integrity Alert 25/2025: That's Not My Job! (Infografik) |

| 18 Jun | Integrity Alert | Integrity Alert 26/2025: Tahukah Anda? (Infografik) |

| 26 Jun | Integrity Alert | Integrity Alert 27/2025: Ignorance of The Law Is No Excuse (Infografik) |

| JULAI | ||

| 11 Julai | Integrity Alert | Integrity Alert 28/2025: Bebas Campur Tangan Pengaruh Luar |

The Third Country Training Programme (TCTP)

-

The Third Country Training Programme (TCTP)

Trade Promotion for African Countries

4 – 13 October 2023

The Third Country Training Programme (TCTP) is a capacity – building collaboration project between the Government of Malaysia and the Government of Japan with the objective of sharing Malaysia’s and Japan’s expertise and experiences in trade promotion strategies and programmes with selected African countries. The project is funded by the Government of Malaysia and the Government of Japan.

The implementation of the project is through a tri-partied cooperation between the Malaysian Technical Cooperation Programme (MTCP), a unit under the purview of the International Cooperation and Development Division, Department of Multilateral Affairs, Ministry of Foreign Affairs, Malaysia, Japan International Cooperation Agency (JICA) and Malaysia External Trade Development Corporation (MATRADE) as the implementing agency for training programmes related to trade promotion and facilitation.

The implementation of the project is through a tri-partied cooperation between:

- Malaysian Technical Cooperation Programme (MTCP), Ministry of Foreign Affairs, Malaysia (a unit under the purview of the International Cooperation and Development Division Department of Multilateral Affairs);

- Japan International Cooperation Agency (JICA); and

- Malaysia External Trade Development Corporation (MATRADE) as the implementing agency for training programmes related to trade promotion and facilitation.

-

1. MATRADE Welcomes You (Opening session)

2. Seminar on Exploring Business Opportunities in Africa

Background

TCTP participants will present a country presentation during the seminar. The seminar will be attended by representatives from various organisation such as government agencies, associations and companies. The objectives of the seminar are to explore opportunities in Africa, to provide insights, market potential, and ways of doing business as well as to enhance bilateral trade and investment relations between Malaysia and Africa countries.

Outline of the presentation

i. Areas to be highlighted

- Brief introduction of the country (Background, Key Economy Data, Demography, etc);

- External Trade and Industry updates;

- Summary of the duties and responsibilities of participants’ organisation/agency;

- Challenges and issues in the participants’ respective countries in developing trade and promotional programme (do’s and don’t’, investment opportunities)

ii, Presenter

- Participant(s)/Representatives of each countries.

- Each speaker is expected to provide a 10-minute presentation which is followed by a 5-minute question and answer session.

- Template slides - Sample of past presentation (Note: MATRADE will provide the presentation template 2 weeks before the commencement of the programme)

3. Closing Ceremony

4. Others

i. Knowledge sharing session on trade promotion

ii. Visits to Malaysia’s government agencies and companies

iii. Plan of action presentation

Background

TCTP participants will present an action plan presentation on summary of lesson learnt throughout the course and how it is applicable to participants’ respective countries.

Outline of the presentation

i. Areas to be highlighted

- Title of the Plan

- Plan and implementation strategies for the challenges/issues

- How to apply knowledge/lessons learnt from the course to the plan

ii. Speaker

- Participant(s)/Representatives of each countries.

- Each speaker is expected to provide a 10-minute presentation which is followed by a 5-minute question and answer session.

iii. Template slides - Sample of past presentation (Note: MATRADE will provide the presentation template 2 weeks before the commencement of the programme)

iv. Course evaluation

-

1. Click here for TCTP 2019/2018 Programme book

2. Photos

-

Title: Third Country Training Programme (TCTP) on Trade Promotion for African Countries

Date: 4-13 October 2023

Application Deadline: 3 August 2023

Target Participants: This course will be relevant to the middle / senior level of government officials from government ministries in charge of trade promotion.

