Uncategorised

Client's Charter Achievement for 2025

| NO. | SELECTED ACTIVITY | STANDARD CHARTER | ACHIEVEMENT | |||

| JAN - MAR | APR - JUN | JUL - SEPT | OCT - DEC | |||

| 1. | To organize at least 30 trade promotion activities every 3 months: | At least 30 activities every 3 months | 383 | 0 | 0 | 0 |

| 2. | To entertain and answer information on trade opportunities within 2 working days | Within 2 working days | 1,175 | 0 | 0 | 0 |

| 3. | To inform the results to the applicants for participation in the trade fairs and trade missions within one (1) week after the Selection Committee Meeting. | Within 1 week | 51 | 0 | 0 | 0 |

| 4. | To ensure the release of publications as follows:- | |||||

| i) MATRADE Online News | Every 2 weeks | 6 | 0 | 0 | 0 | |

| ii) Up-coming Events | Every 3 months | 1 | 0 | 0 | 0 | |

| 5. | To update the website within 2 working days upon receiving the updated information | Within 2 working days | 50 | 0 | 0 | 0 |

| 6. | To approve completed Market Development Grant (MDG) applications within 7 working days | Within 7 working days | 771 | 0 | 0 | 0 |

| 7. | To process and approve applications and claims (upon completed documents) for Services Export Fund (SEF) :- | |||||

| Activity 1 / Activity 2 / Activity 3 / Activity 4 / Activity 7 / Activity 8 / Activity 9 / Activity 10 / Activity 11 / Activity 12 | Within 15 working days | 72 | 0 | 0 | 0 | |

| Activity 6 | Within 30 working days | 2 | 0 | 0 | 0 | |

| Activity 5 | Within 90 working days | 0 | 0 | 0 | 0 | |

Integrity Alert

2025

| Tarikh | Jenis | Program |

| JANUARI | ||

| 3 Januari | Integrity Alert | Integrity Alert 1/2025: Pantun Integriti (Infografik) |

| 9 Januari | Integrity Alert | Integrity Alert 2/2025: Ringkasan Kes Tatatertib MATRADE 2024 (Infografik) |

| 13 Januari | Integrity Alert | Integrity Alert 3/2025: Ketahuilah Bahawa Hadiah Itu Boleh Menjadi RASUAH (Infografik) |

| 15 Januari | Integrity Alert | Integrity Alert 4/2025: DISEGERAKAN (Infografik) |

| 31 Januari | Integrity Alert | Integrity Alert 5/2025: Ingin Melakukan Pekerjaan Luar? (Infografik) |

| FEBRUARI | ||

| 3 Februari | Integrity Alert | Integrity Alert 6/2025: Bicaralah Yang Baik Ataupun Baik Diam (Infografik) |

| 18 Februari | Integrity Alert | Integrity Alert 7/2025: Budayakan Rasa Syukur Dalam Diri (Infografik) |

| 24 Februari | Integrity Alert | Integrity Alert 8/2025: Pastikan Maklumat Aduan Anda Berkualiti (Infografik) |

| MAC | ||

| 11 Mac | Integrity Alert | Integrity Alert 9/2025: Buat Keputusan Dengan Bijak(Infografik) |

| 21 Mac | Integrity Alert | Integrity Alert 10/2025: Jauhi Konflik Kepentingan (Infografik) |

| 25 Mac | Integrity Alert | Integrity Alert 11/2025: Prosedur Penerimaan Hadiah (Infografik) |

| APRIL | ||

| 8 April | Integrity Alert | Integrity Alert 12/2025: Keberkatan Rezeki Di Tempat Kerja (Infografik) |

| 10 April | Integrity Alert | Integrity Alert 13/2025: Pegawai Anda Hilang Dari Radar? (Infografik) |

| 17 April | Integrity Alert | Integrity Alert 14/2025: Jangan Melepak Atau Buang Masa Di Pantry Pejabat (Infografik) |

| MEI | ||

| 2 Mei | Integrity Alert | Integrity Alert 15/2025: Bersikap Baik (Infografik) |

| 5 Mei | Integrity Alert | Integrity Alert 16/2025: Tanggungjawab Untuk Menjalankan Kawalan Dan Pengawasan Ke Atas Pegawai Seliaan (Infografik) |

| 7 Mei | Integrity Alert | Integrity Alert 17/2025: Ciri-Ciri Pekerja Bertanggungjawab Dan Tidak Bertanggungjawab (Infografik) |

| 9 Mei | Integrity Alert | Integrity Alert 18/2025: Menjadi Pekerja Dinamik Dalam Era IR 4.0 (Infografik) |

| 16 Mei | Integrity Alert | Integrity Alert 19/2025: How To Be More Creative (Infografik) |

| 19 Mei | Integrity Alert | Integrity Alert 20/2025: Larangan Membuat Pernyataan Awam (Infografik) |

| 21 Mei | Integrity Alert | Integrity Alert 21/2025: Nilai Dan Etika Dalam Perkhidmatan Awam (Infografik) |

| 22 Mei | Integrity Alert | Integrity Alert 22/2025: Ketidakhadiran Tanpa Cuti (Infografik) |

| 30 Mei | Integrity Alert | Integrity Alert 23/2025: AKTA 605 (Infografik) |

| JUN | ||

| 5 Jun | Integrity Alert | Integrity Alert 24/2025: Keterhutangan Kewangan Yang Serius (Infografik) |

| 13 Jun | Integrity Alert | Integrity Alert 25/2025: That's Not My Job! (Infografik) |

| 18 Jun | Integrity Alert | Integrity Alert 26/2025: Tahukah Anda? (Infografik) |

Trade Performance for April 2023 and The Period of January-April 2023

36th Consecutive Month of Trade Surplus

Malaysia registered the 36th consecutive month of trade surplus since May 2020, with a value of RM12.85 billion in April 2023. In tandem with softer global demand, total trade for the month contracted by 14.5% to RM198 billion. The performance was similar to other regional countries which recorded negative trade growth for April 2023. Exports totalled RM105.42 billion, declined by 17.4% and imports decreased by 11.1% to RM92.58 billion.