Target Countries: Algeria, Angola, Burkina Faso, Cameroon, Côte d'Ivoire, Eswatini, Ethiopia, Ghana, Kenya, Madagascar, Mauritius, Mozambique, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Uganda and Zimbabwe

Mode: Face-to-Face

Venue: Kuala Lumpur, Malaysia

Organised by: MATRADE

Funded by: Malaysian Technical Cooperation Programme (MTCP) & Japan International Cooperation Agency (JICA)

Click here to download the General Information (GI) about this course. You can also download the tentative programme here.

THIS COURSE IS OPEN FOR APPLICATION

Trade Performance for April 2023 and The Period of January-April 2023

36th Consecutive Month of Trade Surplus

Malaysia registered the 36th consecutive month of trade surplus since May 2020, with a value of RM12.85 billion in April 2023. In tandem with softer global demand, total trade for the month contracted by 14.5% to RM198 billion. The performance was similar to other regional countries which recorded negative trade growth for April 2023. Exports totalled RM105.42 billion, declined by 17.4% and imports decreased by 11.1% to RM92.58 billion.

Compared to March 2023, trade, exports, imports and trade surplus were lower by 14.9%, 18.7%, 10.1% and 51.9%, respectively.

For the period of January to April 2023, trade decreased marginally by 1.6% to RM842.8 billion compared to the same period of 2022. Exports was down by 2.6% to RM460.02 billion and imports declined by 0.3% to RM382.78 billion. Trade surplus edged down by 12.7% to RM77.24 billion.

Export Performance of Major Sectors

Manufactured Goods Absorbed 86.2% of Malaysia’s Exports

In April 2023, exports of manufactured goods which constituted 86.2% or RM90.89 billion of total exports decreased by 15.5% year-on-year (y-o-y), attributed to lower exports of electrical and electronic (E&E) products, manufactures of metal and chemicals and chemical products. However, exports of petroleum products registered double-digit increase of 20.8%, sustaining positive growth since May 2022.

Exports of agriculture goods (6.8% share) stood at RM7.21 billion, slipped by 29.2% compared to April 2022 due to lower shipments of palm oil and palm oil-based agriculture products.

Exports of mining goods (6.3% share) totalled RM6.63 billion, a decrease of 28.9% y-o-y on account of lower exports of crude petroleum.

Major exports in April 2023:

• E&E products, valued at RM44.18 billion and accounted for 41.9% of total exports, decreased by 6.5% from April 2022;

• Petroleum products, RM11.52 billion, 10.9% of total exports, increased by 20.8%;

• Palm oil and palm oil-based agriculture products, RM5.45 billion, 5.2% of total exports, decreased by 32.1%;

• Chemicals and chemical products, RM4.82 billion, 4.6% of total exports, decreased by 33.2%; and

• Manufactures of metal, RM4.63 billion, 4.4% of total exports, decreased by 35%.

On a month-on-month (m-o-m) basis, exports of manufactured, mining and agriculture goods were lower by 16.6%, 36.4% and 23.4%, respectively.

For the period of January to April 2023, exports of manufactured goods weakened by 2.3% to RM390 billion compared to the corresponding period last year as a result of lower exports of manufactures of metal, rubber products, chemicals and chemical products as well as palm oil-based manufactured products. However, higher exports of petroleum products, E&E products, paper and pulp products as well as optical and scientific equipment offset the impact of the decline.

Exports of mining goods rose by 8.1% to RM36.48 billion boosted by higher exports of liquefied natural gas (LNG).

Exports of agriculture goods was valued at RM30.79 billion, decreased by 17.6% following lower exports of palm oil and palm oil-based agriculture products.

Trade Performance with Major Markets

ASEAN – Exports Grew in the First Four Months of 2023

In April 2023, trade with ASEAN represented 26.9% or RM53.28 billion of Malaysia’s total trade, declined by 12% y-o-y. Exports contracted by 11.4% to RM30.89 billion, weighed down by lower shipments of chemicals and chemical products, crude petroleum as well as E&E products. However, increases in exports were recorded for commodity-based products mainly LNG and petroleum products. Imports from ASEAN dipped by 12.8% to RM22.39 billion.