Compared to March 2023, trade, exports, imports and trade surplus were lower by 14.9%, 18.7%, 10.1% and 51.9%, respectively.

For the period of January to April 2023, trade decreased marginally by 1.6% to RM842.8 billion compared to the same period of 2022. Exports was down by 2.6% to RM460.02 billion and imports declined by 0.3% to RM382.78 billion. Trade surplus edged down by 12.7% to RM77.24 billion.

Export Performance of Major Sectors

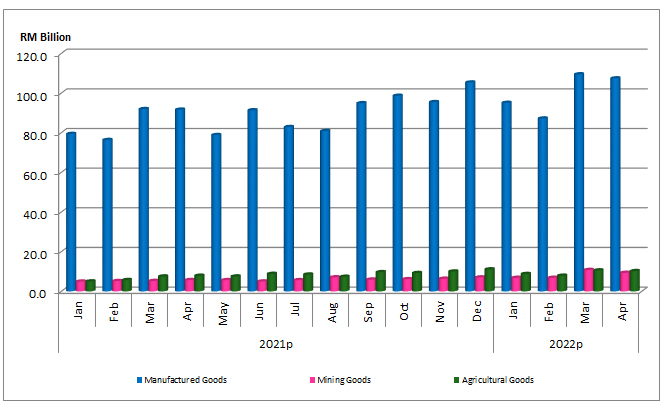

Manufactured Goods Absorbed 86.2% of Malaysia’s Exports

In April 2023, exports of manufactured goods which constituted 86.2% or RM90.89 billion of total exports decreased by 15.5% year-on-year (y-o-y), attributed to lower exports of electrical and electronic (E&E) products, manufactures of metal and chemicals and chemical products. However, exports of petroleum products registered double-digit increase of 20.8%, sustaining positive growth since May 2022.

Exports of agriculture goods (6.8% share) stood at RM7.21 billion, slipped by 29.2% compared to April 2022 due to lower shipments of palm oil and palm oil-based agriculture products.

Exports of mining goods (6.3% share) totalled RM6.63 billion, a decrease of 28.9% y-o-y on account of lower exports of crude petroleum.

Major exports in April 2023:

• E&E products, valued at RM44.18 billion and accounted for 41.9% of total exports, decreased by 6.5% from April 2022;

• Petroleum products, RM11.52 billion, 10.9% of total exports, increased by 20.8%;

• Palm oil and palm oil-based agriculture products, RM5.45 billion, 5.2% of total exports, decreased by 32.1%;

• Chemicals and chemical products, RM4.82 billion, 4.6% of total exports, decreased by 33.2%; and

• Manufactures of metal, RM4.63 billion, 4.4% of total exports, decreased by 35%.

On a month-on-month (m-o-m) basis, exports of manufactured, mining and agriculture goods were lower by 16.6%, 36.4% and 23.4%, respectively.

For the period of January to April 2023, exports of manufactured goods weakened by 2.3% to RM390 billion compared to the corresponding period last year as a result of lower exports of manufactures of metal, rubber products, chemicals and chemical products as well as palm oil-based manufactured products. However, higher exports of petroleum products, E&E products, paper and pulp products as well as optical and scientific equipment offset the impact of the decline.

Exports of mining goods rose by 8.1% to RM36.48 billion boosted by higher exports of liquefied natural gas (LNG).

Exports of agriculture goods was valued at RM30.79 billion, decreased by 17.6% following lower exports of palm oil and palm oil-based agriculture products.

Trade Performance with Major Markets

ASEAN – Exports Grew in the First Four Months of 2023

In April 2023, trade with ASEAN represented 26.9% or RM53.28 billion of Malaysia’s total trade, declined by 12% y-o-y. Exports contracted by 11.4% to RM30.89 billion, weighed down by lower shipments of chemicals and chemical products, crude petroleum as well as E&E products. However, increases in exports were recorded for commodity-based products mainly LNG and petroleum products. Imports from ASEAN dipped by 12.8% to RM22.39 billion.

Breakdown of exports to ASEAN countries:

• Singapore RM16.73 billion, decreased by 1.3%;

• Thailand RM4.25 billion, ↓24.1%;

• Indonesia RM4.09 billion, ↑8.5%;

• Viet Nam RM3.59 billion, ↓28.6%;

• Philippines RM1.71 billion, ↓27.2%;

• Myanmar RM184.8 million, ↓26.9%;

• Brunei RM163.5 million, ↓72.7%;

• Cambodia RM150.6 million, ↓46.1%; and

• Lao PDR RM11.9 million, ↑109.4%.

Exports to ASEAN markets that recorded increases were Indonesia which grew by RM322 million on account of robust exports of petroleum products. Exports to Lao PDR increased by RM6.2 million due to higher exports of transport equipment.

Compared to March 2023, trade, exports and imports declined by 17.8%, 18.6% and 16.6%, respectively.

For the period of January to April 2023, trade with ASEAN eased by 0.1% to RM229.47 billion compared to the same period of 2022. Exports increased by 1.7% to RM136.62 billion underpinned by higher exports of petroleum products and E&E products. Imports from ASEAN was lower by 2.6% to RM92.85 billion.

China – Slower Trade Growth

In April 2023, trade with China which comprised 17.2% or RM34.14 billion of Malaysia’s total trade contracted by 13.1% y-o-y. Exports to China was valued at RM13.92 billion, shrank by 19.9% as a result of lower exports of petroleum products, metalliferous ores and metal scrap, palm oil-based manufactured products, iron and steel as well as chemicals and chemical products. Increase in exports however, was recorded for optical and scientific equipment, crude fertilisers and minerals, seafood, fresh, chilled or frozen, paper and pulp products as well as transport equipment. Imports from China slipped by 7.7% to RM20.23 billion.

Compared to March 2023, trade, exports and imports reduced by 9.8%, 16.6% and 4.4%, respectively.

Trade with China during the period of January to April 2023 edged down by 5.2% to RM142.79 billion compared to the corresponding period of 2022. Exports fell by 11.1% to RM59.92 billion due to lower exports of iron and steel products, petroleum products as well as E&E products. Nevertheless, exports of mining goods registered double-digit growth supported by higher exports of LNG. Imports from China was down by 0.4% to RM82.87 billion.

The US – Trade Was Lower in April 2023

Trade with the United States (US) in April 2023 which accounted for 9% of Malaysia’s total trade contracted by 19.5% y-o-y to RM17.82 billion. Exports decreased by 21.5% to RM11.26 billion, owing to lower exports of manufactures of metal, wood products and rubber products. Imports from the US edged down by 15.7% to RM6.56 billion.

On a m-o-m basis, trade, exports and imports fell by 19.2%, 22.8% and 12.1%, respectively.

For the period of January to April 2023, trade with the US was lower by 1.7% to RM77.45 billion compared to the same period of 2022. Exports declined marginally by 0.4% to RM50.21 billion following lower exports of wood and rubber products. The contraction however was cushioned by double-digit growth in exports of E&E products. Imports from the US fell by 3.9% to RM27.24 billion.

The EU – Imports Grew while Exports Declined

In April 2023, trade with the European Union (EU) contributed 7.9% to Malaysia’s total trade, decreased by 15.9% y-o-y to RM15.61 billion. Exports amounted to RM8.06 billion, dipped by 30.5% on account of lower exports of manufactures of metal and E&E products. However, positive export growth was recorded for petroleum products, other vegetable oil, paper and pulp products as well as processed food. Imports from the EU increased by 8.3% to RM7.54 billion.

Breakdown of exports to the top 10 EU markets which accounted for 92.5% of Malaysia’s total exports to the EU were:

• Netherlands RM2.83 billion, decreased by 33.6%;

• Netherlands RM2.83 billion, decreased by 33.6%;

• Germany RM2.03 billion, ↓18.8%;

• Belgium RM659.8 million, ↓8.6%;

• Spain RM477.1 million, ↓32.2%;

• France RM449.8 million, ↓7.8%;

• Italy RM358.8 million, ↓49.8%;

• Poland RM204.3 million, ↓52.3%;

• Czech Republic RM184.8 million, ↓38.9%;

• Czech Republic RM184.8 million, ↓38.9%;

• Hungary RM167.9 million, ↓30.4%; and

• Sweden RM99.3 million, ↓50.1%.

Compared to March 2023, trade, exports and imports edged down by 19.6%, 26.6% and 10.5%, respectively.

For the first four months of 2023, trade with the EU declined by 1.1% to RM67.66 billion compared to the corresponding period of 2022. Exports stood at RM37.34 billion, a decrease of 10.2% compared to the same period last year owing to lower exports of E&E products, rubber products as well as palm oil and palm oil-based agriculture products. The decline however was softened by increase in exports of petroleum products, optical and scientific equipment as well as other vegetable oil. Imports from the EU rose by 13.1% to RM30.32 billion.

Japan – Increased Demand for Crude Petroleum and E&E Products

In April 2023, trade with Japan which constituted of 5.7% or RM11.38 billion to Malaysia’s total trade contracted by 24.7% y-o-y. Exports was valued at RM6.13 billion, edged down by 20.5% on account of lower exports of LNG, petroleum products and wood products. Nonetheless, higher shipments were recorded for crude petroleum, E&E products as well as optical and scientific equipment. Imports from Japan fell by 29% to RM5.25 billion.

On a m-o-m basis, trade, exports and imports were lower by 24.2%, 26% and 21.9%, respectively.

For the period of January to April 2023, trade with Japan weakened by 5.6% to RM53.67 billion compared to the same period of 2022. Exports was down by 2% to RM29.79 billion attributed to lower shipments of manufactures of metal, wood products as well as palm oil-based manufactured products. On the contrary, higher exports was registered for exports of LNG, crude petroleum, optical and scientific equipment as well as palm oil and palm oil-based agriculture products. Imports from Japan shrank by 9.7% to RM23.88 billion.

Trade with FTA Partners

In April 2023, trade with Free Trade Agreement (FTA) partners which contributed 67.8% or RM134.22 billion to Malaysia’s total trade edged down by 13.5% y-o-y. Exports to FTA partners declined by 13.3% to RM74.98 billion and imports shrank by 13.8% to RM59.24 billion.

Increases in exports were recorded to Republic of Korea (ROK), which rose by 10.9% to RM4.86 billion and New Zealand (↑25.8% to RM526.4 million) boosted by robust exports of petroleum products. Exports to Mexico increased by 0.8% to RM1.54 billion backed by strong exports of iron and steel products. Meanwhile, exports to Pakistan expanded by 3.7% to RM424.7 million following higher exports of palm oil and palm oil-based agriculture products.