Breakdown of exports to ASEAN countries:

• Singapore RM16.73 billion, decreased by 1.3%;

• Thailand RM4.25 billion, ↓24.1%;

• Indonesia RM4.09 billion, ↑8.5%;

• Viet Nam RM3.59 billion, ↓28.6%;

• Philippines RM1.71 billion, ↓27.2%;

• Myanmar RM184.8 million, ↓26.9%;

• Brunei RM163.5 million, ↓72.7%;

• Cambodia RM150.6 million, ↓46.1%; and

• Lao PDR RM11.9 million, ↑109.4%.

Exports to ASEAN markets that recorded increases were Indonesia which grew by RM322 million on account of robust exports of petroleum products. Exports to Lao PDR increased by RM6.2 million due to higher exports of transport equipment.

Compared to March 2023, trade, exports and imports declined by 17.8%, 18.6% and 16.6%, respectively.

For the period of January to April 2023, trade with ASEAN eased by 0.1% to RM229.47 billion compared to the same period of 2022. Exports increased by 1.7% to RM136.62 billion underpinned by higher exports of petroleum products and E&E products. Imports from ASEAN was lower by 2.6% to RM92.85 billion.

China – Slower Trade Growth

In April 2023, trade with China which comprised 17.2% or RM34.14 billion of Malaysia’s total trade contracted by 13.1% y-o-y. Exports to China was valued at RM13.92 billion, shrank by 19.9% as a result of lower exports of petroleum products, metalliferous ores and metal scrap, palm oil-based manufactured products, iron and steel as well as chemicals and chemical products. Increase in exports however, was recorded for optical and scientific equipment, crude fertilisers and minerals, seafood, fresh, chilled or frozen, paper and pulp products as well as transport equipment. Imports from China slipped by 7.7% to RM20.23 billion.

Compared to March 2023, trade, exports and imports reduced by 9.8%, 16.6% and 4.4%, respectively.

Trade with China during the period of January to April 2023 edged down by 5.2% to RM142.79 billion compared to the corresponding period of 2022. Exports fell by 11.1% to RM59.92 billion due to lower exports of iron and steel products, petroleum products as well as E&E products. Nevertheless, exports of mining goods registered double-digit growth supported by higher exports of LNG. Imports from China was down by 0.4% to RM82.87 billion.

The US – Trade Was Lower in April 2023

Trade with the United States (US) in April 2023 which accounted for 9% of Malaysia’s total trade contracted by 19.5% y-o-y to RM17.82 billion. Exports decreased by 21.5% to RM11.26 billion, owing to lower exports of manufactures of metal, wood products and rubber products. Imports from the US edged down by 15.7% to RM6.56 billion.

On a m-o-m basis, trade, exports and imports fell by 19.2%, 22.8% and 12.1%, respectively.

For the period of January to April 2023, trade with the US was lower by 1.7% to RM77.45 billion compared to the same period of 2022. Exports declined marginally by 0.4% to RM50.21 billion following lower exports of wood and rubber products. The contraction however was cushioned by double-digit growth in exports of E&E products. Imports from the US fell by 3.9% to RM27.24 billion.

The EU – Imports Grew while Exports Declined

In April 2023, trade with the European Union (EU) contributed 7.9% to Malaysia’s total trade, decreased by 15.9% y-o-y to RM15.61 billion. Exports amounted to RM8.06 billion, dipped by 30.5% on account of lower exports of manufactures of metal and E&E products. However, positive export growth was recorded for petroleum products, other vegetable oil, paper and pulp products as well as processed food. Imports from the EU increased by 8.3% to RM7.54 billion.

Breakdown of exports to the top 10 EU markets which accounted for 92.5% of Malaysia’s total exports to the EU were:

• Netherlands RM2.83 billion, decreased by 33.6%;

• Netherlands RM2.83 billion, decreased by 33.6%;

• Germany RM2.03 billion, ↓18.8%;

• Belgium RM659.8 million, ↓8.6%;

• Spain RM477.1 million, ↓32.2%;

• France RM449.8 million, ↓7.8%;

• Italy RM358.8 million, ↓49.8%;

• Poland RM204.3 million, ↓52.3%;

• Czech Republic RM184.8 million, ↓38.9%;

• Czech Republic RM184.8 million, ↓38.9%;

• Hungary RM167.9 million, ↓30.4%; and

• Sweden RM99.3 million, ↓50.1%.

Compared to March 2023, trade, exports and imports edged down by 19.6%, 26.6% and 10.5%, respectively.

For the first four months of 2023, trade with the EU declined by 1.1% to RM67.66 billion compared to the corresponding period of 2022. Exports stood at RM37.34 billion, a decrease of 10.2% compared to the same period last year owing to lower exports of E&E products, rubber products as well as palm oil and palm oil-based agriculture products. The decline however was softened by increase in exports of petroleum products, optical and scientific equipment as well as other vegetable oil. Imports from the EU rose by 13.1% to RM30.32 billion.

Japan – Increased Demand for Crude Petroleum and E&E Products

In April 2023, trade with Japan which constituted of 5.7% or RM11.38 billion to Malaysia’s total trade contracted by 24.7% y-o-y. Exports was valued at RM6.13 billion, edged down by 20.5% on account of lower exports of LNG, petroleum products and wood products. Nonetheless, higher shipments were recorded for crude petroleum, E&E products as well as optical and scientific equipment. Imports from Japan fell by 29% to RM5.25 billion.

On a m-o-m basis, trade, exports and imports were lower by 24.2%, 26% and 21.9%, respectively.

For the period of January to April 2023, trade with Japan weakened by 5.6% to RM53.67 billion compared to the same period of 2022. Exports was down by 2% to RM29.79 billion attributed to lower shipments of manufactures of metal, wood products as well as palm oil-based manufactured products. On the contrary, higher exports was registered for exports of LNG, crude petroleum, optical and scientific equipment as well as palm oil and palm oil-based agriculture products. Imports from Japan shrank by 9.7% to RM23.88 billion.

Trade with FTA Partners

In April 2023, trade with Free Trade Agreement (FTA) partners which contributed 67.8% or RM134.22 billion to Malaysia’s total trade edged down by 13.5% y-o-y. Exports to FTA partners declined by 13.3% to RM74.98 billion and imports shrank by 13.8% to RM59.24 billion.

Increases in exports were recorded to Republic of Korea (ROK), which rose by 10.9% to RM4.86 billion and New Zealand (↑25.8% to RM526.4 million) boosted by robust exports of petroleum products. Exports to Mexico increased by 0.8% to RM1.54 billion backed by strong exports of iron and steel products. Meanwhile, exports to Pakistan expanded by 3.7% to RM424.7 million following higher exports of palm oil and palm oil-based agriculture products.

Compared to March 2023, trade, exports and imports decreased by 14.6%, 16.2% and 12.5%, respectively.

Trade with FTA partners during the first four months of 2023 was lower by 1.6% to RM571.19 billion compared to the corresponding period of 2022. Exports eased by 0.8% to RM322.35 billion and imports dropped by 2.6% to RM248.83 billion.

Import Performance

Total imports in April 2023 contracted by 11.1% y-o-y to RM92.58 billion. The three main categories of imports by end use, which accounted for 68.7% of total imports were:

Intermediate goods, valued at RM45.28 billion or 48.9% of total imports, decreased by 24.2% y-o-y, following lower imports of parts and accessories for non-transport capital goods;

Capital goods, valued at RM10.18 billion or 11% of total imports, increased by 11.8%, due to higher imports of industrial transport equipment; and

• Consumption goods, valued at RM8.16 billion or 8.8% of total imports, declined by 1.6%, as a result of lower imports of non-durables.

During the period of January to April 2023, imports decreased marginally by 0.3% to RM382.78 billion from the same period of 2022. Imports of intermediate goods contracted by 9.5% to RM196.15 billion compared to the same period last year, capital goods (↑3.1% to RM37.44 billion) and consumption goods (↑0.2% to RM32.73 billion).