Compared to March 2023, trade, exports and imports decreased by 14.6%, 16.2% and 12.5%, respectively.

Trade with FTA partners during the first four months of 2023 was lower by 1.6% to RM571.19 billion compared to the corresponding period of 2022. Exports eased by 0.8% to RM322.35 billion and imports dropped by 2.6% to RM248.83 billion.

Import Performance

Total imports in April 2023 contracted by 11.1% y-o-y to RM92.58 billion. The three main categories of imports by end use, which accounted for 68.7% of total imports were:

Intermediate goods, valued at RM45.28 billion or 48.9% of total imports, decreased by 24.2% y-o-y, following lower imports of parts and accessories for non-transport capital goods;

Capital goods, valued at RM10.18 billion or 11% of total imports, increased by 11.8%, due to higher imports of industrial transport equipment; and

• Consumption goods, valued at RM8.16 billion or 8.8% of total imports, declined by 1.6%, as a result of lower imports of non-durables.

During the period of January to April 2023, imports decreased marginally by 0.3% to RM382.78 billion from the same period of 2022. Imports of intermediate goods contracted by 9.5% to RM196.15 billion compared to the same period last year, capital goods (↑3.1% to RM37.44 billion) and consumption goods (↑0.2% to RM32.73 billion).

The Third Country Training Programme (TCTP)

-

The Third Country Training Programme (TCTP)

Trade Promotion for African Countries

4 – 13 October 2023

The Third Country Training Programme (TCTP) is a capacity – building collaboration project between the Government of Malaysia and the Government of Japan with the objective of sharing Malaysia’s and Japan’s expertise and experiences in trade promotion strategies and programmes with selected African countries. The project is funded by the Government of Malaysia and the Government of Japan.

The implementation of the project is through a tri-partied cooperation between the Malaysian Technical Cooperation Programme (MTCP), a unit under the purview of the International Cooperation and Development Division, Department of Multilateral Affairs, Ministry of Foreign Affairs, Malaysia, Japan International Cooperation Agency (JICA) and Malaysia External Trade Development Corporation (MATRADE) as the implementing agency for training programmes related to trade promotion and facilitation.

The implementation of the project is through a tri-partied cooperation between:

- Malaysian Technical Cooperation Programme (MTCP), Ministry of Foreign Affairs, Malaysia (a unit under the purview of the International Cooperation and Development Division Department of Multilateral Affairs);

- Japan International Cooperation Agency (JICA); and

- Malaysia External Trade Development Corporation (MATRADE) as the implementing agency for training programmes related to trade promotion and facilitation.

-

1. MATRADE Welcomes You (Opening session)

2. Seminar on Exploring Business Opportunities in Africa

Background

TCTP participants will present a country presentation during the seminar. The seminar will be attended by representatives from various organisation such as government agencies, associations and companies. The objectives of the seminar are to explore opportunities in Africa, to provide insights, market potential, and ways of doing business as well as to enhance bilateral trade and investment relations between Malaysia and Africa countries.

Outline of the presentation

i. Areas to be highlighted

- Brief introduction of the country (Background, Key Economy Data, Demography, etc);

- External Trade and Industry updates;

- Summary of the duties and responsibilities of participants’ organisation/agency;

- Challenges and issues in the participants’ respective countries in developing trade and promotional programme (do’s and don’t’, investment opportunities)

ii, Presenter

- Participant(s)/Representatives of each countries.

- Each speaker is expected to provide a 10-minute presentation which is followed by a 5-minute question and answer session.

- Template slides - Sample of past presentation (Note: MATRADE will provide the presentation template 2 weeks before the commencement of the programme)

3. Closing Ceremony

4. Others

i. Knowledge sharing session on trade promotion

ii. Visits to Malaysia’s government agencies and companies

iii. Plan of action presentation

Background

TCTP participants will present an action plan presentation on summary of lesson learnt throughout the course and how it is applicable to participants’ respective countries.

Outline of the presentation

i. Areas to be highlighted

- Title of the Plan

- Plan and implementation strategies for the challenges/issues

- How to apply knowledge/lessons learnt from the course to the plan

ii. Speaker

- Participant(s)/Representatives of each countries.

- Each speaker is expected to provide a 10-minute presentation which is followed by a 5-minute question and answer session.

iii. Template slides - Sample of past presentation (Note: MATRADE will provide the presentation template 2 weeks before the commencement of the programme)

iv. Course evaluation

-

1. Click here for TCTP 2019/2018 Programme book

2. Photos

-

Title: Third Country Training Programme (TCTP) on Trade Promotion for African Countries

Date: 4-13 October 2023

Application Deadline: 3 August 2023

Target Participants: This course will be relevant to the middle / senior level of government officials from government ministries in charge of trade promotion.

Target Countries: Algeria, Angola, Burkina Faso, Cameroon, Côte d'Ivoire, Eswatini, Ethiopia, Ghana, Kenya, Madagascar, Mauritius, Mozambique, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Uganda and Zimbabwe

Mode: Face-to-Face

Venue: Kuala Lumpur, Malaysia

Organised by: MATRADE

Funded by: Malaysian Technical Cooperation Programme (MTCP) & Japan International Cooperation Agency (JICA)

Click here to download the General Information (GI) about this course. You can also download the tentative programme here.

THIS COURSE IS OPEN FOR APPLICATION

Branding Values for Halal Industry

Global Halal Leader

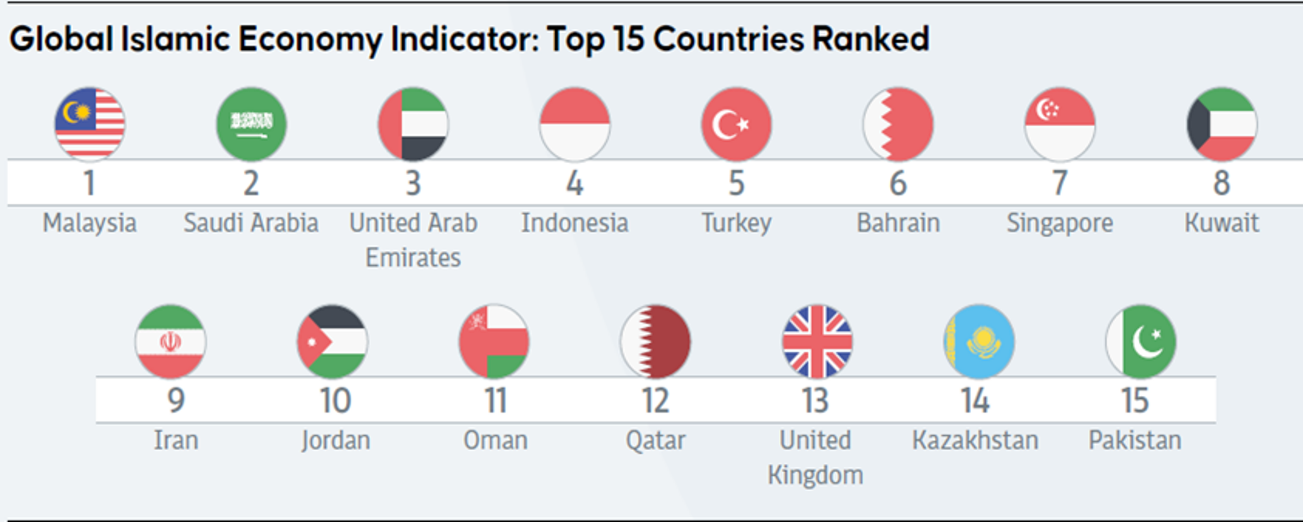

- In 2022, Malaysia leads the overall Global Islamic Economy Indicator (GIEI) ranking for the 9th consecutive year.

- Malaysia International Halal Showcase (MIHAS) has established itself as the world’s largest Halal trade fair for the global Halal industry to network and build

Enabling Halal Environment

- Enabling Halal environment in order to support industry’s growth ranging from reputable & globally recognized certification system, comprehensive masterplan up to strong facilitation in expanding market access.

- The Halal Industry Master Plan (HIMP) 2030 envisages transforming the industry into a key economic contributor to Malaysia’s GDP.

Internationally Recognized Halal Certification

- Malaysia has been recognized at the global forefront as the pioneer in the establishment of a national Halal certification system.

- Through JAKIM, Malaysia's Halal certification system has strengthened its stature through the network of over 80 foreign certification bodies from more than 45 countries.

- The introduction of Malaysia MADANI (SCRIPT) concept may serve as the guiding principle for the incorporation of social and ethical consideration to enhance National Halal Certification system in order to maintain Malaysia’s leading position in the global Halal market.

Diverse and Capable Halal Industry with Global Standards

- Clusters of Halal products and services across key sectors including F&B, pharmaceuticals, Islamic finance, modest fashion, and cosmetics & personal care products.

- The Halal Industry Master Plan (HIMP) 2030 has emphasized on producing more high value-added products and service riding on innovation to increase visibility and acceptability at the international platform covering 3 Halal core sectors namely Food & Beverages, Cosmetics & Personal Care and Pharmaceuticals.

- In 2022, for the 9th year in a row, Malaysia is proudly leading the Global Islamic Economy Indicator (GIEI) ranking. Malaysia has achieved the top spot in various sectors including Halal Food, Islamic Finance, Muslim-Friendly Travel, and Media & Recreation. This remarkable accomplishment solidifies Malaysia's position as a global leader in the Islamic economy.

- Based on the Global Islamic Economy Indicator (GIEI), the Muslim community spent a staggering USD1.27 trillion on Halal food in 2021. This figure is expected to rise to USD1.67 trillion by 2025. The report highlights the significant economic impact of the Halal food industry, with 1.9 billion Muslims contributing to this substantial expenditure.

- According to the Halal Industry Master Plan (HIMP) 2030 report, Malaysia's Halal market is projected to reach a staggering RM523.53 billion (USD113.2 billion). Impressively, by 2030, the Halal industry in Malaysia is set to contribute nearly 11% to the country's GDP, generating over 700,000 job opportunities.

- In 2022, Malaysia's exports of Halal products were valued at RM59.46 billion (USD12.89 billion). By 2030, Malaysia’s exports of Halal products are targeted to reach RM70 billion (USD 15.19 billion).

- Malaysia International Halal Showcase (MIHAS) has established itself as the world’s largest Halal trade fair for the global industry to network and build partnerships.

- Over the course of 18 editions, MIHAS has successfully brought together almost 10,000 Halal suppliers and attracted over 450,000 visitors from around the globe. These editions have generated an impressive total sales amount of RM21.73 billion. MIHAS has truly established itself as a premier event in the Halal industry, showcasing the immense potential and growth in this sector.

- Malaysia has established an enabling Halal environment to support the growth of the Halal industry ranging from a reputable & globally recognized certification system, and comprehensive masterplan up to strong facilitation in expanding market access.

- The Halal Industry Master Plan (HIMP) 2023 envisaged a comprehensive ecosystem that can sustain the rapid expansion of the Halal industry and transform it into a key economic contributor to Malaysia’s GDP.