Branding Values for Halal Industry

Global Halal Leader

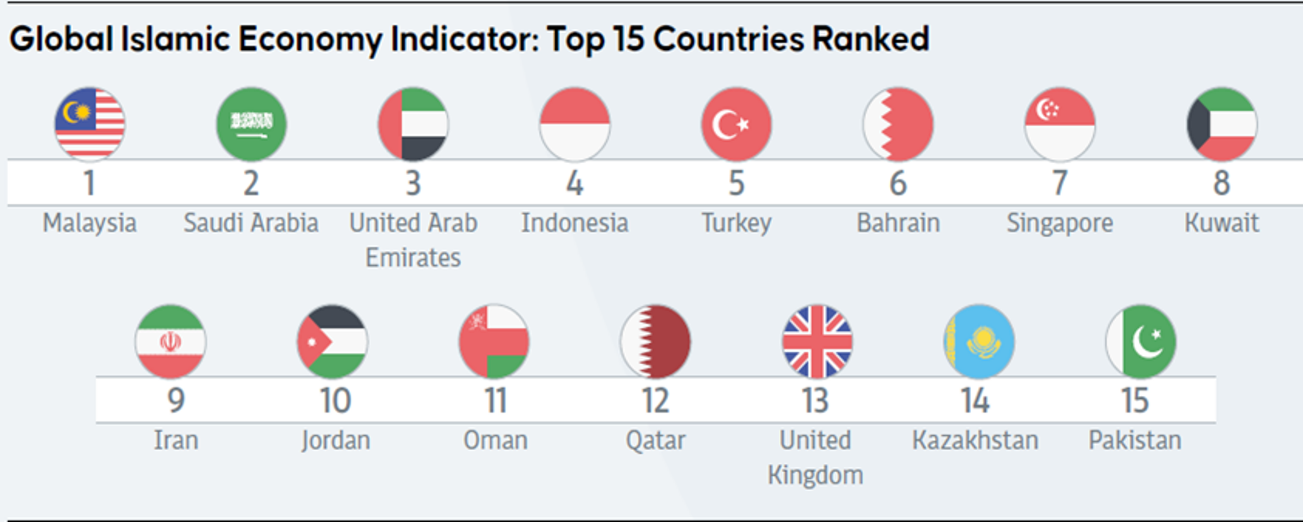

- In 2022, Malaysia leads the overall Global Islamic Economy Indicator (GIEI) ranking for the 9th consecutive year.

- Malaysia International Halal Showcase (MIHAS) has established itself as the world’s largest Halal trade fair for the global Halal industry to network and build

Enabling Halal Environment

- Enabling Halal environment in order to support industry’s growth ranging from reputable & globally recognized certification system, comprehensive masterplan up to strong facilitation in expanding market access.

- The Halal Industry Master Plan (HIMP) 2030 envisages transforming the industry into a key economic contributor to Malaysia’s GDP.

Internationally Recognized Halal Certification

- Malaysia has been recognized at the global forefront as the pioneer in the establishment of a national Halal certification system.

- Through JAKIM, Malaysia's Halal certification system has strengthened its stature through the network of over 80 foreign certification bodies from more than 45 countries.

- The introduction of Malaysia MADANI (SCRIPT) concept may serve as the guiding principle for the incorporation of social and ethical consideration to enhance National Halal Certification system in order to maintain Malaysia’s leading position in the global Halal market.

Diverse and Capable Halal Industry with Global Standards

- Clusters of Halal products and services across key sectors including F&B, pharmaceuticals, Islamic finance, modest fashion, and cosmetics & personal care products.

- The Halal Industry Master Plan (HIMP) 2030 has emphasized on producing more high value-added products and service riding on innovation to increase visibility and acceptability at the international platform covering 3 Halal core sectors namely Food & Beverages, Cosmetics & Personal Care and Pharmaceuticals.