- From the national perspective, Halal is consistent with sustainability and ethical consumption whereby the value proposition offered by Halal does not allow the use of harmful substances and unlawful practices which may be detrimental to humans, the environment, and society at large.

- The conducive environment, backed by its Halal certification expertise, strategic business locations and dedicated industrial parks as well as supportive government initiatives, has steered Malaysia to be one of the attractive Halal investment destinations for businesses to capitalize on the growing global Halal market.

- Malaysia has been recognized at the global forefront as the pioneer in the establishment of a national Halal certification system.

- Through JAKIM, Malaysia's Halal certification system has strengthened its stature through the network of over 80 foreign certification bodies from more than 45 countries.

- With over a dozen Malaysian Halal standards developed by the Department of Standards Malaysia which facilitates the auditing process, the reliability and transparency of Malaysia’s Halal certification system is guaranteed and undisputed.

- The introduction of Malaysia MADANI (SCRIPT) concept may serve as the guiding principle for the incorporation of social and ethical consideration to enhance National Halal Certification system in order to maintain Malaysia’s leading position in the global Halal market.

- Clusters of Halal products and services have expanded beyond the F&B industry. They encompass a wider range of sectors, including pharmaceuticals, modest fashion, cosmetics and personal care products, Islamic finance, and logistics. This expansion is in response to the increasing demand for more Halal products and services.

- The credibility of Malaysian Halal-certified suppliers has been significantly enhanced through their adherence to global industry standards and requirements. Notably, domestic Halal F&B manufacturers prioritize compliance with internationally recognized standards such as the Food Safety Management System (ISO22000), Hazard Analysis Critical Control Points (HACCP), and Good Manufacturing Practices (GMP).

- Over the years, many foreign and multi-national companies (MNCs) have wisely chosen Malaysia as their Halal manufacturing hub. At the same time, home-grown Halal manufacturers have also expanded their capabilities and capacities to meet rising demands both at home and abroad.

- HIMP 2030 has emphasised on producing more high value-added products and service riding on innovation to increase visibility and acceptability at the international platform covering 3 Halal core sectors namely Food & Beverages, Cosmetics & Personal Care and Pharmaceuticals.

Directory Hub

Women Exporters eDirectory

The Women Exporters eDirectory is a platform designed to enhance the visibility of women-owned companies by connecting them with global buyers. It provides access to international markets, expands their networks, and facilitates a broader range of business opportunities.

Malaysia Products Directory

From electronics to processed food, made in Malaysia products are found in more than 200 countries worldwide. Product Directory lists Malaysian exporters registered with MATRADE comprising of manufacturers, contract manufacturers and traders.

Malaysia Services Directory (MSeD)

With interactive elements such as company profiles and business description, exporters’ microsites, products and services listings and feature highlight, exporters and buyers from around the world can access and share trade information as well as establishing hassle-free communication between each other.

Malaysian Brands Directory

Promoting Malaysia's premier brand to the world. Highlighting brands that feature strong positive values, superior innovations and global appeal.

Malaysia's Exports by Main Sectors, 2022

Source: Department of Statistics, Malaysia

Tabulated by: MATRADE

Notes:

p - provisional data

Essential to Export

Exporters who want to start exporting will find ERAT, a Beginner's Guide to Exporting, exporting tips and a tariff code reference guide in this part. They will also learn about free trade agreements and find a centre for export and financial assistance.

Going Global

Things you need to know before going global

Flavours of Malaysia - Wah Nam Hong

MATRADE is organising the 'Flavours of Malaysia' online campaign in collaboration with Wah Nam Hong (WNH), one of the leading Asian supermarkets in The Netherlands with the aim to promote Malaysian food products to the Dutch market. The online marketing campaign will complement the in-store promotion efforts by Ministry of Agriculture & Food Industry (MAFI), Malaysia.

'Flavours of Malaysia' will take place from 16 September until 16 October 2021 to increase market awareness about Malaysian food products, strengthening Malaysia's brand presence in the local F&B segment.

Come, discover our range of Malaysian food products with special offers, recipe cards and cooking videos, just a click away at https://wahnamhong.nl

Malaysia Pavilion @ HOFEX 2021

MATRADE, Malaysia's National trade promotion agency, is bringing MALAYSIAN EXPORTERS to the global F&B scene through HOFEX 2021 in Hong Kong from 9 to 11 September 2021.

25 Malaysian companies will showcase a wide range of food and beverages products including durian products, coffee, confectionery and pastes at the MALAYSIA PAVILION @ HOFEX 2021.

Interested buyers / importers can contact MATRADE Hong Kong at This email address is being protected from spambots. You need JavaScript enabled to view it. or +852-2527 8109 to get in touch with the Malaysian companies and/or their distributors either physically at HKCEC or virtually through Zoom meeting.

Click here for more details

Postponement of The 17th Edition of The Malaysia International Halal Showcase (MIHAS) 2020 to 2021

FRIDAY, 3 JULY 2020, KUALA LUMPUR: The Malaysia External Trade Development Corporation (MATRADE) announced the postponement of the 17th Malaysia International Halal Showcase (MIHAS) which was scheduled to take place from 1st to 4th September 2020 to next year.

The decision was made after taking into account the COVID-19 pandemic, and the adverse impacts that could jeopardise the show's reputation if it were to proceed. Based on the feedback received by MATRADE through its 46 overseas offices, most foreign exhibitors, buyers and trade visitors are not ready to travel and partake in international exhibitions held abroad.

A quick survey made among Malaysian exhibitors also validated the concerns raised by foreign exhibitors about possible meagre number of visitors and buyers to visit the show, in view of the travel restrictions imposed by many countries around the world.

According to Dato’ Wan Latiff, CEO of MATRADE “The postponement of the show to 2021, is for the best interest of our exhibitors and buyers. The present environment is very challenging, and we believe it would affect the effectiveness of the show. The date for next year will be determined later depending on the development of the pandemic. By deferring it to 2021, it will allow our local and foreign exhibitors to appraise their strategies and calibrate for the changed environmentâ€.

Over the last 16 years, MIHAS has built its reputation as the world’s leading Halal exhibition where thousands of Halal industry players from all over the world meet annually to showcase their innovative and latest products and services. It is also the venue of congregation for academics, practitioners and stakeholders of the Halal, Islamic finance and syariah-compliant businesses.

“MATRADE’s commitment is to hosting a remarkable show that will be the benchmarkand sought after by the Halal and Islamic economy fraternities. We would like to recordour gratitude to exhibitors, sponsors, strategic partners and buyers for their continuedsupportâ€, Dato’ Wan Latiff said.

Iklan Pengambilan Pekerja Sambilan Harian (PSH) Tahun 2020

MATRADE mempelawa Warganegera Malaysia yang berkelayakan dan berminat untuk memohon jawatan sebagai Pekerja Sambilan Harian (PSH).

Lokasi:

Bahagian Tranformasi Dan Perdagangan Digital

Seksyen Teknologi Maklumat

Menara MATRADE

Jalan Sultan Haji Ahmad Shah

50480 Kuala Lumpur

Calon bagi lantikan ini hendaklah memiliki kelayakan seperti berikut:

- Warganegara Malaysia; dan

- Berumur tidak kurang daripada 25 tahun pada tarikh tutup iklan; dan

- Memiliki Ijazah Sarjana Muda dalam bidang Teknologi Maklumat atau Sains Komputer atau Pengurusan Projek atau kelayakan yang diiktiraf setaraf dengannya; dan

- Mahir berkomunikasi dengan baik secara lisan dan bertulis di dalam Bahasa Melayu dan Bahasa Inggeris; dan

- Mahir menggunakan perisian Microsoft Project, Microsoft Excel dan Microsoft PowerPoint dengan baik.

Calon-calon yang memiliki kriteria berikut akan diberikan keutamaan:

- Pernah terlibat secara aktif di dalam projek ICT.

- Berpengetahuan di dalam pengurusan projek ICT.

- Mempunyai ciri kepimpinan.

- Mempunyai sijil di dalam pengurusan projek.

Bidang tugas:

Pegawai akan bertindak sebagai pasukan pengurusan projek ICT bagi membantu Pengurus Projek untuk:

- Melaksanakan urusan pentadbiran projek seperti mengemaskini dokumen projek, mengawasi pelaksanaan aktiviti projek, mengemaskini Jadual Pelaksanaan Projek menggunakan perisian Microsoft Project dan mengatur mesyuarat secara berkala.

- Memantau dan menyediakan laporan status kemajuan projek secara berkala kepada pihak berkenaan.

- Menjadi urus setia mesyuarat.

Calon-calon yang berminat, boleh mengemukakan resume terkini kepada This email address is being protected from spambots. You need JavaScript enabled to view it..

Tarikh tutup permohonan : 6 Julai 2020

Hanya calon yang disenarai pendek sahaja akan dipanggil ke Sesi Temuduga

Branding Malaysia as a Technology Hub at ITAP 2019

TUESDAY, 22 OCTOBER 2019, SINGAPORE: In an effort to enhance Malaysia’s branding as a technological hub, Malaysia External Trade Development Corporation (MATRADE) led the participation of 10 Malaysian companies to Industrial Transformation Asia Pacific (ITAP) 2019 where Malaysian companies showcased their capabilities in Industry 4.0.

The participation this year will see MATRADE introducing a Malaysia Pavilion for the first time to facilitate engagement of Malaysian companies with international businesses from all over Asia Pacific. The Malaysia Pavilion was officiated by the Malaysian High Commissioner to Singapore, YBhg. Dato’ Zainol Rahim Zainuddin today.

According to Puan Jamaliah Jamaluddin, Director of Electrical, Electronics, ICT, Machinery & Equipment Section at MATRADE, the event can be a catalyst to business transactions, learning, networking and establishing collaboration for Malaysian local Small and Medium Enterprises at the event. “We have identified the growing strength of ITAP and given its comprehensive programme lineups which include exhibition, conference and fora, Malaysian companies will be able to enhance their knowledge in innovation and finding likeminded partners for their business,†Jamaliah said.

The exhibitors at the Malaysia Pavilion comprise of those providing Industry 4.0 consultancy and solutions, unmanned aerial system (UAS) solutions, industrial automation solutions, electrical distribution solutions, IoT cloud and factory navigation systems. Others offerings include integrated power and controls systems, digital transformation solutions as well as IT solutions based on block chain technology, just to name a few.

“We hope our participation in ITAP will expose Malaysian companies to the leading edge technologies and future trends around the world for them to leverage or emulate,†Jamaliah said.

Seminar Usahawan Desa Jaguh Eksport

Market Expansion Into Europe: The Thriving Journey

|

Event | : | Market Expansion Into Europe: The Thriving Journey |

| Date | : | 4 October 2017 | |

| Location | : | MATRADE | |

| Click here to view album collection | |||

Market Expansion Into Europe: The Thriving Journey

Malaysia - Taiwan Trade Window

The demand for food and household cleaning products have increased tremendously in Taiwan due to the COVID-19 pandemic, especially since the Level 3 Alert started. Among items that consumers purchased the most are instant and dried noodle, rice, egg, flour, cooking paste, seasoning, ready to eat meals and beverages, cereals, frozen food, sanitiser and hand wash.