- In 2022, for the 9th year in a row, Malaysia is proudly leading the Global Islamic Economy Indicator (GIEI) ranking. Malaysia has achieved the top spot in various sectors including Halal Food, Islamic Finance, Muslim-Friendly Travel, and Media & Recreation. This remarkable accomplishment solidifies Malaysia's position as a global leader in the Islamic economy.

- Based on the Global Islamic Economy Indicator (GIEI), the Muslim community spent a staggering USD1.27 trillion on Halal food in 2021. This figure is expected to rise to USD1.67 trillion by 2025. The report highlights the significant economic impact of the Halal food industry, with 1.9 billion Muslims contributing to this substantial expenditure.

- According to the Halal Industry Master Plan (HIMP) 2030 report, Malaysia's Halal market is projected to reach a staggering RM523.53 billion (USD113.2 billion). Impressively, by 2030, the Halal industry in Malaysia is set to contribute nearly 11% to the country's GDP, generating over 700,000 job opportunities.

- In 2022, Malaysia's exports of Halal products were valued at RM59.46 billion (USD12.89 billion). By 2030, Malaysia’s exports of Halal products are targeted to reach RM70 billion (USD 15.19 billion).

- Malaysia International Halal Showcase (MIHAS) has established itself as the world’s largest Halal trade fair for the global industry to network and build partnerships.

- Over the course of 18 editions, MIHAS has successfully brought together almost 10,000 Halal suppliers and attracted over 450,000 visitors from around the globe. These editions have generated an impressive total sales amount of RM21.73 billion. MIHAS has truly established itself as a premier event in the Halal industry, showcasing the immense potential and growth in this sector.

- Malaysia has established an enabling Halal environment to support the growth of the Halal industry ranging from a reputable & globally recognized certification system, and comprehensive masterplan up to strong facilitation in expanding market access.

- The Halal Industry Master Plan (HIMP) 2023 envisaged a comprehensive ecosystem that can sustain the rapid expansion of the Halal industry and transform it into a key economic contributor to Malaysia’s GDP.

- From the national perspective, Halal is consistent with sustainability and ethical consumption whereby the value proposition offered by Halal does not allow the use of harmful substances and unlawful practices which may be detrimental to humans, the environment, and society at large.

- The conducive environment, backed by its Halal certification expertise, strategic business locations and dedicated industrial parks as well as supportive government initiatives, has steered Malaysia to be one of the attractive Halal investment destinations for businesses to capitalize on the growing global Halal market.

- Malaysia has been recognized at the global forefront as the pioneer in the establishment of a national Halal certification system.

- Through JAKIM, Malaysia's Halal certification system has strengthened its stature through the network of over 80 foreign certification bodies from more than 45 countries.

- With over a dozen Malaysian Halal standards developed by the Department of Standards Malaysia which facilitates the auditing process, the reliability and transparency of Malaysia’s Halal certification system is guaranteed and undisputed.

- The introduction of Malaysia MADANI (SCRIPT) concept may serve as the guiding principle for the incorporation of social and ethical consideration to enhance National Halal Certification system in order to maintain Malaysia’s leading position in the global Halal market.

- Clusters of Halal products and services have expanded beyond the F&B industry. They encompass a wider range of sectors, including pharmaceuticals, modest fashion, cosmetics and personal care products, Islamic finance, and logistics. This expansion is in response to the increasing demand for more Halal products and services.

- The credibility of Malaysian Halal-certified suppliers has been significantly enhanced through their adherence to global industry standards and requirements. Notably, domestic Halal F&B manufacturers prioritize compliance with internationally recognized standards such as the Food Safety Management System (ISO22000), Hazard Analysis Critical Control Points (HACCP), and Good Manufacturing Practices (GMP).

- Over the years, many foreign and multi-national companies (MNCs) have wisely chosen Malaysia as their Halal manufacturing hub. At the same time, home-grown Halal manufacturers have also expanded their capabilities and capacities to meet rising demands both at home and abroad.

- HIMP 2030 has emphasised on producing more high value-added products and service riding on innovation to increase visibility and acceptability at the international platform covering 3 Halal core sectors namely Food & Beverages, Cosmetics & Personal Care and Pharmaceuticals.