Nevertheless, this situation in Taiwan, coupled with an adjusted consumer behavior will result in a new trend and lifestyle of home living that will create new opportunities for Malaysian companies, beyond the era of pandemic. In terms of trend, demand for eco-friendly options and green products is growingly visible in Taiwan, given the rise of the environmental consciousness and creation of a sustainable lifestyle in the market.

Looking ahead to the domestic economy for 2021, the strong external demand with the advantages of Taiwan’s high-tech and communications industries (including e-commerce), is expected to increase the market’s export growth momentum. As for domestic demand, the stable employment rate and active stock market will boost private consumption.

Bilateral Trade between Malaysia & Taiwan

Malaysia’s trade with Taiwan contracted by 2.7% to reach RM91.51 billion (USD21.80 billion) in 2020. Exports to Taiwan decreased by 8.6% to RM33.85 billion (USD8.06 billion) in 2020. Major exports were electrical and electronic (E&E) products, optical and scientific equipment, manufactures of metal, chemicals & chemical products and petroleum products. Imports from Taiwan increased by 1.1% to RM57.66 billion (USD13.73 billion) in 2020. Major imports were E&E products, chemicals & chemical products as well as iron & steel products.

Malaysia’s Ranking

In 2020, Taiwan was Malaysia’s:

- 5th largest global trading partner

- 8th largest exports destination

- 5th largest source of imports

Taiwan’s Ranking

In 2020, Malaysia was Taiwan:

- 7th largest global trading partner

- 8th largest exports destination

- 5th largest source of imports

MATRADE has extended its Memorandum of Understanding (MOU) with Taiwan External Trade Development Council (TAITRA) for another two years until April 2022 and through the cooperation stated in the MOU, both organisations believe it will enhance bilateral trade cooperation and trade promotion in the field of Halal, F&B, ICT, healthcare and e-Commerce.

In the spirit of collaboration between MATRADE and TAITRA, Malaysian companies are encourage to participate in the B2B platform via taiwantrade.com. Please register your business interest at https://matrade.taiwantrade.com/ to promote your products and services to the Taiwanese counterparts. In the platform, newsletters on the Taiwanese latest market trend along with the list of events organized in Taiwan, will be featured. Thus, Malaysian exporters are advised to seize this opportunity to explore Taiwanese market via this platform (at no cost).

Taiwan is known for its first class services in the healthcare sector. Taiwan is among the leading markets that managed to overcome COVID-19 pandemic without any lockdown. In this regard, for those who would like to learn from Taiwan’s experience in facing the COVID-19 challenges, please feel free to visit this website: https://www.anticovid19tw.org/

New MER - Company Profile

MATRADE Organises Trade Talk on Halal Silk Route

Pempamer Malaysia Jana Jualan RM71.7j daripada Pesta Perdagangan Jerman

Pempamer Malaysia jana jualan RM71.7j daripada Pesta Perdagangan Jerman

Infographics

Source From Malaysia

Directories

Browse through our comprehensive directory of Malaysian companies that provide products and services that suit your sourcing needs.

Trade Events

Find out about our trade missions and trade exhibitions held in Malaysia and overseas.

- Held Overseas

- Held in Malaysia

Industry Capabilities

To promote business opportunities for buyers of Malaysian value-added goods and services. Discover top industries and meet the biggest brands in Malaysia.

Publications

As a top reference to both local and foreign traders, MATRADE’s publications include handbooks, directories, guidebooks and many more.

MATRADE Global Network

MATRADE overseas offices in strategic locations around the globe assist Malaysian exporters and foreign buyers alike in doing business.

*Please allow the location service to view the interactive map

Institution under Ministry of Finance

Cradle Fund Sdn. Bhd.

The Cradle Investment Programme (CIP) is Malaysia's first development and technology commercialisation funding programme that enables budding innovators and aspiring entrepreneurs to transform their raw technology-based ideas into commercially-viable ventures, and helps local start-up companies to attain commercialisation. [Visit Website]

Institution under Ministry of Higher Education

University of Malaya

The University of Malaya was established on the 8th of October 1949 in Singapore as an outcome of a merger between the King Edward VII Medical College and Raffles College. The University was a key player in creating trained and specialized human resources for the Federation of Malaya and Singapore.

The dynamic growth of the University in its first decade led to the creation of two autonomous branches in 1959, one in Singapore, and the other in Kuala Lumpur.

Institutions under Ministry of Science, Technology & Innovation

Standard and Industrial Research Institute of Malaysia

Incorporated in November 1995 as a wholly-owned Government company under the Minister of Finance Incorporated, SIRIM Berhad is a pioneer organisation in industrial Research & Development and Standardisation. [Visit Website]

Ministry of Science, Technology & Innovation

Ministry of Science, Technology and Innovation (MOSTI) was set-up on 27 March, 2004. It was first established in 1973 as the Ministry of Technology, Research and Local Government and known as Ministry of Science, Technology and Environment (MOSTE) since 1976. [Visit Website]

Enquiries

China & Northeast Asia Section

Level 14 (East Wing),

Menara MATRADE,

Jalan Sultan Haji Ahmad Shah,

50480 Kuala Lumpur

Tel: 603-6207 7077

Malaysian Friendship & Trade Centre

Trade Section (MATRADE)

101F-D, Hung Kuo Building

No. 167 Dun Hua North Road

Taipei 105, Taiwan

Tel: +886-2-2545 2260

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.